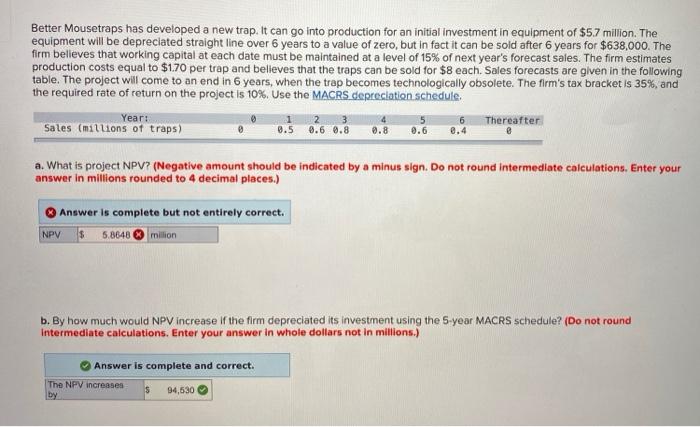

Question: please help answer part a. part b is correct but i cannot get the right answer for a. which is not $-4.341million either.. thank you!

Better Mousetraps has developed a new trap. It can go into production for an initial investment in equipment of $57 million. The equipment will be depreciated straight line over 6 years to a value of zero, but in fact it can be sold after 6 years for $638,000. The firm believes that working capital at each date must be maintained at a level of 15% of next year's forecast sales. The firm estimates production costs equal to $170 per trap and believes that the traps can be sold for $8 each. Sales forecasts are given in the following table. The project will come to an end in 6 years, when the trap becomes technologically obsolete. The firm's tax bracket is 35%, and the required rate of return on the project is 10%. Use the MACRS depreciation schedule Year: 23 Thereafter Sales (millions of traps) 0.5 0.6 0.8 0.8 0.6 2.4 4 6 a. What is project NPV? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer in millions rounded to 4 decimal places.) Answer is complete but not entirely correct. NPV 5.8648 million b. By how much would NPV increase if the firm depreciated its investment using the 5-year MACRS schedule? (Do not round Intermediate calculations. Enter your answer in whole dollars not in millions.) Answer is complete and correct. The NPV increases 94,530

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts