Question: Question Completion Status Click Submit to complete this assessment. Question 3 of 3 Question 3 5 points On December 31, 2021, Pearl Corporation holds debt

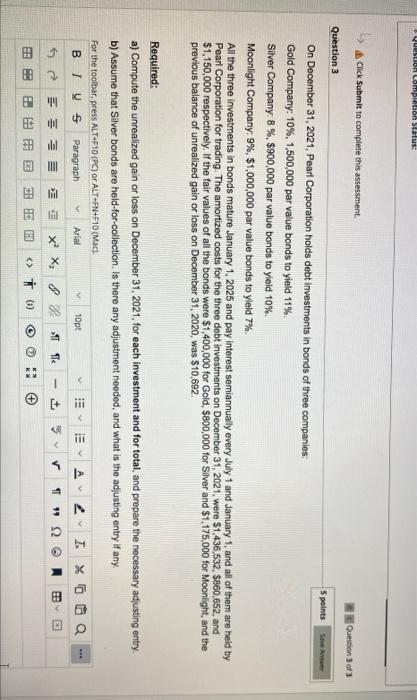

Question Completion Status Click Submit to complete this assessment. Question 3 of 3 Question 3 5 points On December 31, 2021, Pearl Corporation holds debt investments in bonds of three companies Gold Company: 10%, 1,500,000 par value bonds to yield 11% Silver Company, 8 %, $900,000 par value bonds to yield 10% Moonlight Company: 9%, $1,000,000 par value bonds to yleld 7% All the three investments bonds mature January 1, 2025 and pay interest semiannually every July 1 and January 1, and all of them are held by Pearl Corporation for trading. The amortized costs for the three debt investments on December 31, 2021 were $1.436,532, $860,652, and $1,150,000 respectively. If the fair values all the bonds were $1,400,000 for Gold, $800,000 for Silver and $1,175,000 for Moonlight, and the previous balance of unrealized gain or loss on December 31, 2020, was $10,692 Required: a) Compute the unrealized gain or loss on December 31, 2021. for each investment and for total, and prepare the necessary adjusting entry. b) Assume that Silver bonds are held-for-collection. Is there any adjustment needed, and what is the adjusting entry if any. For the toolbar, press ALT-F10(PC) or ALT=FN+F10(Mac). BIU & Paragraph Arial 10pt A 2 IXO 6 = = = X X, 8 & ST The * 2 DE ( * ) > !!! !!!

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts