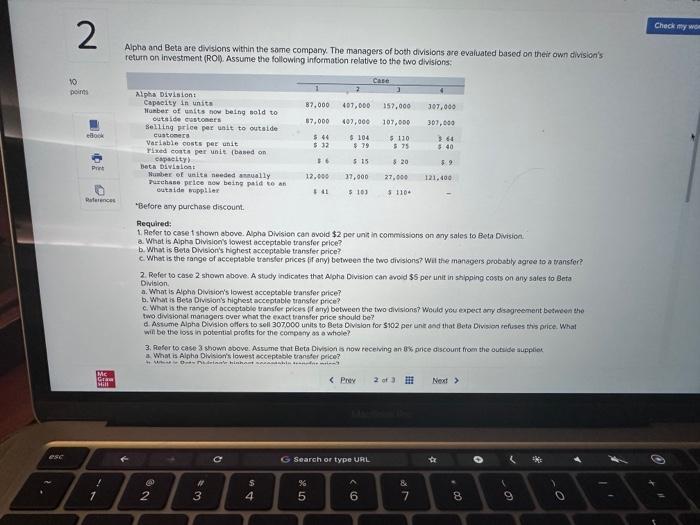

Question: please help!!!! Alpha and Beta are divisions within the some company. The managers of both divisions are evaluated based on theit own division's return on

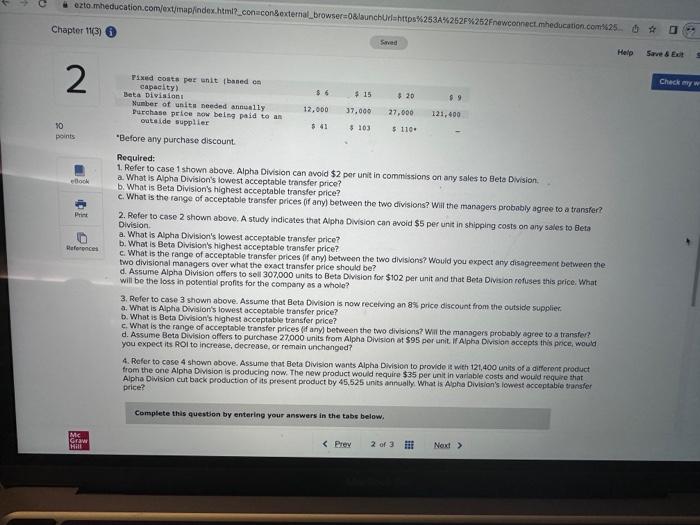

Alpha and Beta are divisions within the some company. The managers of both divisions are evaluated based on theit own division's return on investment (RO:). Assume the following information relative to tho two divisions: verore any purenase discount. Required: 1. Refer to case f shawn above. Alpha Division can ovoid $2 per una in commissions on any sales to Reta Division. a. What is Alpha Division's towest acceptable transfer price? b. What is Bela Division's highest acceptable transfer price? c. What is the range of acceptable trensler prices ff anyl between the two divisions? Wil the managers probably agroe to a transfor? 2. Refer to case 2 shown above. A study indicotes that Alpha Divisien can aroid $5 per unit in shipping cosis on any sales to Beta Dision, a. What is Alpha Division's lowest acceptable tansfer price? b. Whan is Beta Division's highest acceptable transfer price? c. What is the range of acceptable trarsfer prices (f ary) between the two divisians? Would you eapect arty disogreenent botheen the two divisional managers over what the exact transfer price should be? if. Astume Alpha Division offlers to sell 307000 units to Beta Division for 5102 per unt and that Beta Drision tefises this price. What win be the ioss in potentist prosts for the compory as a wholie? 3. Rofer to case 3 shown obove. Assume that Beta Division s now recehing an 8 s price ascount from the outuiderauppiod a. What is Alpha Divison's lowest ecceptable transter pice? Required: 1. Refer to case 1 shown above. Alpha Division can avoid $2 por unit in comm'ssions on any sales to Beta Division. a. What is Alpha Division's lowest acceptable transfer price? b. What is Beta Division's highest acceptable transfer price? c. What is the range of acceptable transfer prices (ff any) between the two divisions? Will the managers probably agree to a transfer? 2. Refer to case 2 shown abowe. A study indicates that Alpha Division can avoid $5 per unit in shipping costs on any sales to Beta Division. a. Whot is Alpha Division's lowest acceptable transter price? b. What is Beto Division's highest acceptable transfer price? c. What is the range of acceptoble transfer prices ff any) betweon the two divisions? Would you expect any disogreemeot between the two divisional managers over what the exact transfer price should be? d. Assume Alpha Division offers to sell 307,000 units to Beta Dwision for $102 per unit and that Beta Division refieses this price. What will be the loss in potential profits for the comparyy as a whole? 3. Refer to case 3 shown above. Assume that Beta Dwision is now recetving an 8% price discount from the outside suppliec. a. What is Alpha Division's lowest acceptable transfer price? b. What is Bota Division's highest acceptable transfer price? 5. What is the range of acceptable transfer prices if anyl between the two divisions? Wilt the managers probably agree to a fransfer? d. Assume Beta Division offers to purchase 27000 units from Alpha Division at $95 per unit if Alpha. Divisian accepts this price, would you expect its ROI to increase, decrease, or remain unchanged? 4. Rafer to case 4 shown obove. Assume that Beta Olvision wants Alpha Dision to provide is with 121,400 units of a different product trom the one Alphe Division is producing now. The new product would require $35 per init in varlable costs and would require that Alpha Division cut back production of its present product by 45,525 units anrually What is Afpha Division's lowest accoptabie eransfer price? Complete this quention by entering your answers in the tabs below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts