Question: Please help answer these parts. Will thumbs up. Thanks. Mannisto, Inc., uses the FIFO inventory cost flow assumption. In a year of rising costs and

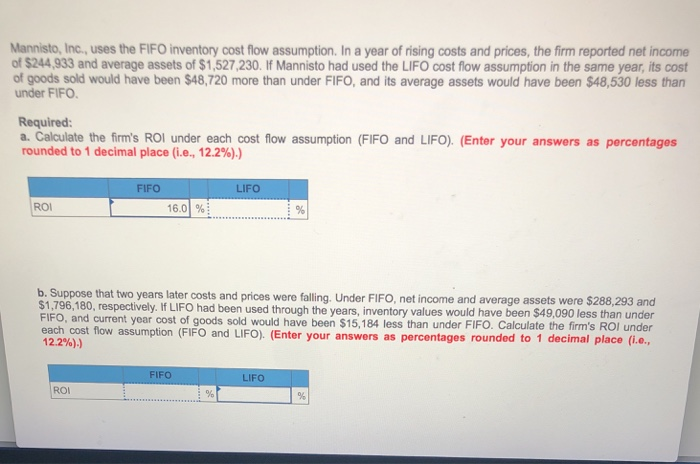

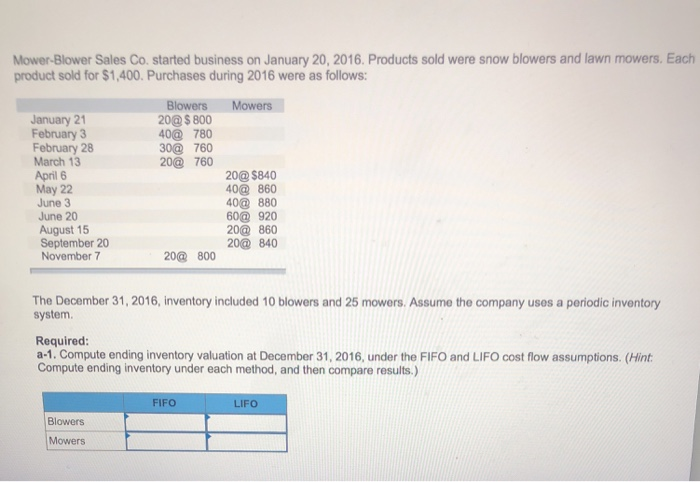

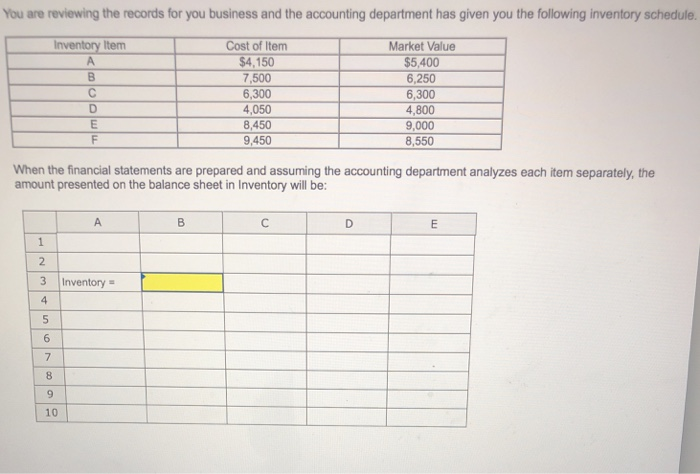

Mannisto, Inc., uses the FIFO inventory cost flow assumption. In a year of rising costs and prices, the firm reported net income of $244,933 and average assets of $1,527,230. If Mannisto had used the LIFO cost flow assumption in the same year, its cost of goods sold would have been $48,720 more than under FIFO, and its average assets would have been $48,530 less than under FIFO Required: a. Calculate the firm's ROl under each cost flow assumption (FIFO and LIFO). (Enter your answers as percentages rounded to 1 decimal place (i.e., 12.2%).) FIFO LIFO ROI 16,01 % b. Suppose that two years later costs and prices were falling. Under FIFO, net income and average assets were $288,293 and $1,796,180, respectively. If LIFO had been used through the years, inventory values would have been $49,090 less than under FIFO, and current yoar cost of goods sold would have been $15,184 less than under FiFO. Calculate the firm's ROl under each cost flow assumption (FIFO and LIFO). (Enter your answers as percentages rounded to 1 decimalp 12.2%).) FIFO LIFO ROI Mower-Blower Sales Co. started business on January 20, 2016. Products sold were snow blowers and lawn mowers. Each product sold for $1,400. Purchases during 2016 were as follows: BlowersMowers 20@$ 800 40@ 780 0@ 760 20@ 760 January 21 February 3 February 28 March 13 April 6 May 22 June 3 June 20 August 15 September 20 20@$840 40@ 860 0 880 60 920 20@ 860 20@ 840 November 7 20@ 800 The December 31, 2016, inventory included 10 blowers and 25 mowers. Assume the company uses a periodic inventory system. Required: a-1. Compute ending inventory valuation at December 31, 2016, under the FIFO and LIFO cost flow assumptions. (Hint Compute ending inventory under each method, and then compare results.) FIFO LIFO Blowers Mowers You are reviewing the records for you business and the accounting department has given you the following inventory schedule. Inventory ltem Cost of Item $4,150 7,500 6,300 4,050 8,450 9,450 Market Value $5,400 6,250 6,300 4,800 9,000 8,550 When the financial statements are prepared and assuming the accounting department analyzes each item separately, the amount presented on the balance sheet in Inventory will be: 8 3 Inventory 8 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts