Question: Please help answer correctly, and show the process,thank you The Digital Electronic Quotation System (DEQS) Corporation pays no cash dividends currently and is not expected

Please help answer correctly, and show the process,thank you

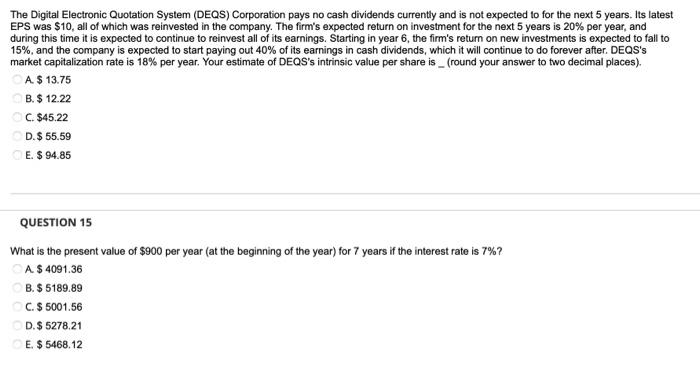

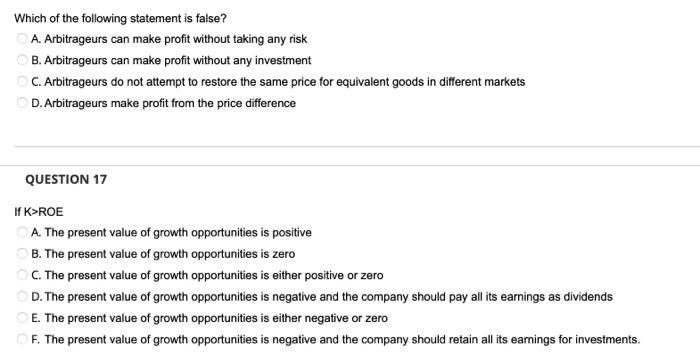

The Digital Electronic Quotation System (DEQS) Corporation pays no cash dividends currently and is not expected to for the next 5 years. Its latest EPS was $10, all of which was reinvested in the company. The firm's expected return on investment for the next 5 years is 20% per year, and during this time it is expected to continue to reinvest all of its earnings. Starting in year 6 , the firm's retum on new investments is expected to fall to 15%, and the company is expected to start paying out 40% of its earnings in cash dividends, which it will continue to do forever after. DEQS's market capitalization rate is 18% per year. Your estimate of DEQS's intrinsic value per share is_ (round your answer to two decimal places). A. $13.75 B. $12.22 C. $45.22 D. $55.59 E. $94.85 QUESTION 15 What is the present value of $900 per year (at the beginning of the year) for 7 years if the interest rate is 7% ? A. $4091.36 B. $5189.89 C. $5001.56 D. $5278.21 E. $5468.12 Which of the following statement is false? A. Arbitrageurs can make profit without taking any risk B. Arbitrageurs can make profit without any investment C. Arbitrageurs do not attempt to restore the same price for equivalent goods in different markets D. Arbitrageurs make profit from the price difference QUESTION 17 If K>ROE A. The present value of growth opportunities is positive B. The present value of growth opportunities is zero C. The present value of growth opportunities is either positive or zero D. The present value of growth opportunities is negative and the company should pay all its earnings as dividends E. The present value of growth opportunities is either negative or zero F. The present value of growth opportunities is negative and the company should retain all its earnings for investments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts