Question: Please help answer and explain. Need help with these concepts. Managerial Economics (ARE) 100A University of California, Davis Fall Quarter, 2017 Instructor: Luca salvatici Homework

Please help answer and explain. Need help with these concepts.

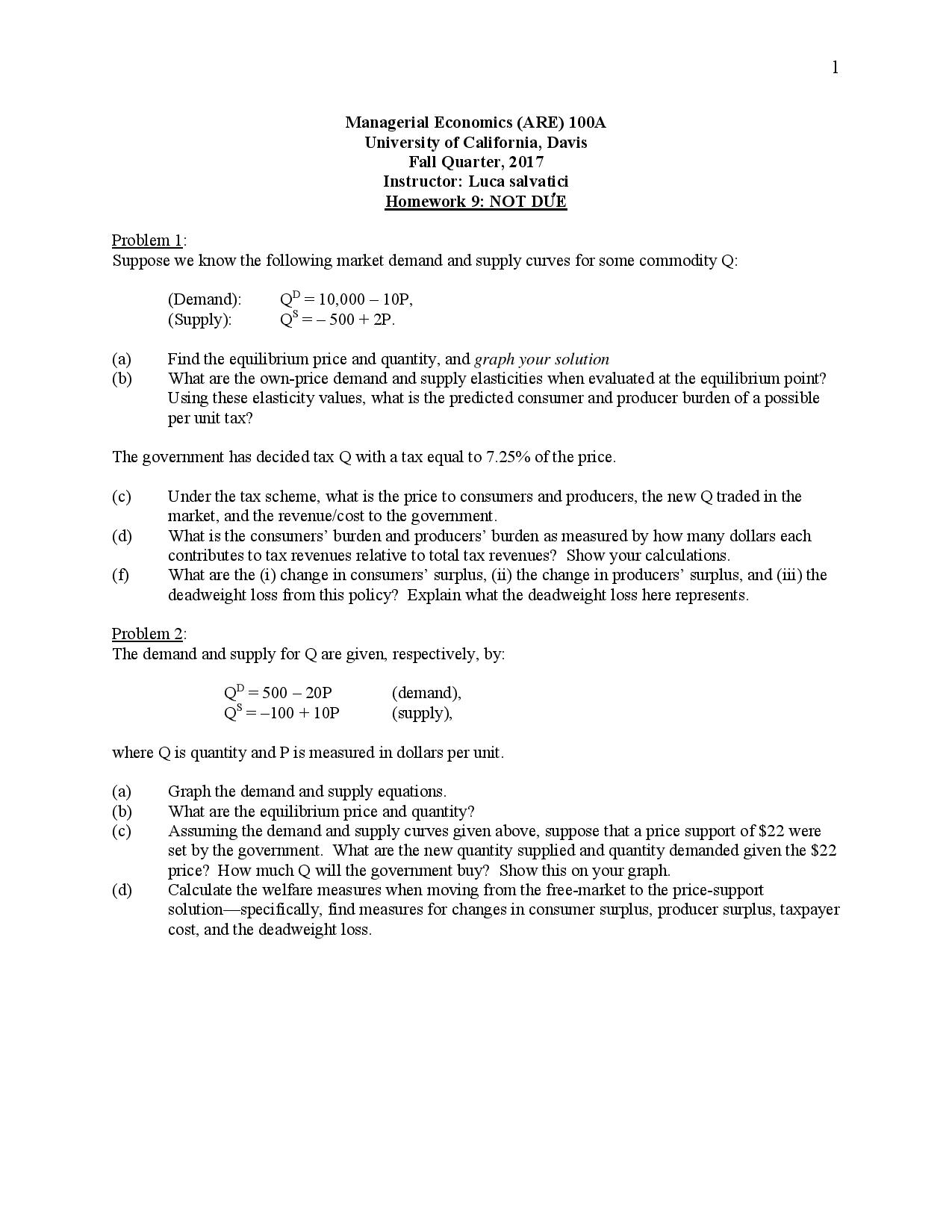

Managerial Economics (ARE) 100A University of California, Davis Fall Quarter, 2017 Instructor: Luca salvatici Homework 9: NOT DUE Problem 1: Suppose we know the following market demand and supply curves for some commodity Q: (a) (1)) (Demand): Q\" = 10,000 101), (Supply): Q5 = 500 + 2P. Find the equilibrium price and quantity, and graph your solution What are the own-price demand and supply elasticities when evaluated at the equilibrium point? Using these elasticity values, what is the predicted consumer and producer burden of a possible per unit tax? The government has decided tax Q with a tax equal to 7.25% ofthe price. (c) Under the tax scheme, what is the price to consumers and producers, the new Q traded in the market, and the revenuelcost to the government. ((1) What is the consumers' burden and producers' burden as measured by how many dollars each contributes to tax revenues relative to total tax revenues? Show your calculations. (i) What are the (i) change in consumers' surplus, (ii) the change in producers' surplus, and (iii) the deadweight loss from this policy? Explain what the deadweight loss here represents. Problem 2: The demand and supply for Q are given, respectively, by: Q\" = 500 20p (demand), Q5 = 100 + 101) (supply), where Q is quantity and P is measured in dollars per unit. (a) (b) (C) ((1) Graph the demand and supply equations. What are the equilibrium price and quantity? Assuming the demand and supply curves given above, suppose that a price support of $22 were set by the government. What are the new quantity supplied and quantity demanded given the $22 price? How much Q will the government buy? Show this on your graph. Calculate the welfare measures when moving from the free-market to the price-support solutionspecically, nd measures for changes in consumer surplus, producer surplus, taxpayer cost, and the deadweight loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts