Question: Please help and show step by step on the question G. THANK YOU! g. Determine the quarters for which XYZ is subject to underpayment of

Please help and show step by step on the question G. THANK YOU!

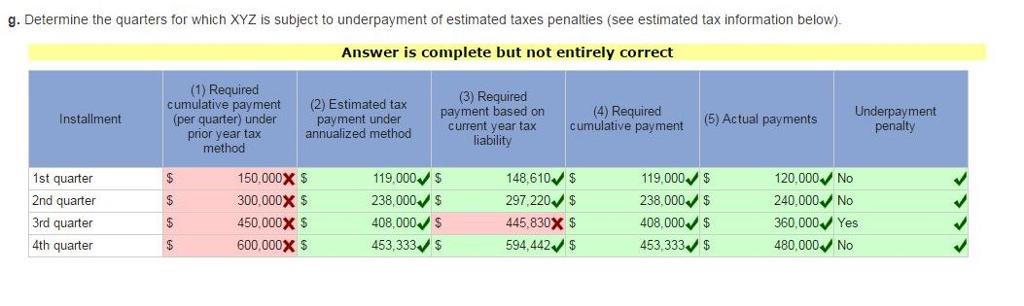

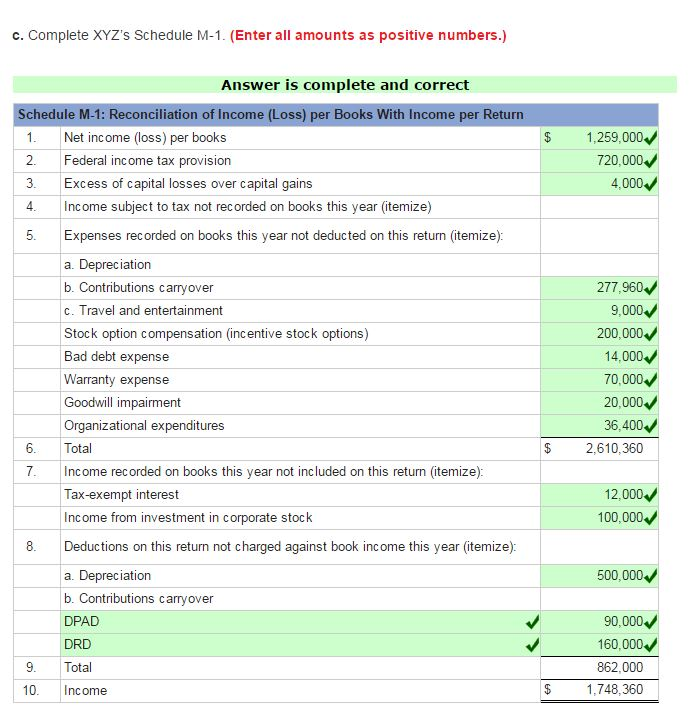

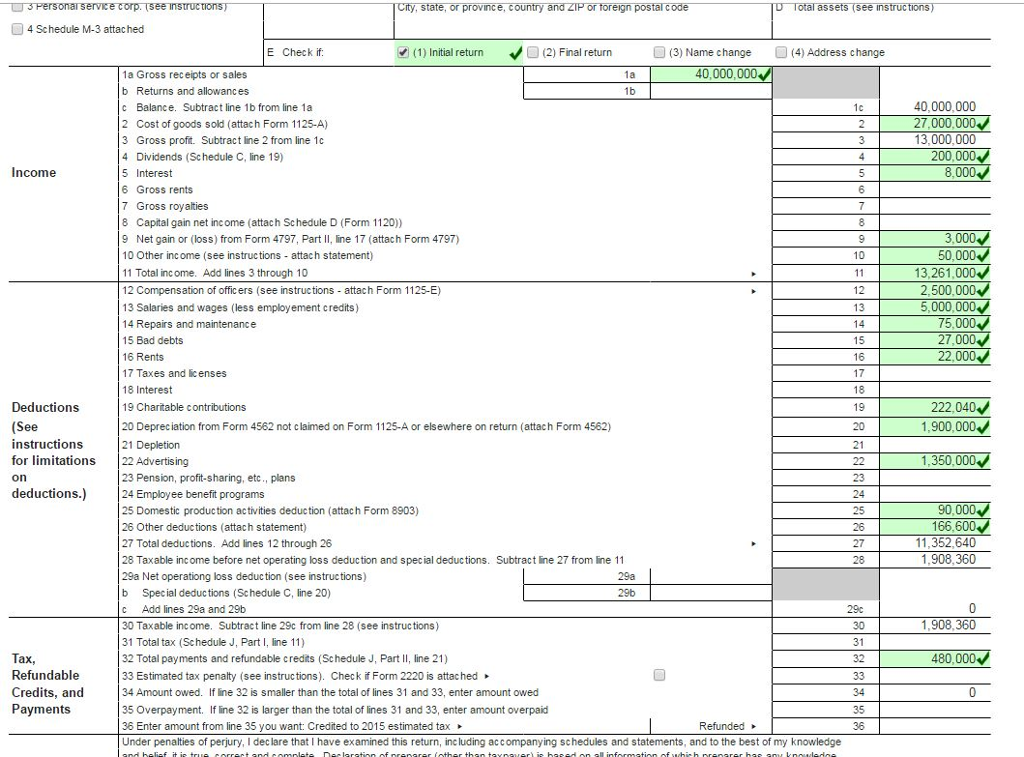

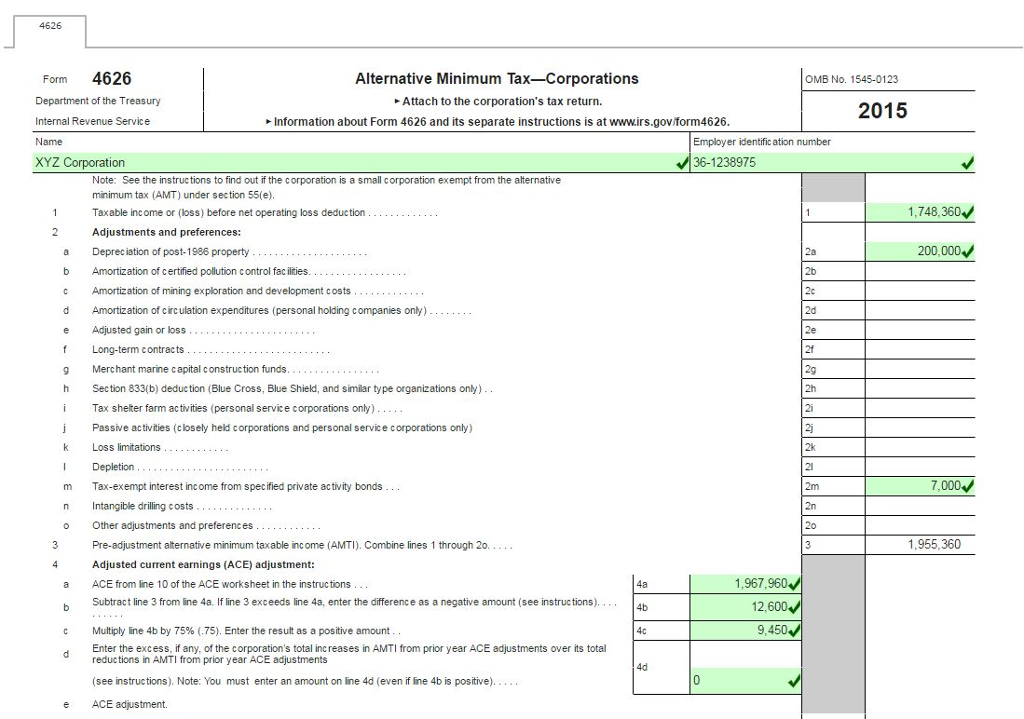

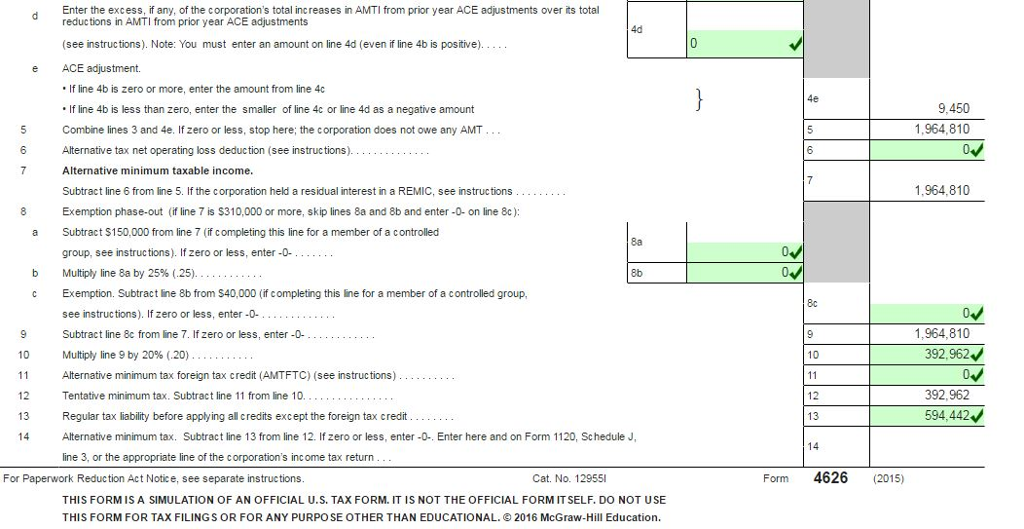

g. Determine the quarters for which XYZ is subject to underpayment of estimated taxes penalties (see estimated tax information below). Answer is complete but not entirely correct (1) Required (3) Required cumulative payment (2) Estimated tax payment based on (4) Required 5) Actual payments Underpayment (per quarter) under payment under current year ta cumulative payment penalty prior year tax annualized method liability method nstallment 148,610V 150,000X 119,000 119,000 120,000 No 1st quarter 240,000 No 300,000X 238,000 297, 220V 238,000 2nd quarter 450,000X 445,830X 360,000 Yes 3rd quarter 408,000 V S 408,000 V s 453,333 594,442 453,333 480,000 No 4th quarter 600,000X g. Determine the quarters for which XYZ is subject to underpayment of estimated taxes penalties (see estimated tax information below). Answer is complete but not entirely correct (1) Required (3) Required cumulative payment (2) Estimated tax payment based on (4) Required 5) Actual payments Underpayment (per quarter) under payment under current year ta cumulative payment penalty prior year tax annualized method liability method nstallment 148,610V 150,000X 119,000 119,000 120,000 No 1st quarter 240,000 No 300,000X 238,000 297, 220V 238,000 2nd quarter 450,000X 445,830X 360,000 Yes 3rd quarter 408,000 V S 408,000 V s 453,333 594,442 453,333 480,000 No 4th quarter 600,000X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts