Question: Please help and show work 2. Bond X has 20 years to maturity, a 9% annual coupon, and a $1000 face value. The required rate

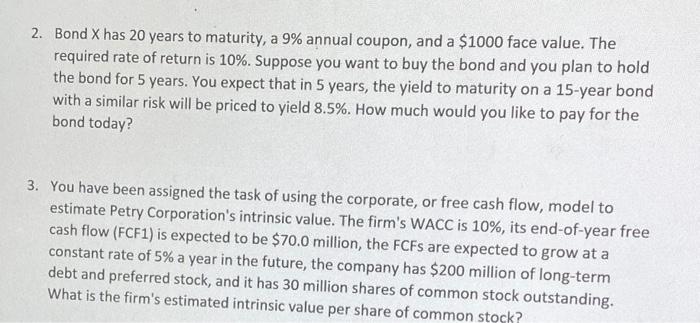

2. Bond X has 20 years to maturity, a 9% annual coupon, and a $1000 face value. The required rate of return is 10%. Suppose you want to buy the bond and you plan to hold the bond for 5 years. You expect that in 5 years, the yield to maturity on a 15-year bond with a similar risk will be priced to yield 8.5%. How much would you like to pay for the bond today? 3. You have been assigned the task of using the corporate, or free cash flow, model to estimate Petry Corporation's intrinsic value. The firm's WACC is 10%, its end-of-year free cash flow (FCF1) is expected to be $70.0 million, the FCFs are expected to grow at a constant rate of 5% a year in the future, the company has $200 million of long-term debt and preferred stock, and it has 30 million shares of common stock outstanding. What is the firm's estimated intrinsic value per share of common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts