Question: please help answering 17-19 :( 3A CA COMPLETELY W WARES RONS RESERVED OH PENCHONEST EB EC BC EB EC B CD CD ED CD CE

please help answering 17-19 :(

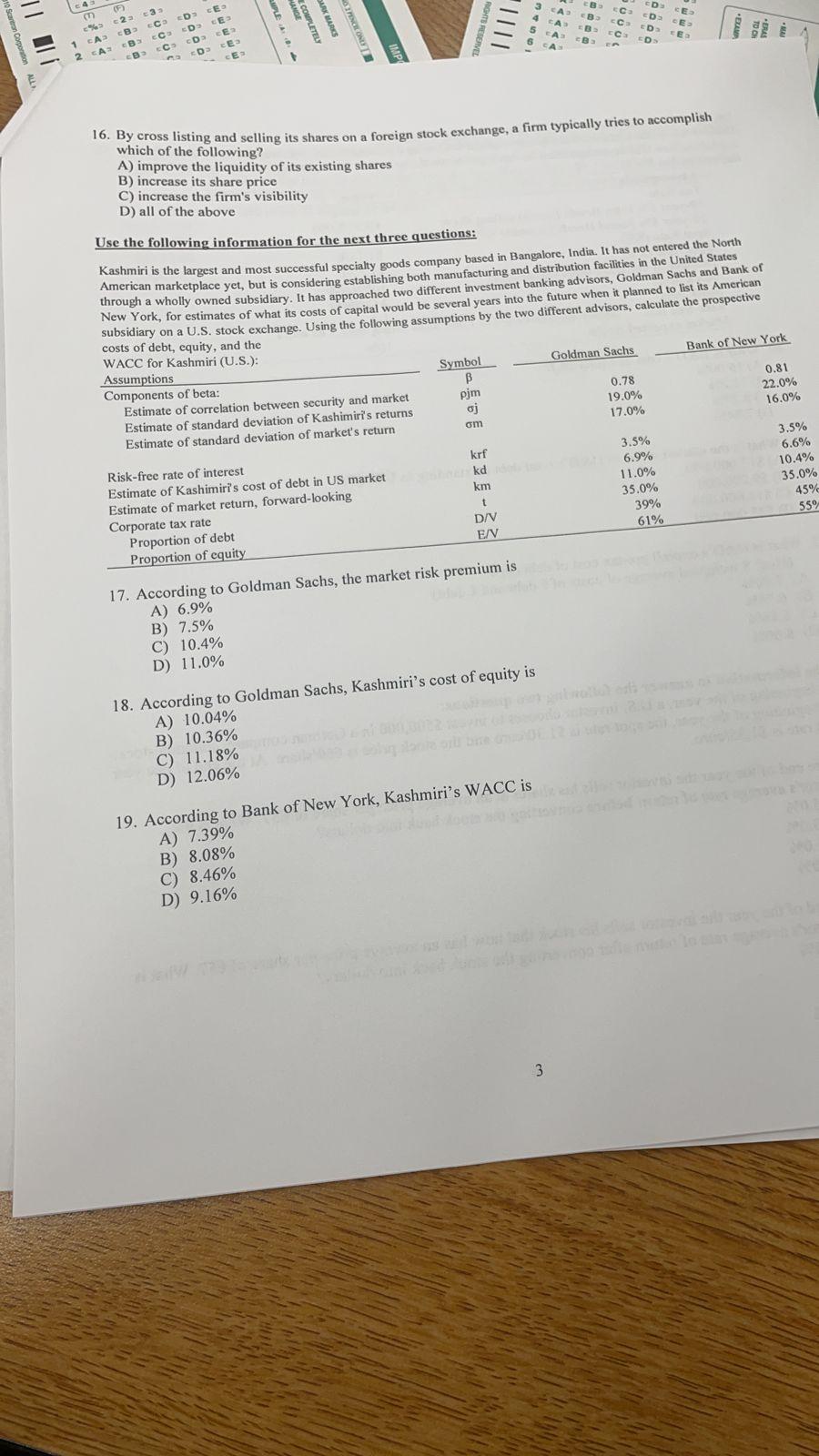

3A CA COMPLETELY W WARES RONS RESERVED OH PENCHONEST EB EC BC EB EC B CD CD ED CD CE CE EE (F) % 23 1 CAP CE 2 CAB COD CE B DES CE CA= 16. By cross listing and selling its shares on a foreign stock exchange, a firm typically tries to accomplish which of the following? A) improve the liquidity of its existing shares B) increase its share price C) increase the firm's visibility D) all of the above Use the following information for the next three questions: Kashmiri is the largest and most successful specialty goods company based in Bangalore, India. It has not entered the North American marketplace yet, but is considering establishing both manufacturing and distribution facilities in the United States through a wholly owned subsidiary. It has approached two different investment banking advisors, Goldman Sachs and Bank of New York, for estimates of what its costs of capital would be several years into the future when it planned to list its American subsidiary on a U.S. stock exchange. Using the following assumptions by the two different advisors, calculate the prospective costs of debt, equity, and the WACC for Kashmiri (U.S.): Assumptions Goldman Sachs Bank of New York Components of beta: Estimate of correlation between security and market 22.0% Estimate of standard deviation of Kashimiri's returns oj Estimate of standard deviation of market's return 0.81 Symbol B pjm 0.78 19.0% 17.0% 16.0% om krf a kdo km t D/V E/ Risk-free rate of interest Estimate of Kashimiri's cost of debt in US market Estimate of market return, forward-looking Corporate tax rate Proportion of debt Proportion of equity 3.5% 6.6% 10.4% 35.0% 45% 559 3.5% 6.9% 11.0% 35.0% 39% 61% 17. According to Goldman Sachs, the market risk premium is A) 6.9% B) 7.5% C) 10.4% D) 11.0% 18. According to Goldman Sachs, Kashmiri's cost of equity is A) 10.04% B) 10.36% C) 11.18% D) 12.06% 19. According to Bank of New York, Kashmiri's WACC is A) 7.39% B) 8.08% C) 8.46% D) 9.16% 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts