Question: Please help and explain every step with shown work and how the answer was gotten. Thank you! 1) Archer Foods has a freezer that is

Please help and explain every step with shown work and how the answer was gotten. Thank you!

Please help and explain every step with shown work and how the answer was gotten. Thank you!

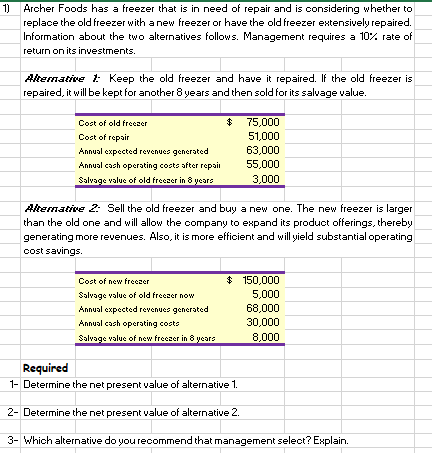

1) Archer Foods has a freezer that is in need of repair and is considering whether to replace the old freezer with a new freezer or have the old freezer extensively repaired. Information about the two alternatives follows. Management requires a 10% rate of return on its investments Alterative ? Keep the old freezer and have it repaired. If the old freezer is repaired, it will be kept for another 8 years and then sold for its salvage value. $ Cost of old freccer Cost of repair Annual expected revenues generated Annual cash operating costs after repair Salvage value of old frecaer in 8 years 75,000 51,000 63,000 55,000 3,000 Alematie 2: Sell the old freezer and buy a new one. The new freezer is larger than the old one and will allow the company to expand its product offerings, thereby generating more revenues. Also, it is more efficient and will yield substantial operating cost savings. $ Cost of new freezer Salvage value of old frecaer now Annual expected revenues generated Annual cash operating costs Salvage value of new freccer in 8 years 150,000 5,000 68,000 30,000 Required 1- Determine the net present value of alternative 1. 2- Determine the net present value of alternative 2. 3- Which alternative do you recommend that management select? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts