Question: Please help as fast as you can with clear formatting, would really appreciate it!! Thank you. Gomez Company fad the following transactions in the last

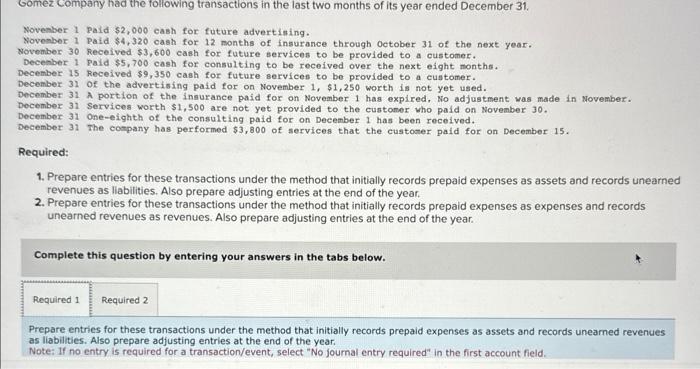

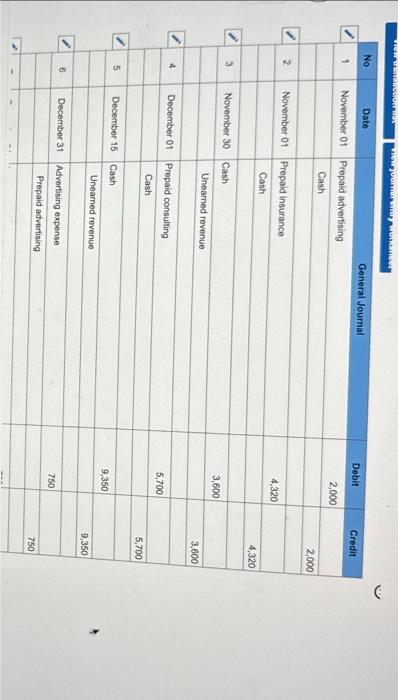

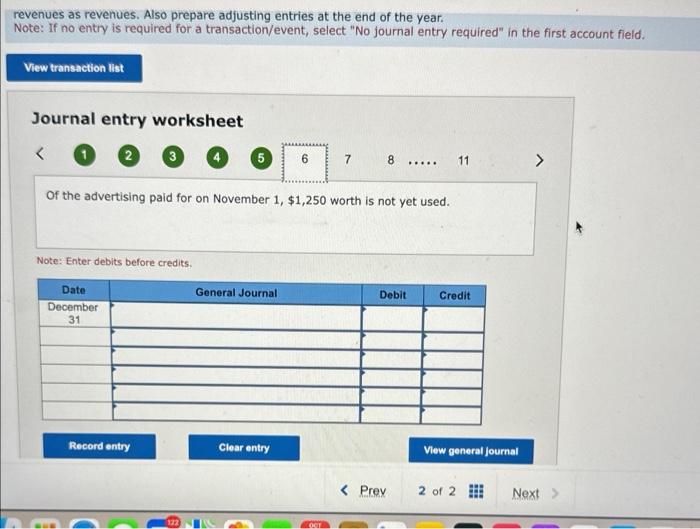

Gomez Company fad the following transactions in the last two months of its year ended December 31. Novenber 1 Paid $2,000 cash for future advertining. November 1 paid $4,320 cash for 12 months of insurance through October 31 of the next year. November 30 Received $3,600 cash for future services to be provided to a customer. Decenber 1 paid $5,700 cash for consulting to be roceived over the next eight months. December 15 Received $9,350 cash for future services to be provided to a customer. December 31 of the advertising paid for on November 1,$1,250 worth is not yet used. December 31 A portion of the insurance paid for on November 1 has expired, No adjustment was made in November. December 31 Services worth $1,500 are not yet provided to the customer who paid on November 30 . December 31 One-eighth of the consulting paid for on December 1 has been received. December 31 The company has performed $3,800 of services that the customer paid for on December 15 . Required: 1. Prepare entries for these transactions under the method that initially records prepaid expenses as assets and records unearned revenues as liabilities. Also prepare adjusting entries at the end of the year. 2. Prepare entries for these transactions under the method that initially records prepaid expenses as expenses and records unearned revenues as revenues. Also prepare adjusting entries at the end of the year. Complete this question by entering your answers in the tabs below. Prepare entries for these transactions under the method that initially records prepaid expenses as assets and records unearned revenues as liabilities. Also prepare adjusting entries at the end of the year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. \begin{tabular}{|c|c|c|c|c|c|} \hline & No & Date & General Journal & Debit & Credit \\ \hline \multirow[t]{3}{*}{1} & 1 & November 01 & Prepaid advertising & 2,000 & \\ \hline & & & Cash & & 2,000 \\ \hline & & & & & \\ \hline \multirow[t]{3}{*}{ I } & 2 & November 01 & Prepaid insurance & 4,320 & \\ \hline & & & Cash & & 4,320 \\ \hline & & & & & \\ \hline \multirow[t]{3}{*}{1} & 3 & November 30 & Cash & 3,600 & \\ \hline & & & Uneamed revenue & & 3,600 \\ \hline & & & & & \\ \hline \multirow[t]{3}{*}{7} & 4 & December 01 & Prepaid consulting & 5,700 & \\ \hline & & & Cash & & 5,700 \\ \hline & & & & & \\ \hline \multirow[t]{3}{*}{1} & 5 & December 15 & Cash & 9,350 & \\ \hline & & & Unearned revenue & & 9,350 \\ \hline & & & & & \\ \hline & 6 & December 31 & Advertising expense & 750 & \\ \hline & & & Prepaid advertising & & 750 \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline & & & Unearned revenue & & 9,350 \\ \hline \multirow[t]{2}{*}{i} & 6 & December 31 & Advertising expense & 750 & \\ \hline & & & Prepaid advertising & & 750 \\ \hline \multirow[t]{2}{*}{2} & 7 & December 31 & Insurance expense & 720 & \\ \hline & & & Prepaid insurance & & 720 \\ \hline & 8 & December 31 & Unearned revenue & 2,100 & \\ \hline & & & Service revenue & & 2,100 \\ \hline \multirow[t]{3}{*}{2} & 9 & December 31 & Consulting expense & 713 & \\ \hline & & & Prepaid consulting & & 713 \\ \hline & & & & & \\ \hline \multirow[t]{2}{*}{1} & 10 & December 31 & Unearned revenue & 3,800 & \\ \hline & & & Service revenue & & 3,800 \\ \hline \end{tabular} revenues as revenues. Also prepare adjusting entries at the end of the year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet (1) 23 7811 Of the advertising paid for on November 1,$1,250 worth is not yet used. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts