Question: Please help answer :) Despite theoretical assertions by M-M and others, many investors do care about dividends quite a bit. The chart below lists some

Please help answer :)

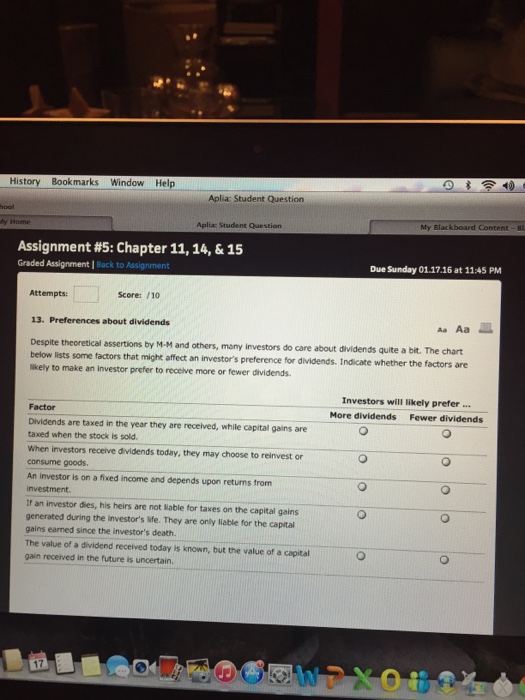

Please help answer :)Despite theoretical assertions by M-M and others, many investors do care about dividends quite a bit. The chart below lists some factors are likely to make an investor prefer to receive more or fewer dividends. Indicate whether the factors are likely to make an investor prefer to receive more or fewer dividends. Factor Investors will likely prefer More dividents Fewer dividends Dividends are taxed in the year they are received, while capital gains are taxed when the stock is sold. When investors receive dividends today, they may choose to reinvest or consume goods. An investor is on a fixed income and depends upon returns from investment. If an investor dies, his heirs are not liable for taxes on the capital gains generated during the investor's life. They are only liable for the capital gains earned since the investor's death. The value of a dividend received today is known, but the value of a capital gain received in the future is uncertain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts