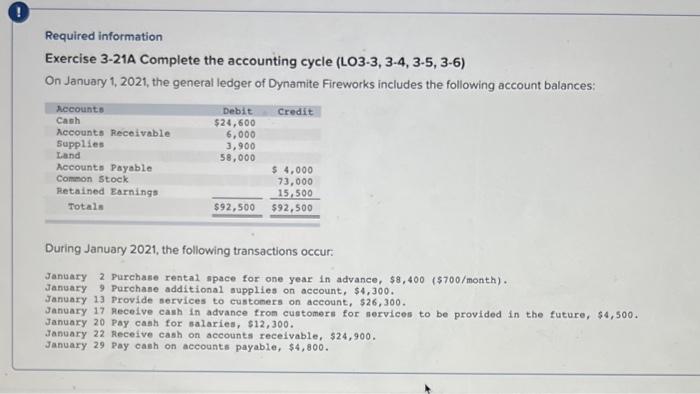

Question: please help! ASAP 0 Required information Exercise 3-21A Complete the accounting cycle (L03-3, 3-4,3-5,3-6) On January 1, 2021, the general ledger of Dynamite Fireworks includes

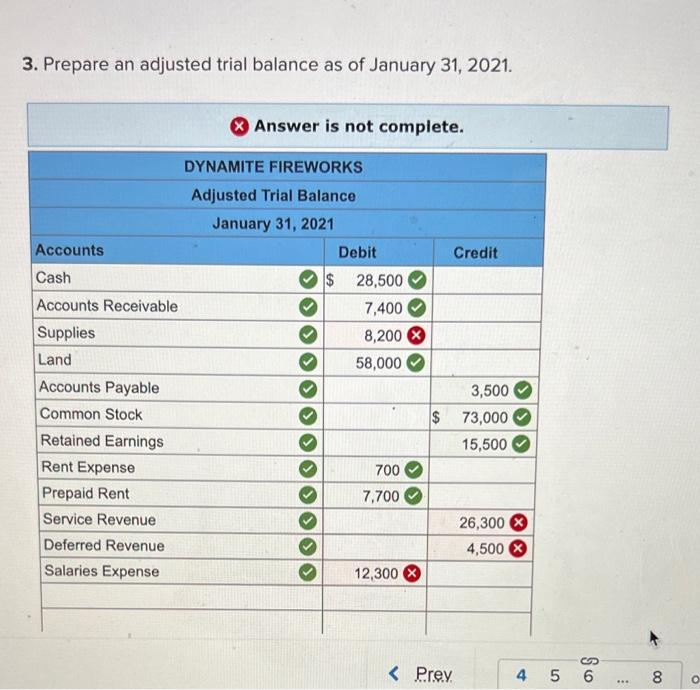

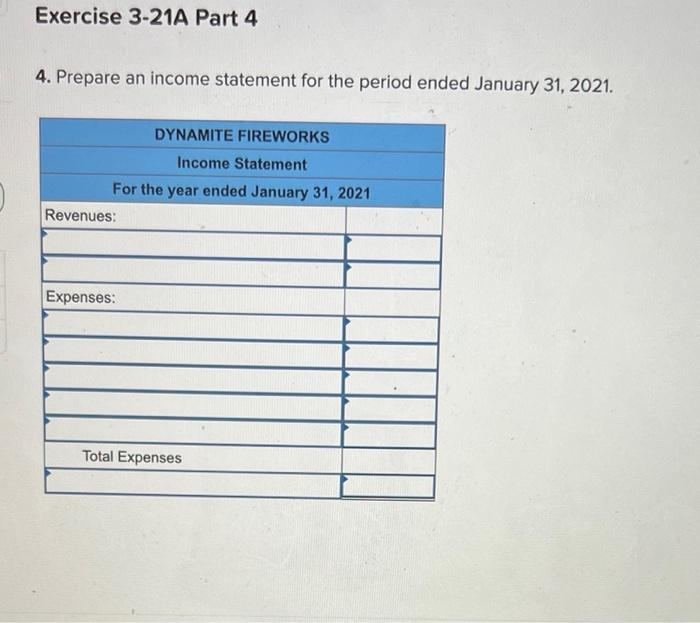

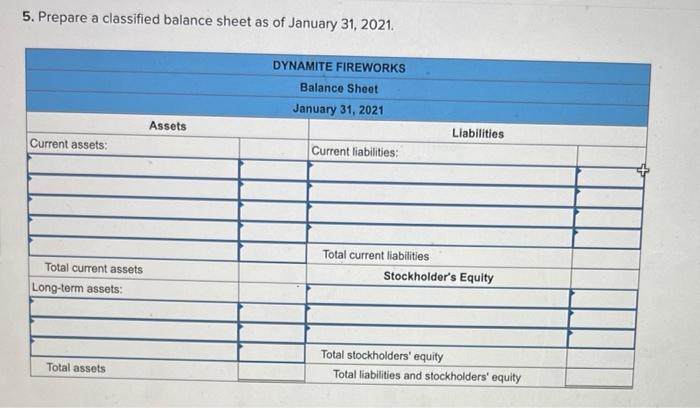

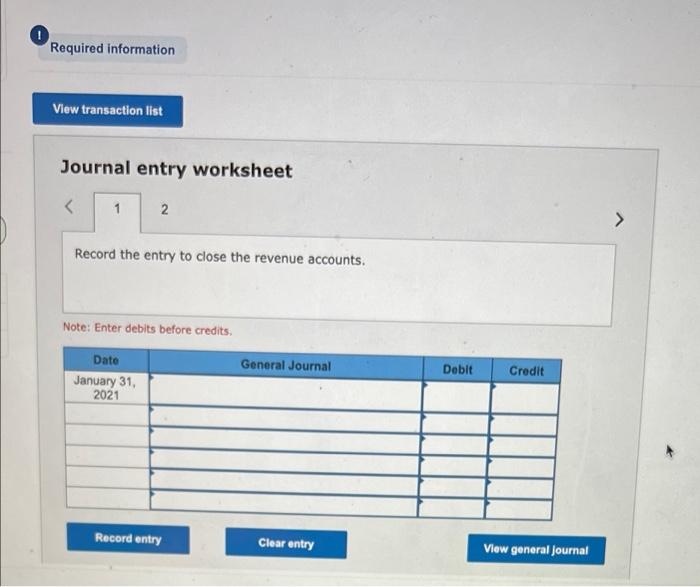

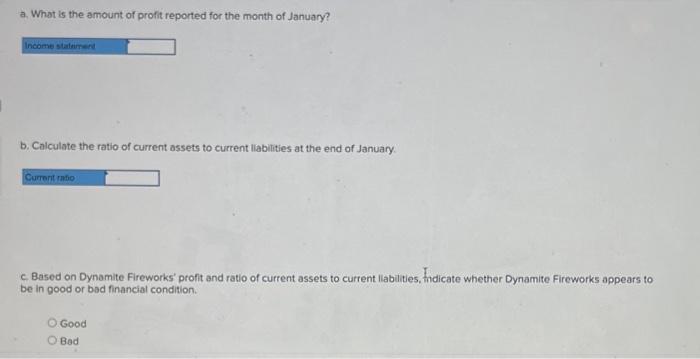

0 Required information Exercise 3-21A Complete the accounting cycle (L03-3, 3-4,3-5,3-6) On January 1, 2021, the general ledger of Dynamite Fireworks includes the following account balances: Accounts Debit Credit Cash $24,600 Accounts Receivable 6,000 Supplies 3,900 58,000 Accounts Payable $ 4,000 Common Stock 73,000 Retained Earnings 15,500 Totala $92,500 $92,500 Land During January 2021, the following transactions occur. January 2 Purchase rental space for one year in advance, $8,400 ($700/month). January 9 Purchase additional supplies on account, $4,300. January 13 Provide services to customers on account, $26,300. January 17 Receive cash in advance from customers for services to be provided in the futuro, $4,500. January 20 Pay cash for salaries, $12,300. January 22 Receive cash on accounts receivable, $24,900. January 29 Pay cash on accounts payable, $4,800. 3. Prepare an adjusted trial balance as of January 31, 2021. & Answer is not complete. DYNAMITE FIREWORKS Accounts Credit Cash Adjusted Trial Balance January 31, 2021 Debit $ 28,500 7,400 8,200 58,000 $ Accounts Receivable Supplies Land Accounts Payable Common Stock Retained Earnings Rent Expense Prepaid Rent Service Revenue Deferred Revenue Salaries Expense 3,500 73,000 15,500 700 7.700 26,300 $ 4,500 12,300 Record the entry to close the revenue accounts. Note: Enter debits before credits. General Journal Debit Date January 31, 2021 Credit Record entry Clear entry View general Journal a. What is the amount of profit reported for the month of January? Income statement b. Calculate the ratio of current assets to current liabilities at the end of January Current ratio c Based on Dynamite Fireworks' profit and ratio of current assets to current liabilities, fodicate whether Dynamite Fireworks appears to be in good or bad financial condition O Good O Bad 0 Required information Exercise 3-21A Complete the accounting cycle (L03-3, 3-4,3-5,3-6) On January 1, 2021, the general ledger of Dynamite Fireworks includes the following account balances: Accounts Debit Credit Cash $24,600 Accounts Receivable 6,000 Supplies 3,900 58,000 Accounts Payable $ 4,000 Common Stock 73,000 Retained Earnings 15,500 Totala $92,500 $92,500 Land During January 2021, the following transactions occur. January 2 Purchase rental space for one year in advance, $8,400 ($700/month). January 9 Purchase additional supplies on account, $4,300. January 13 Provide services to customers on account, $26,300. January 17 Receive cash in advance from customers for services to be provided in the futuro, $4,500. January 20 Pay cash for salaries, $12,300. January 22 Receive cash on accounts receivable, $24,900. January 29 Pay cash on accounts payable, $4,800. 3. Prepare an adjusted trial balance as of January 31, 2021. & Answer is not complete. DYNAMITE FIREWORKS Accounts Credit Cash Adjusted Trial Balance January 31, 2021 Debit $ 28,500 7,400 8,200 58,000 $ Accounts Receivable Supplies Land Accounts Payable Common Stock Retained Earnings Rent Expense Prepaid Rent Service Revenue Deferred Revenue Salaries Expense 3,500 73,000 15,500 700 7.700 26,300 $ 4,500 12,300 Record the entry to close the revenue accounts. Note: Enter debits before credits. General Journal Debit Date January 31, 2021 Credit Record entry Clear entry View general Journal a. What is the amount of profit reported for the month of January? Income statement b. Calculate the ratio of current assets to current liabilities at the end of January Current ratio c Based on Dynamite Fireworks' profit and ratio of current assets to current liabilities, fodicate whether Dynamite Fireworks appears to be in good or bad financial condition O Good O Bad

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts