Question: Please help and please explain your answer so i can learn as well..Also please clearly state your answers. If the answers are correct then ill

Please help and please explain your answer so i can learn as well..Also please clearly state your answers. If the answers are correct then ill thumbs up:) THANK YOU in advance!

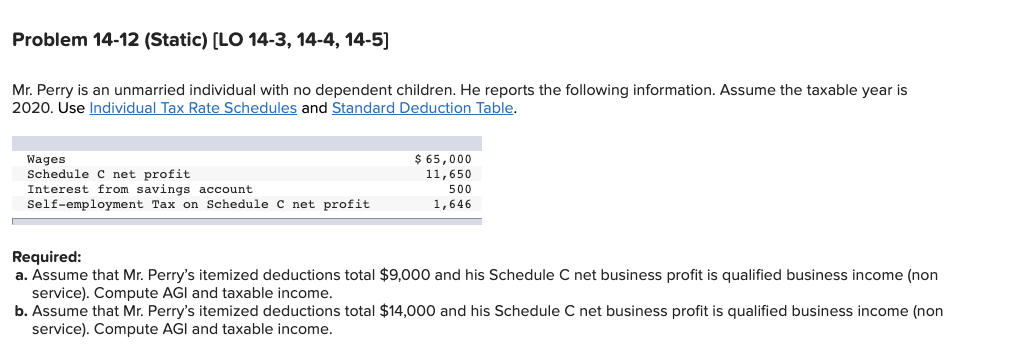

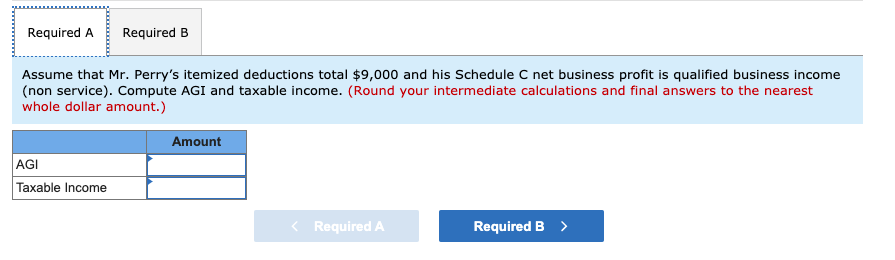

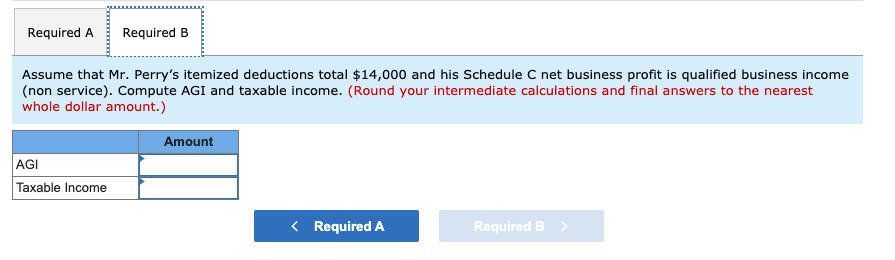

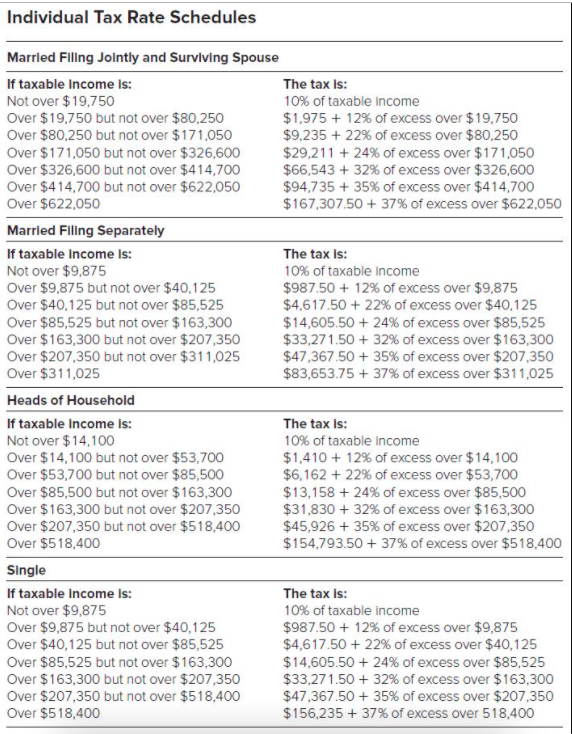

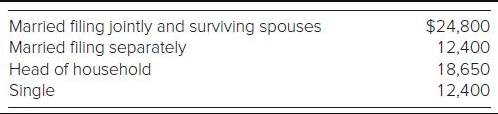

Problem 14-12 (Static) (LO 14-3, 14-4, 14-5) Mr. Perry is an unmarried individual with no dependent children. He reports the following information. Assume the taxable year is 2020. Use Individual Tax Rate Schedules and Standard Deduction Table. Wages Schedule C net profit Interest from savings account Self-employment Tax on Schedule C net profit $ 65,000 11,650 500 1,646 Required: a. Assume that Mr. Perry's itemized deductions total $9,000 and his Schedule C net business profit is qualified business income (non service). Compute AGI and taxable income. b. Assume that Mr. Perry's itemized deductions total $14,000 and his Schedule C net business profit is qualified business income (non service). Compute AGI and taxable income. Required A Required B Assume that Mr. Perry's itemized deductions total $9,000 and his Schedule C net business profit is qualified business income (non service). Compute AGI and taxable income. (Round your intermediate calculations and final answers to the nearest whole dollar amount.) Amount AGI Taxable income Required A Required B Assume that Mr. Perry's itemized deductions total $14,000 and his Schedule C net business profit is qualified business income (non service). Compute AGI and taxable income. (Round your intermediate calculations and final answers to the nearest whole dollar amount.) Amount AGI Taxable income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts