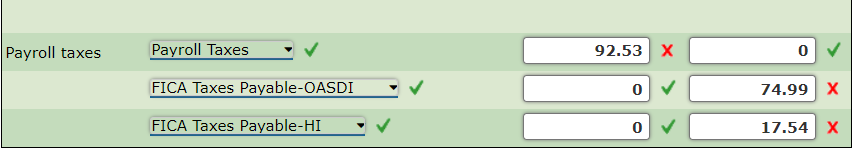

Question: Please help and explain if you're able. Thank you! The journal entry to record the payroll from Figure 6.1 , on pages 62 and 63,

Please help and explain if you're able. Thank you!

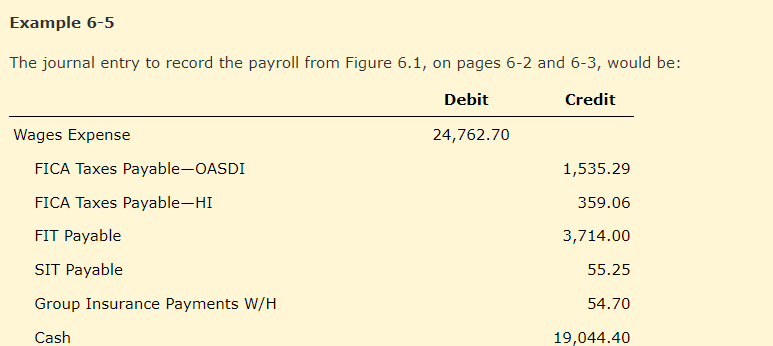

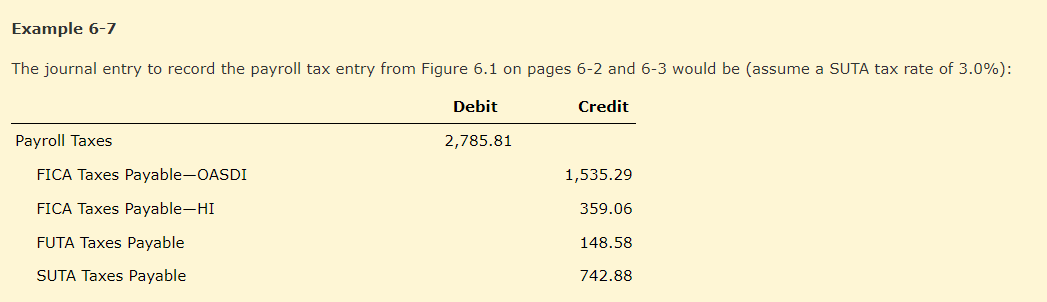

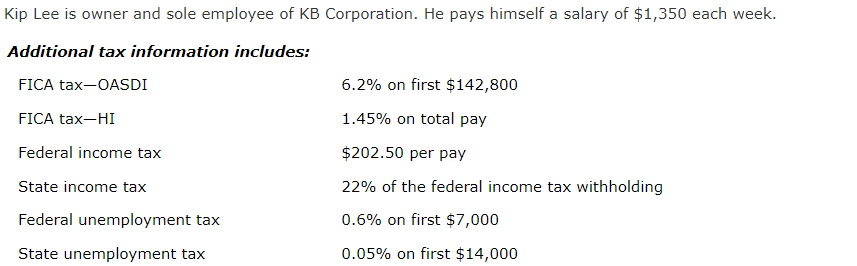

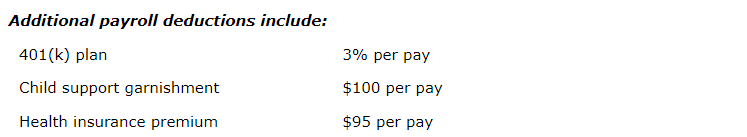

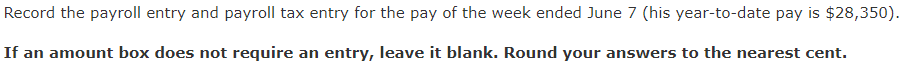

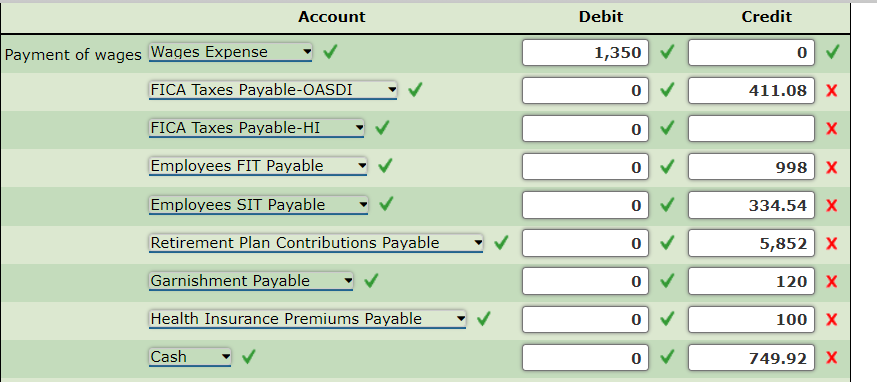

The journal entry to record the payroll from Figure 6.1 , on pages 62 and 63, would be: The journal entry to record the payroll tax entry from Figure 6.1 on pages 62 and 63 would be (assume a SUTA tax rate of 3.0% ): Kip Lee is owner and sole employee of KB Corporation. He pays himself a salary of $1,350 each week. Additional tax information includes: FICA tax-OASDI 6.2% on first $142,800 FICA tax-HI 1.45% on total pay Federal income tax $202.50 per pay State income tax 22% of the federal income tax withholding Federal unemployment tax 0.6% on first $7,000 State unemployment tax 0.05% on first $14,000 Additional payroll deductions include: Record the payroll entry and payroll tax entry for the pay of the week ended June 7 (his year-to-date pay is $28,350 ). If an amount box does not require an entry, leave it blank. Round your answers to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts