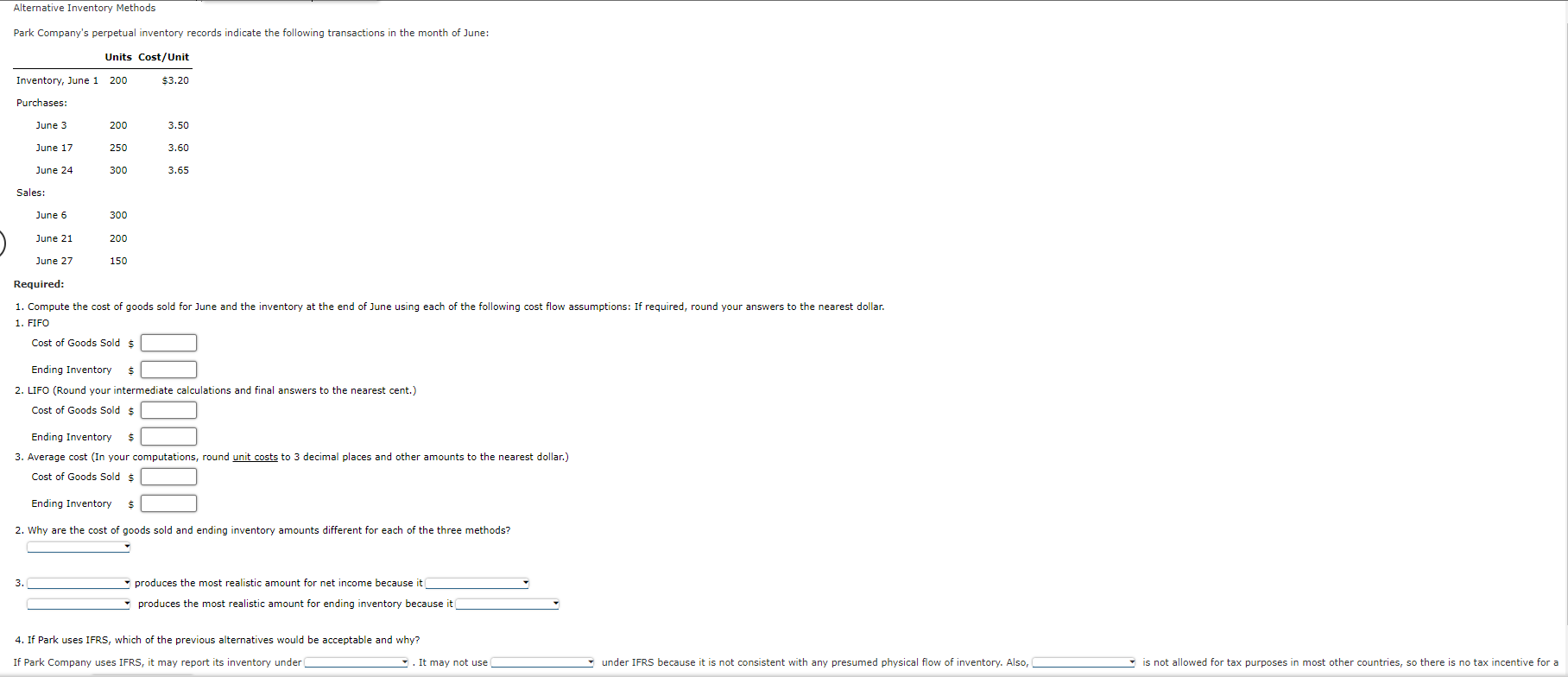

Question: Please help with the following Alternative Inventory method questions. Park Company's perpetual inventory records indicate the following transactions in the month of June: Required:

\

Please help with the following Alternative Inventory method questions.

Park Company's perpetual inventory records indicate the following transactions in the month of June: Required: 1. Compute the cost of goods sold for June and the inventory at the end of June using each of the following cost flow assumptions: If required, round your answers to the nearest dollar. 1. FIFO Cost of Goods Sold $ Ending Inventory $ 2. LIFO (Round your intermediate calculations and final answers to the nearest cent.) Cost of Goods Sold $ Ending Inventory $ 3. Average cost (In your computations, round unit costs to 3 decimal places and other amounts to the nearest dollar.) Cost of Goods Sold $ Ending Inventory $ 2. Why are the cost of goods sold and ending inventory amounts different for each of the three methods? 3. produces the most realistic amount for net income because it :. produces the most realistic amount for ending inventory because it 4. If Park uses IFRS, which of the previous alternatives would be acceptable and why? If Park Company uses IFRS, it may report its inventory under. . It may not use under IFRS because it is not consistent with any presumed physical flow of inventory. Also

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts