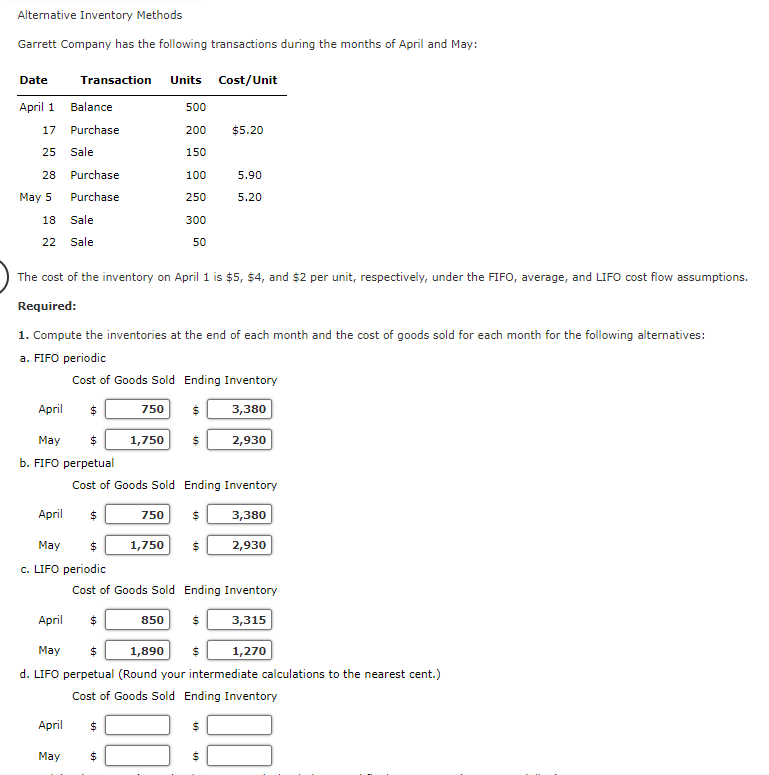

Question: Please help answer the below Alternative Inventory Method questions Alternative Inventory Methods Garrett Company has the following transactions during the months of April and May:

Please help answer the below Alternative Inventory Method questions

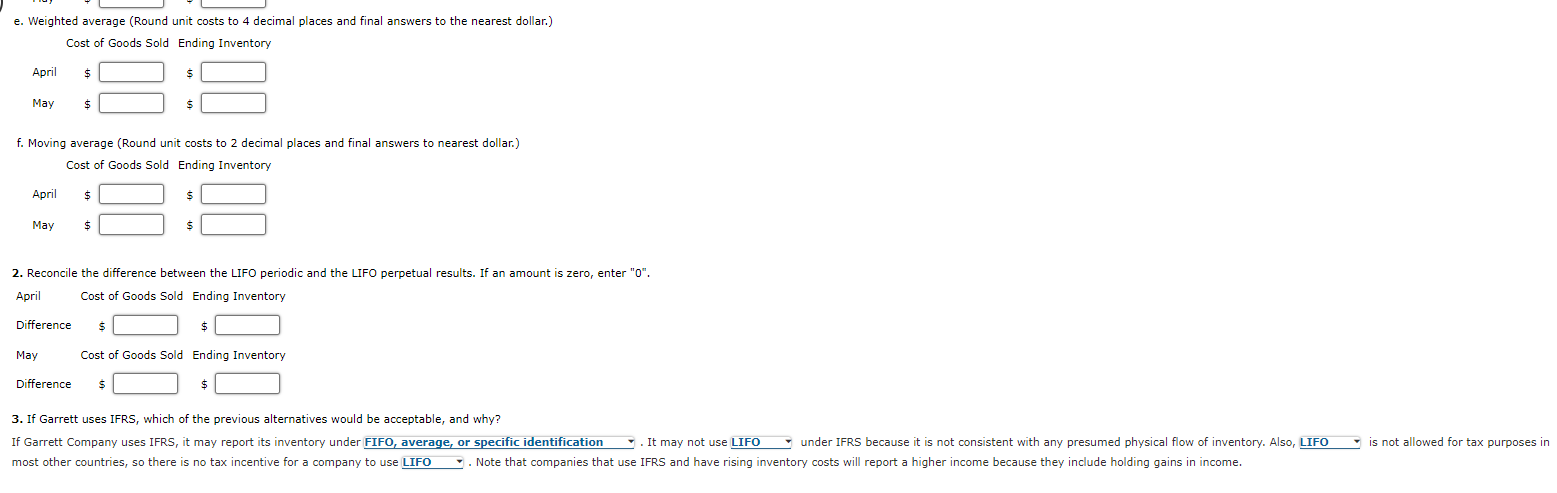

Alternative Inventory Methods Garrett Company has the following transactions during the months of April and May: The cost of the inventory on April 1 is $5,$4, and $2 per unit, respectively, under the FIFO, average, and LIFO cost flow assumption Required: 1. Compute the inventories at the end of each month and the cost of goods sold for each month for the following alternatives: a. FIFO periodic b. Ilru perpetual Cost of Goods Sold Ending Inventory May $ c. LIFO periodic Cost of Goods Sold Ending Inventory April $ May $ d. LIFO perpetual (Round your intermediate calculations to the nearest cent.) Cost of Goods Sold Ending Inventory e. Weighted average (Round unit costs to 4 decimal places and final answers to the nearest dollar.) Cost of Goods Sold Ending Inventory f. Moving average (Round unit costs to 2 decimal places and final answers to nearest dollar.) Cost of Goods Sold Ending Inventory AprilMay$$$$ 2. Reconcile the difference between the LIFO periodic and the LIFO perpetual results. If an amount is zero, enter "0". April Cost of Goods Sold Ending Inventory Difference $ May Cost of Goods Sold Ending Inventory Difference $ 3. If Garrett uses IFRS, which of the previous alternatives would be acceptable, and why? most other countries, so there is no tax incentive for a company to use 1 . Note that companies that use IFRS and have rising inventory costs will report a higher income because they include holding gains in income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts