Question: Please help answer 1., a,b,c, and 2. (this has an example at the end). Thank you! Critical Thinking This problem requires you to compute stock

Please help answer 1., a,b,c, and 2. (this has an example at the end). Thank you!

- Critical Thinking This problem requires you to compute stock basis and determine the tax treatment in a stock transfer under Sec. 351 and Sec. 1244. Please be sure to label your work and show all calculations for the opportunity to earn partial credit.

Gigi transfers real estate with a basis of $60,000 and a fair market value of $40,000 to Monarch Corporation in exchange for shares of 1244 stock. Assume that the transfer qualifies under 351.

a. What is the basis of the stock to Gigi? Gigi and Monarch do not make an election to reduce her stock basis.

b. What is the basis of the stock to Gigi for purposes of applying 1244?

c. If Gigi sells the stock for $38,000 two years later, how will she treat the loss for tax purposes?

2. Sparrow Corporation (a calendar year, accrual basis taxpayer) had the following transactions in 2023, its second year of operation:

| Taxable income | $330,000 |

| Federal income tax liability paid | 69,300 |

| Tax-exempt interest income | 5,000 |

| Meals expense (total) | 3,000 |

| Premiums paid on key employee life insurance | 3,500 |

| Increase in cash surrender value attributable to life insurance premiums | 700 |

| Proceeds from key employee life insurance policy | 130,000 |

| Cash surrender value of life insurance policy at distribution | 20,000 |

| Excess of capital losses over capital gains | 13,000 |

| MACRS deduction | 26,000 |

| Straight-line depreciation using ADS lives | 16,000 |

| Section 179 expense elected during 2022 | 25,000 |

| Dividends received from domestic corporations (less than 20% owned) | 35,000 |

Sparrow uses the LIFO inventory method, and its LIFO recapture amount increased by $10,000 during 2023. In addition, Sparrow sold property on installment during 2022. The property was sold for $40,000 and had an adjusted basis at sale of $32,000. During 2023, Sparrow received a $15,000 payment on the installment sale. Finally, assume that no additional first-year depreciation was claimed. Compute Sparrow's current E & P.

This problem requires you to make adjustments to a corporation's taxable income to compute the corporation's Current Earnings and Profits (E&P). ). Use the format shown in Example 9 (Below) of Chapter 19 to present your work. Please be sure to label your work and show all calculations for the opportunity to earn partial credit.

Example 9

Crimson Corporation (a calendar year, accrual basis taxpayer) reports taxable income of $429,000 in 2023. In addition, it provides the following information:

| Federal income tax liability paid | $?90,090 |

| Tax-exempt interest income | 6,250 |

| Meal expenses (total) | 10,000 |

| Entertainment expenses | 3,000 |

| Premiums paid on key employee life insurance | 8,500 |

| Life insurance proceeds from key employee life insurance policy | 250,000 |

| Excess of capital losses over capital gains | 22,000 |

| MACRS cost recovery deduction | 82,000 |

| E & P depreciation (straight-line depreciation using ADS) | 64,000 |

| Section 179 expense elected and deducted during 2020 for regular tax purposes | 120,000 |

| Dividends received from domestic corporations (less than 20% owned) | 35,000 |

Crimson sold property on installment during 2021. The property was sold for $120,000 and had an $84,000 adjusted basis when sold. During 2023, Crimson received a $30,000 payment on the installment sale. Finally, assume that Crimson did not claim any 179 expense or bonus depreciation in 2023. What is Crimson's current E & P?

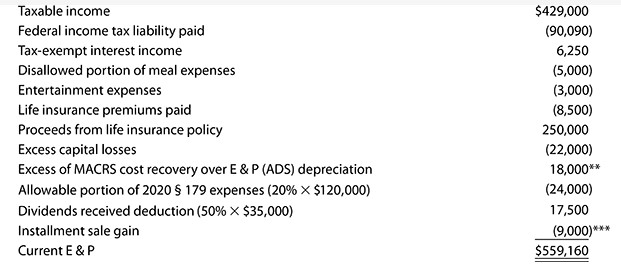

Taxable income $429,000 Federal income tax liability paid (90,090) Tax-exempt interest income 6,250 Disallowed portion of meal expenses (5,000) Entertainment expenses (3,000) Life insurance premiums paid (8,500) Proceeds from life insurance policy 250,000 Excess capital losses (22,000) Excess of MACRS cost recovery over E & P (ADS) depreciation 18,000** Allowable portion of 2020 5 179 expenses (20% * $120,000) (24,000) Dividends received deduction (50% * $35,000) 17,500 Installment sale gain (9,000) Current E & P $559,160

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts