Question: please help!!! as fast u can even if 1 question only On December 31, 2021, Pearl Corporation holds debt investments in bonds of three companies

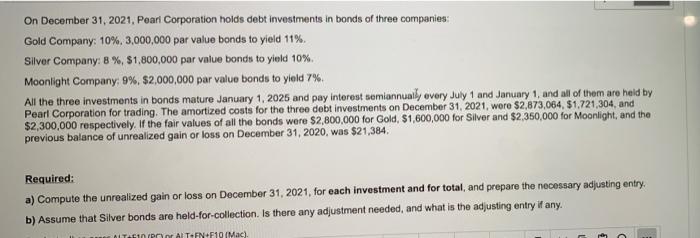

On December 31, 2021, Pearl Corporation holds debt investments in bonds of three companies Gold Company: 10%. 3,000,000 par value bonds to yield 11%. Silver Company: 8 %, $1,800,000 par value bonds to yield 10%. Moonlight Company: 9%, $2,000,000 par valuo bonds to yield 7% All the three investments in bonds mature January 1, 2025 and pay interest semiannually every July 1 and January 1, and all of them are held by Pearl Corporation for trading. The amortized costs for the three debt investments on December 31, 2021, were $2,873,064, $1721,304, and $2,300,000 respectively. If the fair values of all the bonds were $2,800,000 for Gold, S1,600,000 for Silver and $2,350,000 for Moonlight, and the previous balance of unrealized gain or loss on December 31, 2020, was $21,384. Required: a) Compute the unrealized gain or loss on December 31, 2021, for each investment and for total, and prepare the necessary adjusting entry. b) Assume that Silver bonds are held-for-collection. Is there any adjustment needed, and what is the adjusting entry if any. Tan Prior Al TFN+F10 (Mac)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts