Question: Please help where there is an X 1. 2. 3. The Generic Genetic (GG) Corporation pays no cash dividends currently and is not expected to

Please help where there is an "X"

1. 2.

2.  3.

3.

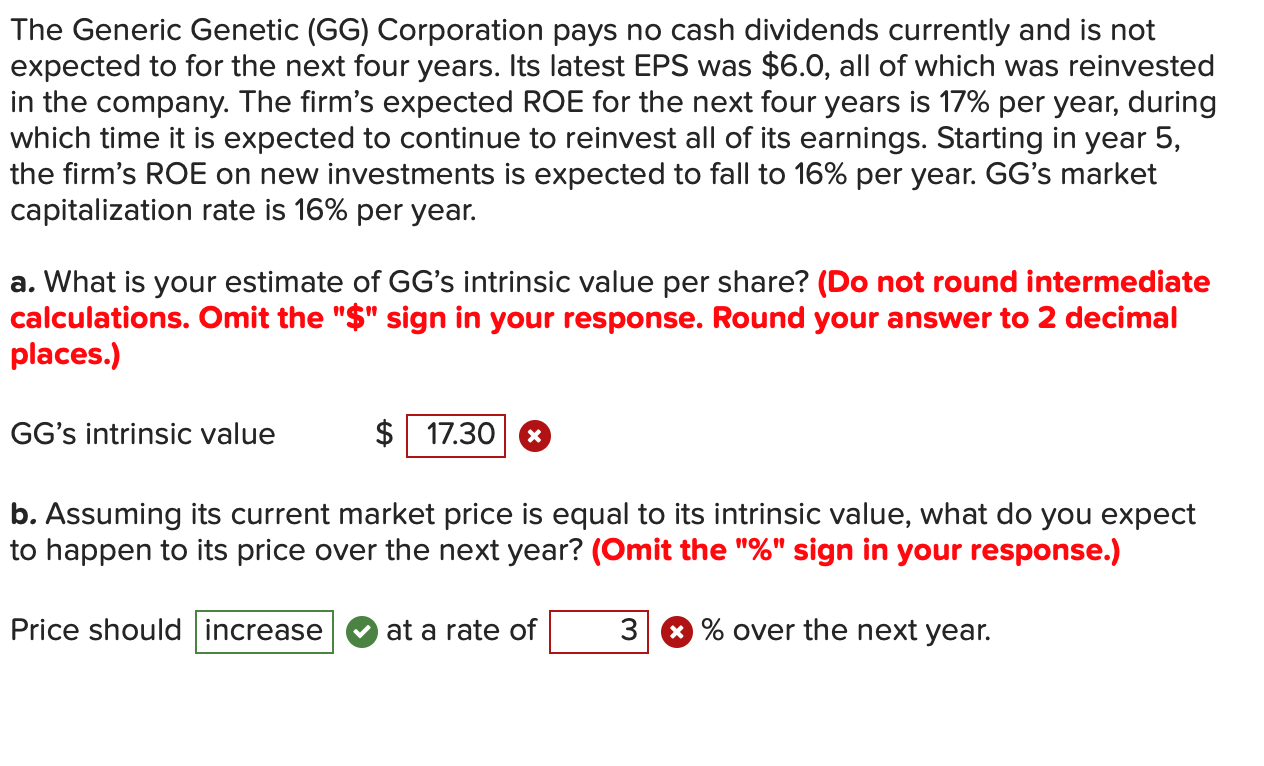

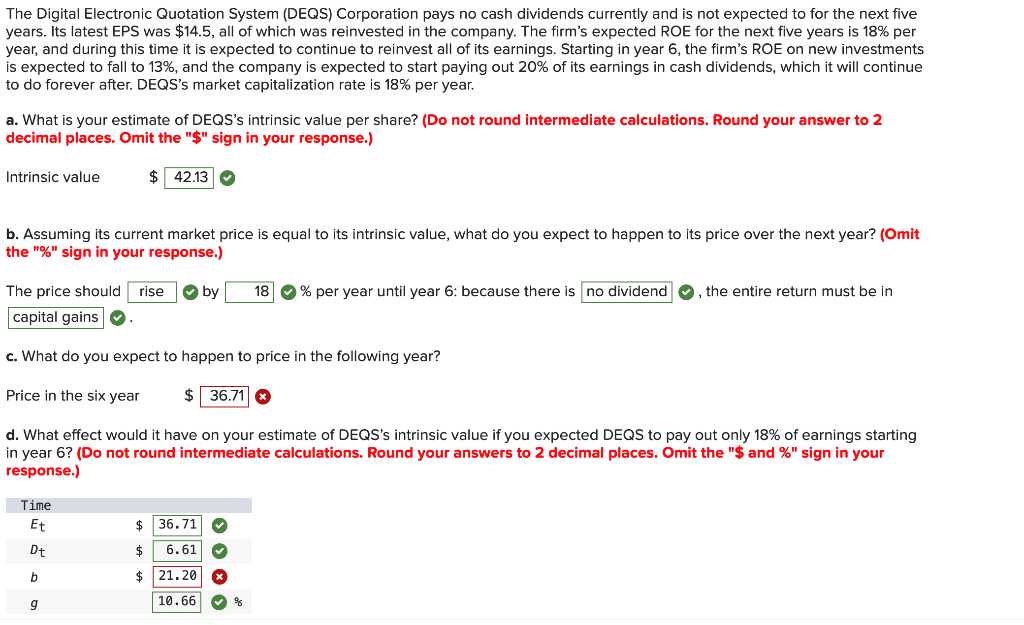

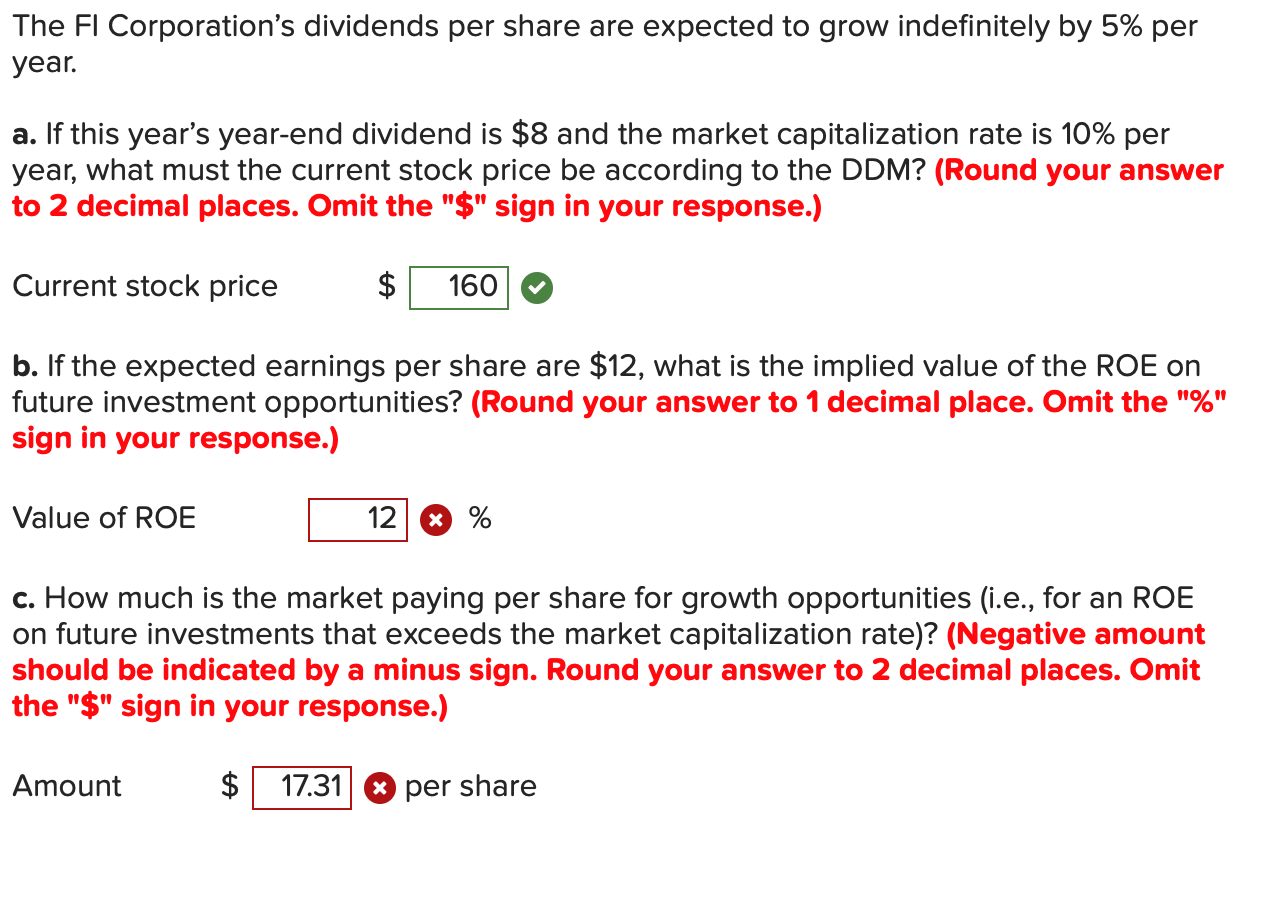

The Generic Genetic (GG) Corporation pays no cash dividends currently and is not expected to for the next four years. Its latest EPS was $6.0, all of which was reinvested in the company. The firm's expected ROE for the next four years is 17% per year, during which time it is expected to continue to reinvest all of its earnings. Starting in year 5, the firm's ROE on new investments is expected to fall to 16% per year. GG's market capitalization rate is 16% per year. a. What is your estimate of GG's intrinsic value per share? (Do not round intermediate calculations. Omit the "$" sign in your response. Round your answer to 2 decimal places.) GG's intrinsic value 17.30 X b. Assuming its current market price is equal to its intrinsic value, what do you expect to happen to its price over the next year? (Omit the "%" sign in your response.) Price should increase at a rate of % over the next year. 3 The Digital Electronic Quotation System (DEQS) Corporation pays no cash dividends currently and is not expected to for the next five years. Its latest EPS was $14.5, all of which was reinvested in the company. The firm's expected ROE for the next five years is 18% per year, and during this time it is expected to continue to reinvest all of its earnings. Starting in year 6, the firm's ROE on new investments is expected to fall to 13%, and the company is expected to start paying out 20% of its earnings in cash dividends, which it will continue to do forever after. DEQS's market capitalization rate is 18% per year. a. What is your estimate of DEQS's intrinsic value per share? (Do not round intermediate calculations. Round your answer to 2 decimal places. Omit the "$" sign in your response.) $42.13 Intrinsic value b. Assuming its current market price is equal to its intrinsic value, what do you expect to happen to its price over the next year? (Omit the "%" sign in your response.) The price should rise by capital gains c. What do you expect to happen to price in the following year? Price in the six year $36.71 d. What effect would it have on your estimate of DEQS's intrinsic value if you expected DEQS to pay out only 18% of earnings starting in year 6? (Do not round intermediate calculations. Round your answers to 2 decimal places. Omit the "$ and%" sign in your response.) Time Et Dt b g $ 36.71 $ 6.61 $ 21.20 10.66 18 % per year until year 6: because there is no dividend, the entire return must be in The FI Corporation's dividends per share are expected to grow indefinitely by 5% per year. a. If this year's year-end dividend is $8 and the market capitalization rate is 10% per year, what must the current stock price be according to the DDM? (Round your answer to 2 decimal places. Omit the "$" sign in your response.) Current stock price b. If the expected earnings per share are $12, what is the implied value of the ROE on future investment opportunities? (Round your answer to 1 decimal place. Omit the "%" sign in your response.) Value of ROE 160 Amount 12 * % c. How much is the market paying per share for growth opportunities (i.e., for an ROE on future investments that exceeds the market capitalization rate)? (Negative amount should be indicated by a minus sign. Round your answer to 2 decimal places. Omit the "$" sign in your response.) $ 17.31 per share The Generic Genetic (GG) Corporation pays no cash dividends currently and is not expected to for the next four years. Its latest EPS was $6.0, all of which was reinvested in the company. The firm's expected ROE for the next four years is 17% per year, during which time it is expected to continue to reinvest all of its earnings. Starting in year 5, the firm's ROE on new investments is expected to fall to 16% per year. GG's market capitalization rate is 16% per year. a. What is your estimate of GG's intrinsic value per share? (Do not round intermediate calculations. Omit the "$" sign in your response. Round your answer to 2 decimal places.) GG's intrinsic value 17.30 X b. Assuming its current market price is equal to its intrinsic value, what do you expect to happen to its price over the next year? (Omit the "%" sign in your response.) Price should increase at a rate of % over the next year. 3 The Digital Electronic Quotation System (DEQS) Corporation pays no cash dividends currently and is not expected to for the next five years. Its latest EPS was $14.5, all of which was reinvested in the company. The firm's expected ROE for the next five years is 18% per year, and during this time it is expected to continue to reinvest all of its earnings. Starting in year 6, the firm's ROE on new investments is expected to fall to 13%, and the company is expected to start paying out 20% of its earnings in cash dividends, which it will continue to do forever after. DEQS's market capitalization rate is 18% per year. a. What is your estimate of DEQS's intrinsic value per share? (Do not round intermediate calculations. Round your answer to 2 decimal places. Omit the "$" sign in your response.) $42.13 Intrinsic value b. Assuming its current market price is equal to its intrinsic value, what do you expect to happen to its price over the next year? (Omit the "%" sign in your response.) The price should rise by capital gains c. What do you expect to happen to price in the following year? Price in the six year $36.71 d. What effect would it have on your estimate of DEQS's intrinsic value if you expected DEQS to pay out only 18% of earnings starting in year 6? (Do not round intermediate calculations. Round your answers to 2 decimal places. Omit the "$ and%" sign in your response.) Time Et Dt b g $ 36.71 $ 6.61 $ 21.20 10.66 18 % per year until year 6: because there is no dividend, the entire return must be in The FI Corporation's dividends per share are expected to grow indefinitely by 5% per year. a. If this year's year-end dividend is $8 and the market capitalization rate is 10% per year, what must the current stock price be according to the DDM? (Round your answer to 2 decimal places. Omit the "$" sign in your response.) Current stock price b. If the expected earnings per share are $12, what is the implied value of the ROE on future investment opportunities? (Round your answer to 1 decimal place. Omit the "%" sign in your response.) Value of ROE 160 Amount 12 * % c. How much is the market paying per share for growth opportunities (i.e., for an ROE on future investments that exceeds the market capitalization rate)? (Negative amount should be indicated by a minus sign. Round your answer to 2 decimal places. Omit the "$" sign in your response.) $ 17.31 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts