Question: Please help answer all questions correctly with explanations. 27. If shareholders are granted a preemptive right they will a. be given the choice of receiving

Please help answer all questions correctly with explanations.

Please help answer all questions correctly with explanations.

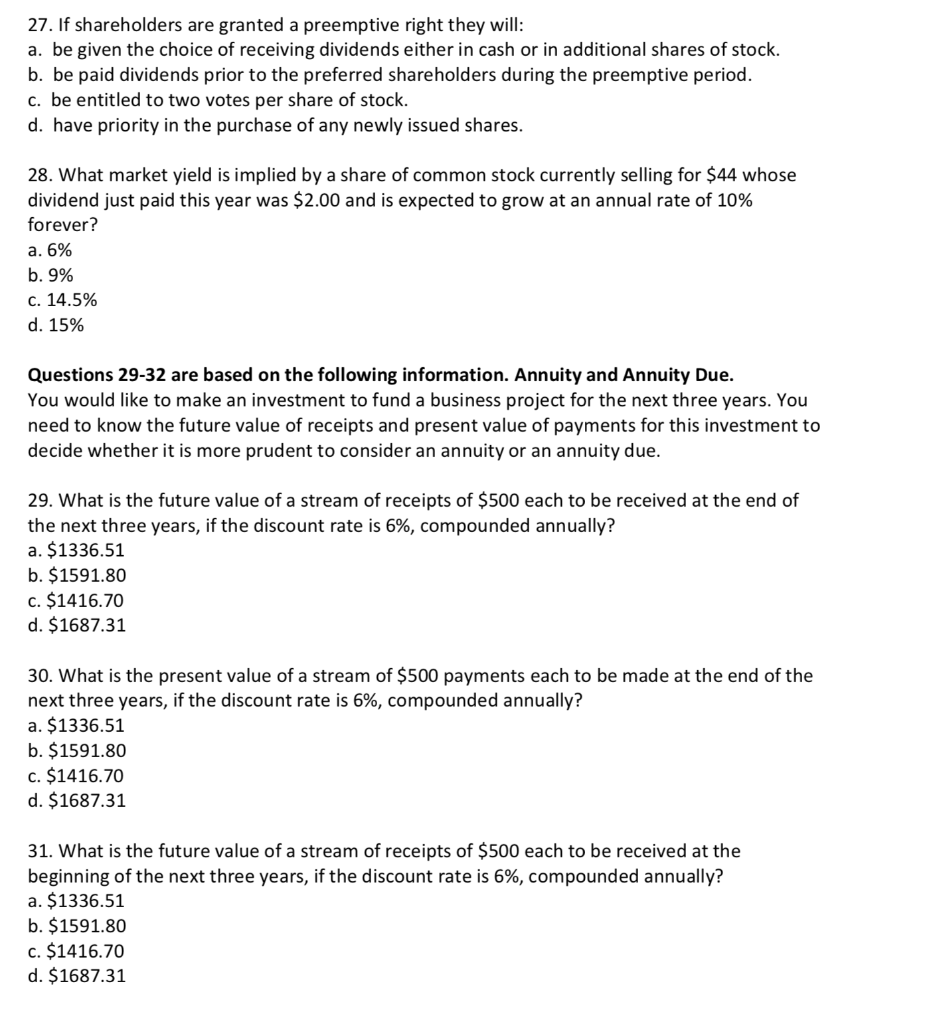

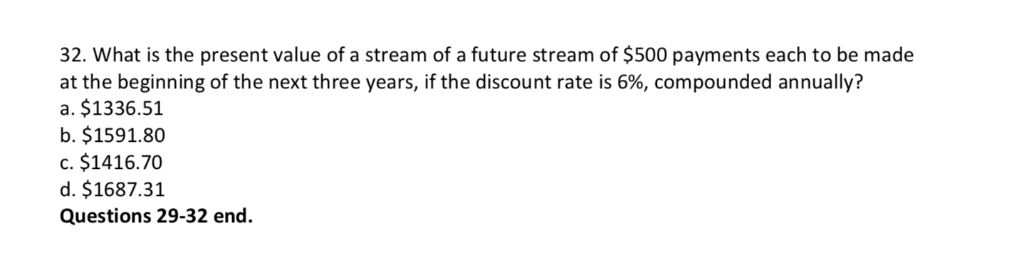

27. If shareholders are granted a preemptive right they will a. be given the choice of receiving dividends either in cash or in additional shares of stock b. be paid dividends prior to the preferred shareholders during the preemptive period c. be entitled to two votes per share of stock. d. have priority in the purchase of any newly issued shares 28. What market yield is implied by a share of common stock currently selling for $44 whose dividend just paid this year was $2.00 and is expected to grow at an annual rate of 10% forever? a. 6% b. 9% C. 14.5% d. 15% Questions 29-32 are based on the following information. Annuity and Annuity Due. You would like to make an investment to fund a business project for the next three years. You need to know the future value of receipts and present value of payments for this investment to decide whether it is more prudent to consider an annuity or an annuity due. 29. What is the future value of a stream of receipts of $500 each to be received at the end of the next three years, if the discount rate is 6%, compounded annually? a. $1336.51 b. $1591.80 c. $1416.70 d. $1687.31 30. What is the present value of a stream of $500 payments each to be made at the end of the next three years, if the discount rate is 6%, compounded annually? a. $1336.51 b. $1591.80 c. $1416.70 d. $1687.31 31. What is the future value of a stream of receipts of $500 each to be received at the beginning of the next three years, if the discount rate is 6%, compounded annually? a. $1336.51 b. $1591.80 c. $1416.70 d. $1687.31 32. What is the present value of a stream of a future stream of $500 payments each to be made at the beginning of the next three years, if the discount rate is 6%, compounded annually? a. $1336.51 b. $1591.80 c. $1416.70 d. $1687.31 Questions 29-32 end

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts