Question: PLEASE HELP ASAP #1 and 2. I appreciate the help! Question 1 2 pts You are ready to buy a house and you have $15,000

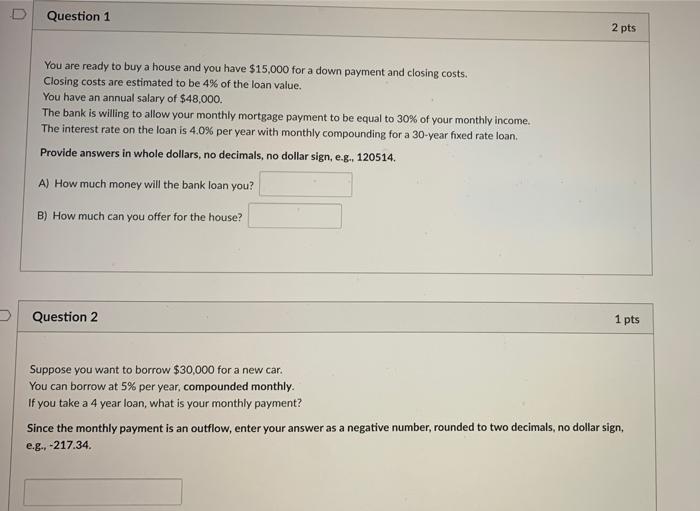

Question 1 2 pts You are ready to buy a house and you have $15,000 for a down payment and closing costs. Closing costs are estimated to be 4% of the loan value. You have an annual salary of $48,000. The bank is willing to allow your monthly mortgage payment to be equal to 30% of your monthly income. The interest rate on the loan is 4.0% per year with monthly compounding for a 30-year fixed rate loan. Provide answers in whole dollars, no decimals, no dollar sign, e.g., 120514. A) How much money will the bank loan you? B) How much can you offer for the house? Question 2 1 pts Suppose you want to borrow $30,000 for a new car. You can borrow at 5% per year, compounded monthly If you take a 4 year loan, what is your monthly payment? Since the monthly payment is an outflow, enter your answer as a negative number, rounded to two decimals, no dollar sign, e.g., -217.34

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts