Question: PLEASE HELP ANSWER THIS QUESTION QUESTION 3 (19 MARKS) a) Yankee Industry is an all equity firm that has 20,000 shares of stock outstanding at

PLEASE HELP ANSWER THIS QUESTION

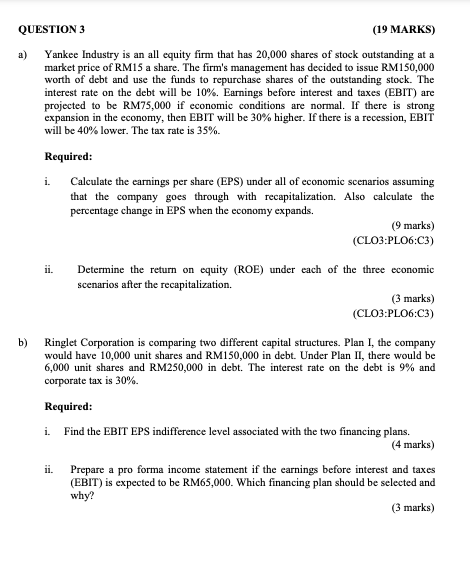

QUESTION 3 (19 MARKS) a) Yankee Industry is an all equity firm that has 20,000 shares of stock outstanding at a market price of RM15 a share. The firm's management has decided to issue RM150,000 worth of debt and use the funds to repurchase shares of the outstanding stock. The interest rate on the debt will be 10%. Earnings before interest and taxes (EBIT) are projected to be RM75,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 30% higher. If there is a recession, EBIT will be 40% lower. The tax rate is 35%. Required: Calculate the earnings per share (EPS) under all of economic scenarios assuming that the company goes through with recapitalization. Also calculate the percentage change in EPS when the economy expands. (9 marks) (CLO3:PLO6:03) i. Determine the return on equity (ROE) under each of the three economic scenarios after the recapitalization, (3 marks) (CLO3:PLO6:03) b) Ringlet Corporation is comparing two different capital structures. Plan I, the company would have 10,000 unit shares and RM150,000 in debt. Under Plan II, there would be 6,000 unit shares and RM250,000 in debt. The interest rate on the debt is 9% and corporate tax is 30%. Required: Find the EBIT EPS indifference level associated with the two financing plans. (4 marks) Prepare a pro forma income statement if the earnings before interest and taxes (EBIT) is expected to be RM65,000. Which financing plan should be selected and why? (3 marks) i. QUESTION 3 (19 MARKS) a) Yankee Industry is an all equity firm that has 20,000 shares of stock outstanding at a market price of RM15 a share. The firm's management has decided to issue RM150,000 worth of debt and use the funds to repurchase shares of the outstanding stock. The interest rate on the debt will be 10%. Earnings before interest and taxes (EBIT) are projected to be RM75,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 30% higher. If there is a recession, EBIT will be 40% lower. The tax rate is 35%. Required: Calculate the earnings per share (EPS) under all of economic scenarios assuming that the company goes through with recapitalization. Also calculate the percentage change in EPS when the economy expands. (9 marks) (CLO3:PLO6:03) i. Determine the return on equity (ROE) under each of the three economic scenarios after the recapitalization, (3 marks) (CLO3:PLO6:03) b) Ringlet Corporation is comparing two different capital structures. Plan I, the company would have 10,000 unit shares and RM150,000 in debt. Under Plan II, there would be 6,000 unit shares and RM250,000 in debt. The interest rate on the debt is 9% and corporate tax is 30%. Required: Find the EBIT EPS indifference level associated with the two financing plans. (4 marks) Prepare a pro forma income statement if the earnings before interest and taxes (EBIT) is expected to be RM65,000. Which financing plan should be selected and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts