Question: please help me out pleaee help me out 10 lijs Question 52 2 pts Cray Corp. purchased supplies at a cost of $12,000 during the

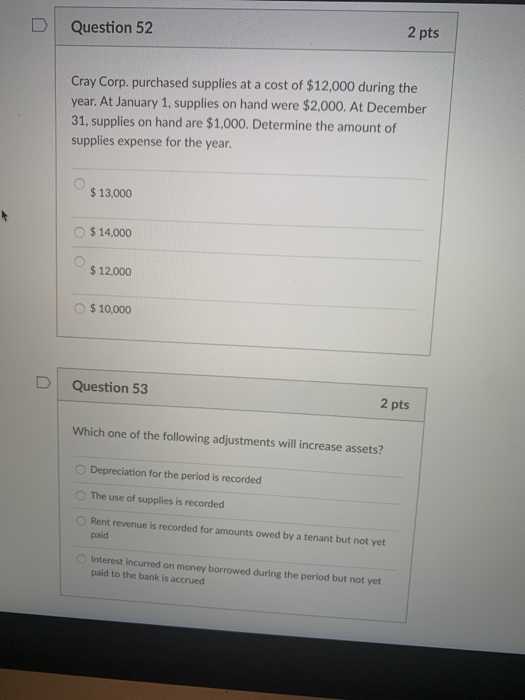

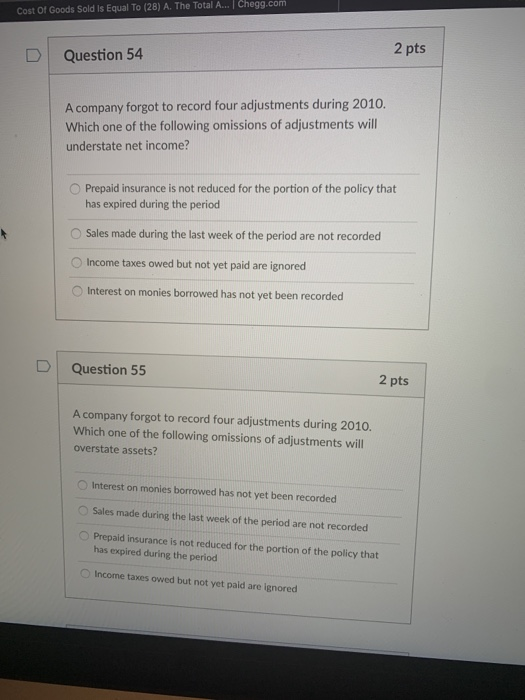

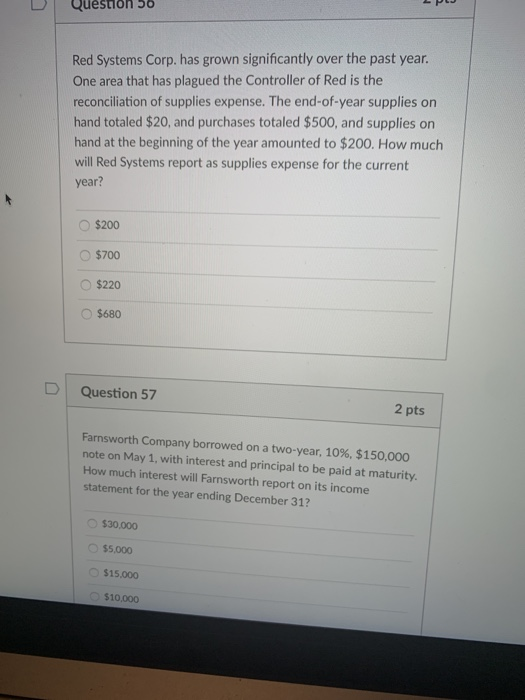

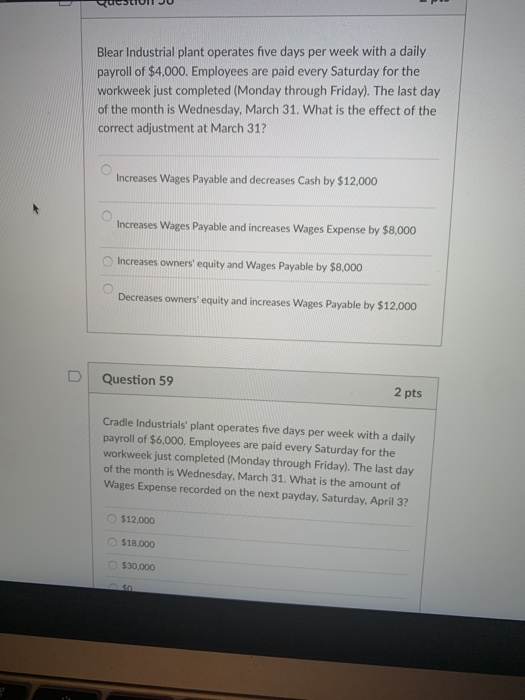

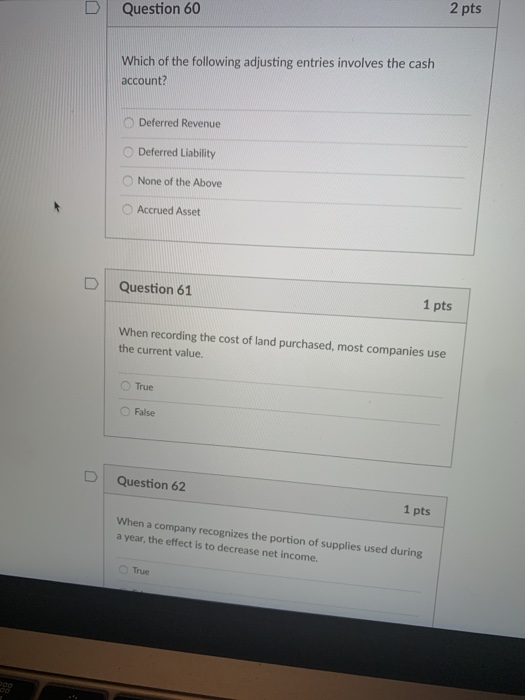

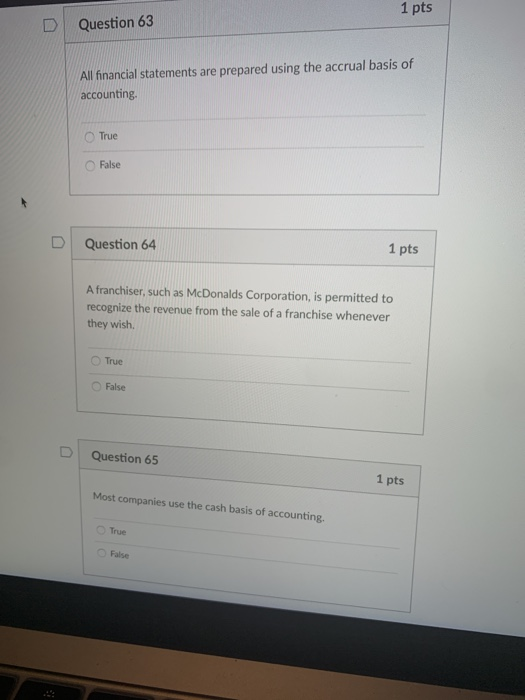

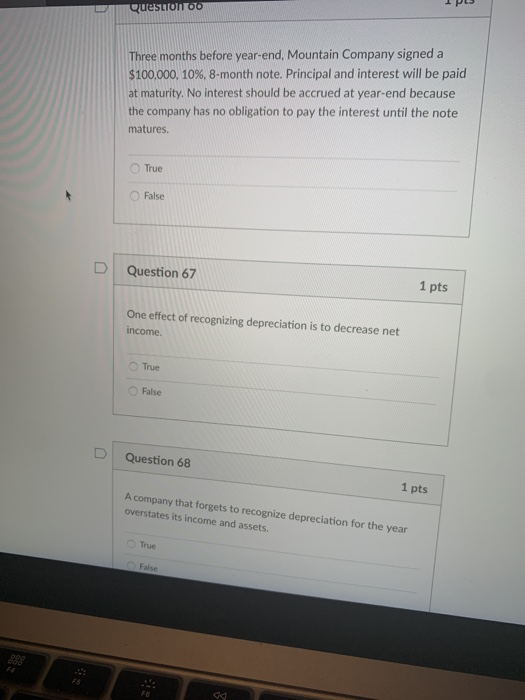

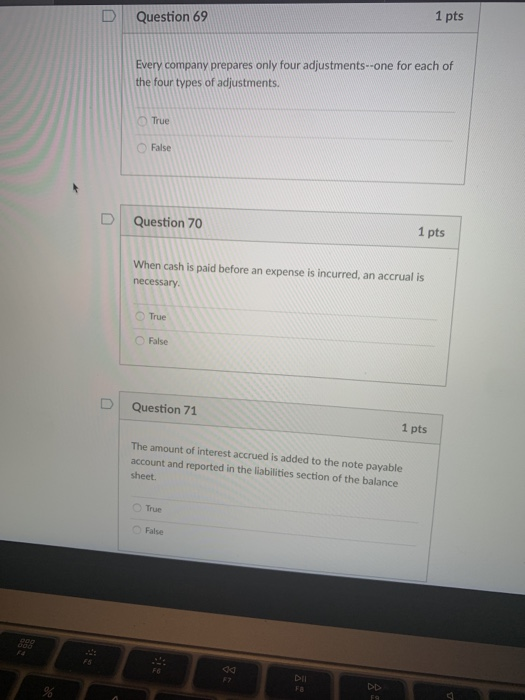

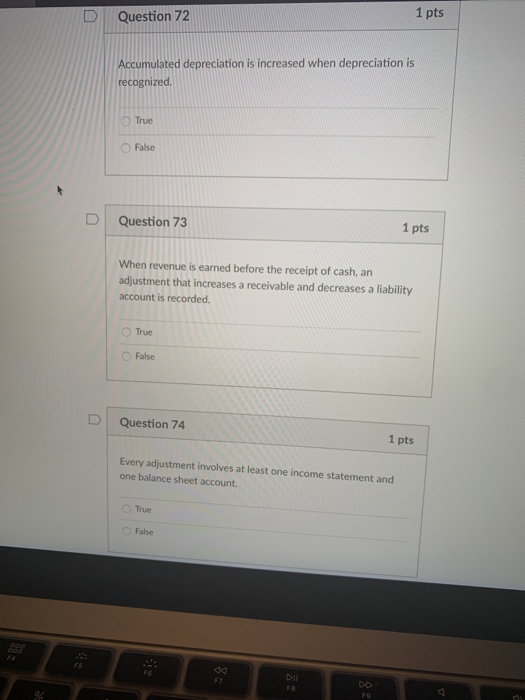

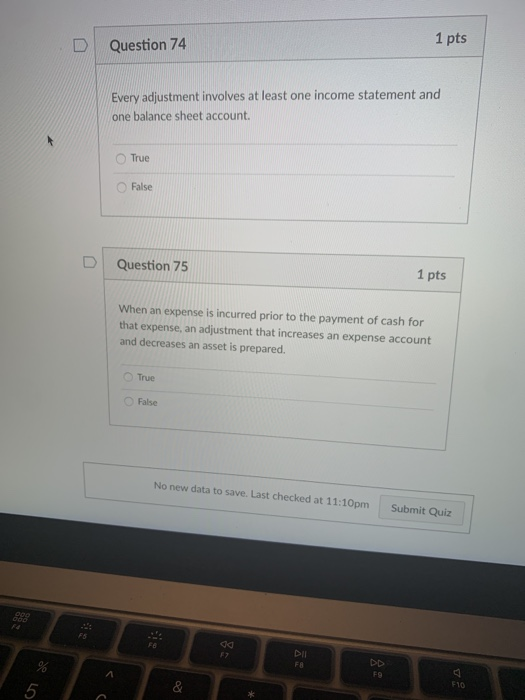

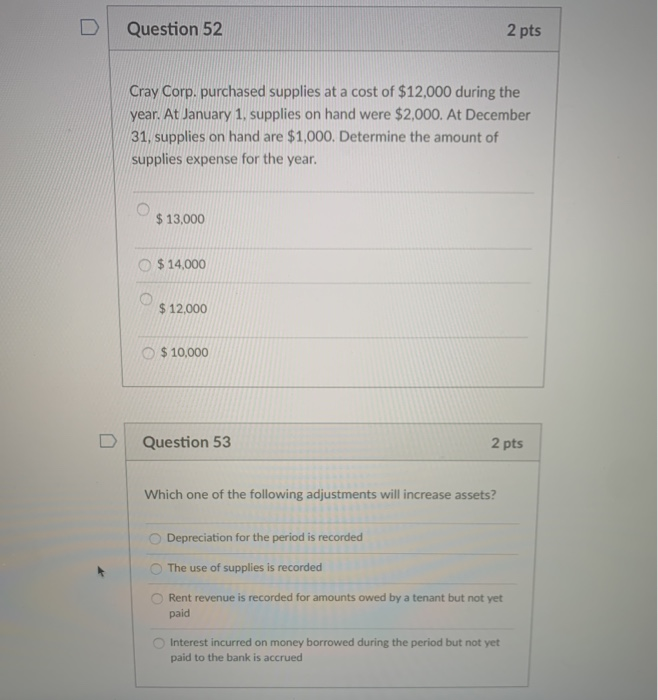

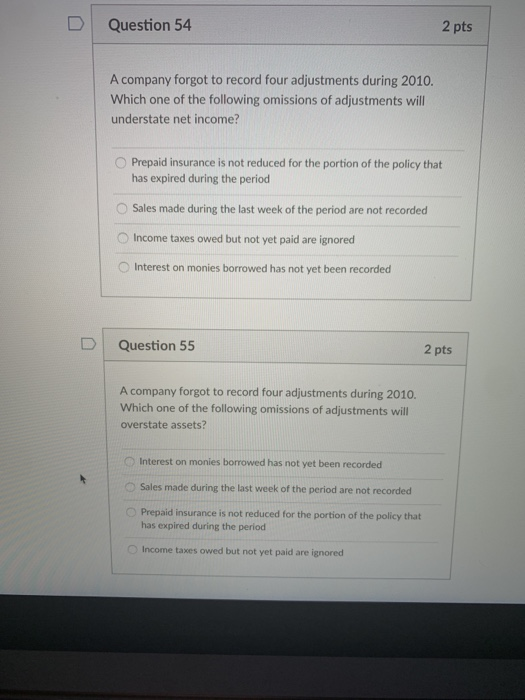

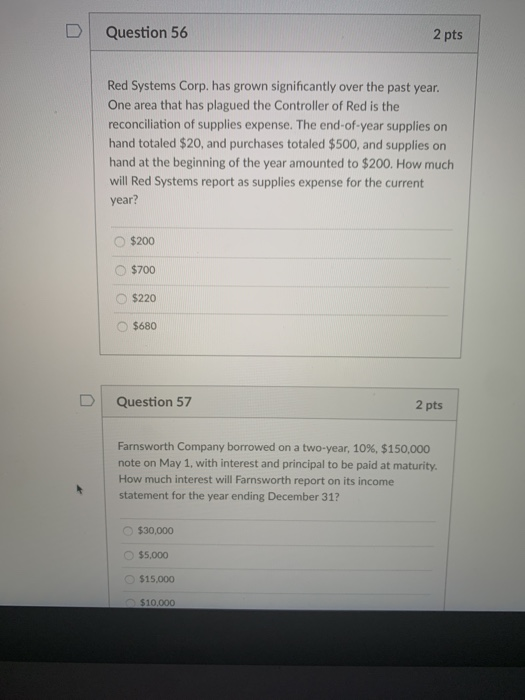

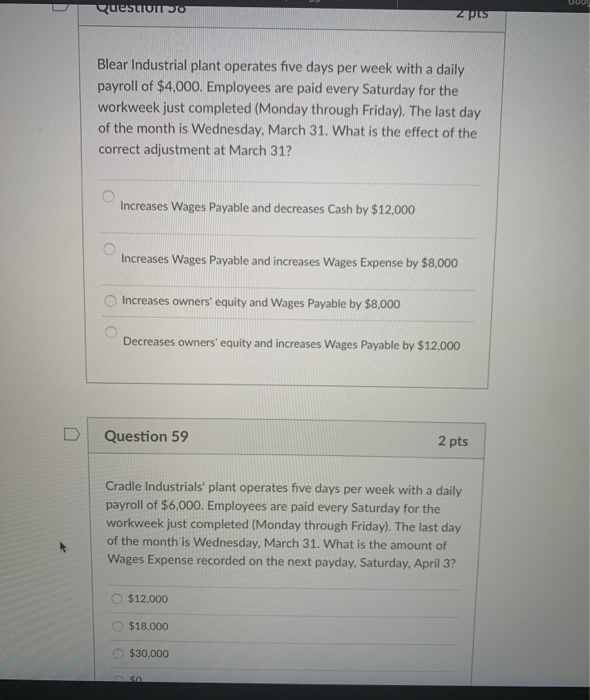

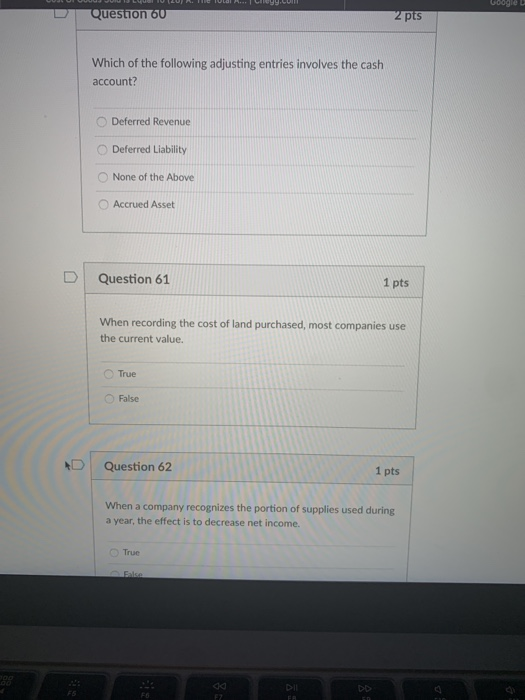

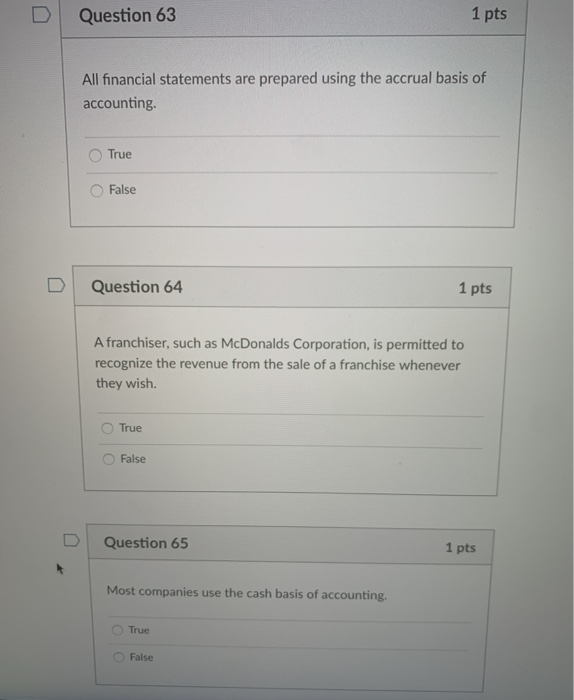

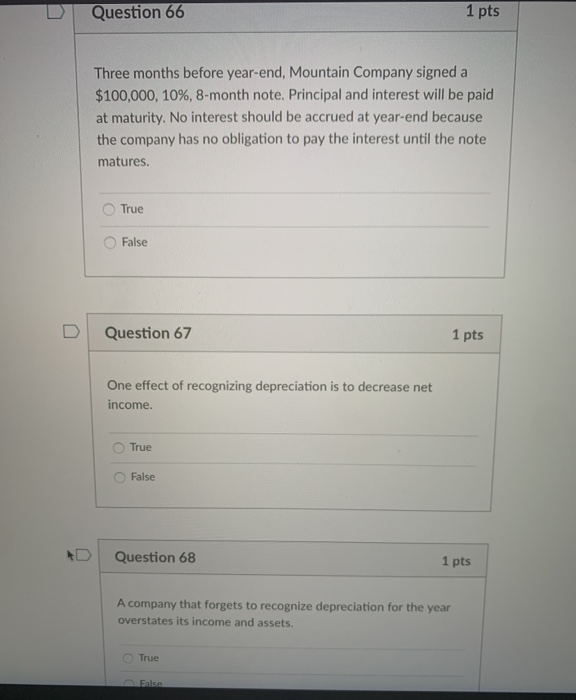

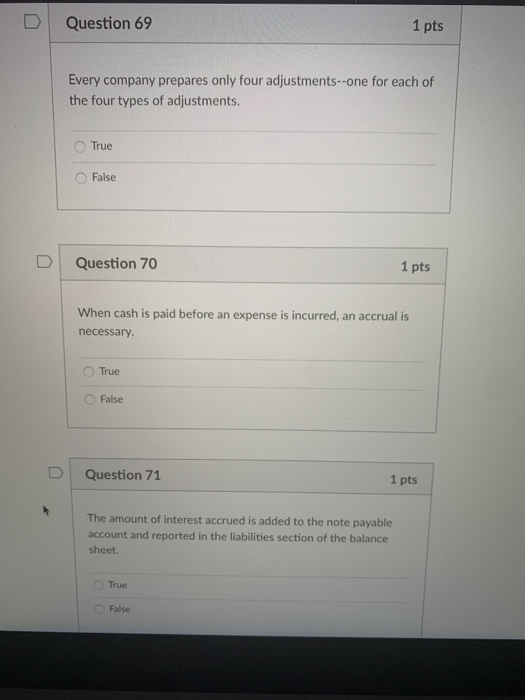

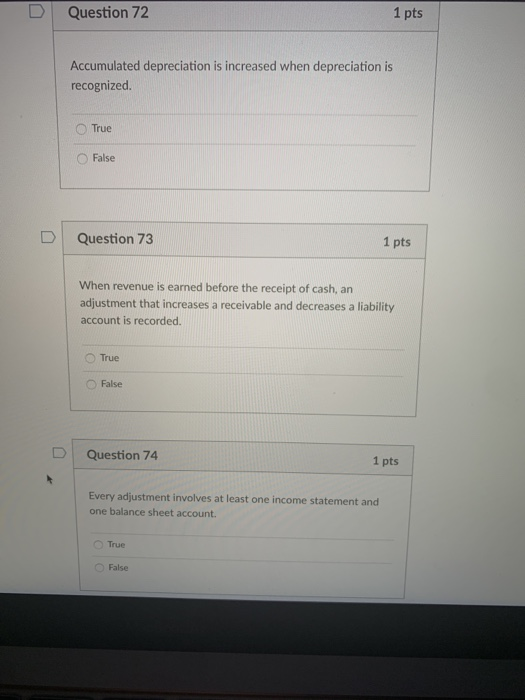

10 lijs Question 52 2 pts Cray Corp. purchased supplies at a cost of $12,000 during the year. At January 1, supplies on hand were $2,000. At December 31, supplies on hand are $1,000. Determine the amount of supplies expense for the year. $13,000 $ 14,000 $ 12,000 $ 10.000 D Question 53 2 pts Which one of the following adjustments will increase assets? Depreciation for the period is recorded The use of supplies is recorded Rent revenue is recorded for amounts owed by a tenant but not yet paid Interest incurred on money borrowed during the period but not yet paid to the bank is accrued Cost Of Goods Sold is Equal To (28) A. The Total A... | Chegg.com Question 54 2 pts A company forgot to record four adjustments during 2010. Which one of the following omissions of adjustments will understate net income? Prepaid insurance is not reduced for the portion of the policy that has expired during the period Sales made during the last week of the period are not recorded Income taxes owed but not yet paid are ignored Interest on monies borrowed has not yet been recorded Question 55 2 pts A company forgot to record four adjustments during 2010. Which one of the following omissions of adjustments will overstate assets? Interest on monies borrowed has not yet been recorded Sales made during the last week of the period are not recorded Prepaid Insurance is not reduced for the portion of the policy that has expired during the period Income taxes owed but not yet paid are ignored Question 56 Red Systems Corp. has grown significantly over the past year. One area that has plagued the Controller of Red is the reconciliation of supplies expense. The end-of-year supplies on hand totaled $20, and purchases totaled $500, and supplies on hand at the beginning of the year amounted to $200. How much will Red Systems report as supplies expense for the current year? $200 $700 $220 $680 Question 57 2 pts Farnsworth Company borrowed on a two-year, 10%, $150,000 note on May 1, with interest and principal to be paid at maturity. How much interest will Farnsworth report on its income statement for the year ending December 31? $30,000 $5,000 $15.000 $10.000 Blear Industrial plant operates five days per week with a daily payroll of $4,000. Employees are paid every Saturday for the workweek just completed (Monday through Friday). The last day of the month is Wednesday, March 31. What is the effect of the correct adjustment at March 31? Increases Wages Payable and decreases Cash by $12,000 Increases Wages Payable and increases Wages Expense by $8,000 Increases owners' equity and Wages Payable by $8,000 Decreases owners' equity and increases Wages Payable by $12,000 Question 59 2 pts Cradle Industrials' plant operates five days per week with a daily payroll of $6,000. Employees are paid every Saturday for the workweek just completed (Monday through Friday). The last day of the month is Wednesday, March 31. What is the amount of Wages Expense recorded on the next payday, Saturday, April 3? $12.000 $18.000 $30,000 Question 60 2 pts Which of the following adjusting entries involves the cash account? Deferred Revenue Deferred Liability None of the Above Accrued Asset Question 61 1 pts When recording the cost of land purchased, most companies use the current value True False Question 62 1 pts When a company recognizes the portion of supplies used during a year, the effect is to decrease net income. True 1 pts Question 63 All financial statements are prepared using the accrual basis of accounting. True False Question 64 1 pts A franchiser, such as McDonalds Corporation, is permitted to recognize the revenue from the sale of a franchise whenever they wish. True False U Question 65 1 pts Most companies use the cash basis of accounting. True O False Question IPS Three months before year-end, Mountain Company signed a $100,000, 10%, 8-month note. Principal and interest will be paid at maturity. No interest should be accrued at year-end because the company has no obligation to pay the interest until the note matures. True False D Question 67 1 pts One effect of recognizing depreciation is to decrease net income. True False U Question 68 1 pts A company that forgets to recognize depreciation for the year overstates its income and assets. True False F5 D Question 69 1 pts Every company prepares only four adjustments--one for each of the four types of adjustments. True False U Question 70 1 pts When cash is paid before an expense is incurred, an accrual is necessary True False U Question 71 1 pts The amount of interest accrued is added to the note payable account and reported in the liabilities section of the balance sheet True O False od 7 n Question 72 1 pts Accumulated depreciation is increased when depreciation is recognized. True False Question 73 1 pts When revenue is earned before the receipt of cash, an adjustment that increases a receivable and decreases a liability account is recorded. True False Question 74 1 pts Every adjustment involves at least one income statement and one balance sheet account. True False 15 F DIL DD FB Question 74 1 pts Every adjustment involves at least one income statement and one balance sheet account True False Question 75 1 pts When an expense is incurred prior to the payment of cash for that expense, an adjustment that increases an expense account and decreases an asset is prepared. True False No new data to save. Last checked at 11:10pm Submit Quiz 990 % FB DD FO 5 & F10 Question 52 2 pts Cray Corp. purchased supplies at a cost of $12,000 during the year. At January 1, supplies on hand were $2,000. At December 31, supplies on hand are $1,000. Determine the amount of supplies expense for the year. $ 13,000 $ 14,000 $ 12,000 $ 10,000 Question 53 2 pts Which one of the following adjustments will increase assets? Depreciation for the period is recorded The use of supplies is recorded Rent revenue is recorded for amounts owed by a tenant but not yet paid Interest incurred on money borrowed during the period but not yet paid to the bank is accrued Question 54 2 pts A company forgot to record four adjustments during 2010. Which one of the following omissions of adjustments will understate net income? Prepaid insurance is not reduced for the portion of the policy that has expired during the period Sales made during the last week of the period are not recorded Income taxes owed but not yet paid are ignored Interest on monies borrowed has not yet been recorded Question 55 2 pts A company forgot to record four adjustments during 2010. Which one of the following omissions of adjustments will overstate assets? Interest on monies borrowed has not yet been recorded Sales made during the last week of the period are not recorded Prepaid insurance is not reduced for the portion of the policy that has expired during the period Income taxes owed but not yet paid are ignored Question 56 2 pts Red Systems Corp. has grown significantly over the past year. One area that has plagued the Controller of Red is the reconciliation of supplies expense. The end-of-year supplies on hand totaled $20, and purchases totaled $500, and supplies on hand at the beginning of the year amounted to $200. How much will Red Systems report as supplies expense for the current year? $200 $700 $220 $680 Question 57 2 pts Farnsworth Company borrowed on a two-year, 10%, $150,000 note on May 1, with interest and principal to be paid at maturity. How much interest will Farnsworth report on its income statement for the year ending December 31? $30,000 $5,000 $15,000 $10,000 Question z pus Blear Industrial plant operates five days per week with a daily payroll of $4,000. Employees are paid every Saturday for the workweek just completed (Monday through Friday). The last day of the month is Wednesday, March 31. What is the effect of the correct adjustment at March 31? Increases Wages Payable and decreases Cash by $12,000 Increases Wages Payable and increases Wages Expense by $8,000 Increases owners' equity and Wages Payable by $8,000 Decreases owners' equity and increases Wages Payable by $12,000 Question 59 2 pts Cradle Industrials' plant operates five days per week with a daily payroll of $6,000. Employees are paid every Saturday for the workweek just completed (Monday through Friday). The last day of the month is Wednesday, March 31. What is the amount of Wages Expense recorded on the next payday, Saturday, April 3? $12.000 $18,000 $30,000 SO gy.com Google Question 60 2 pts Which of the following adjusting entries involves the cash account? Deferred Revenue Deferred Liability None of the Above Accrued Asset Question 61 1 pts When recording the cost of land purchased, most companies use the current value. True False Question 62 1 pts When a company recognizes the portion of supplies used during a year, the effect is to decrease net income. True False FB Dil F F7 Question 63 1 pts All financial statements are prepared using the accrual basis of accounting True False Question 64 1 pts A franchiser, such as McDonalds Corporation, is permitted to recognize the revenue from the sale of a franchise whenever they wish. True False D Question 65 1 pts Most companies use the cash basis of accounting. True False Question 66 1 pts Three months before year-end, Mountain Company signed a $100,000, 10%, 8-month note. Principal and interest will be paid at maturity. No interest should be accrued at year-end because the company has no obligation to pay the interest until the note matures True False Question 67 1 pts One effect of recognizing depreciation is to decrease net income. True False Question 68 1 pts A company that forgets to recognize depreciation for the year overstates its income and assets. True Else Question 69 1 pts Every company prepares only four adjustments--one for each of the four types of adjustments. True False Question 70 1 pts When cash is paid before an expense is incurred, an accrual is necessary. True False Question 71 1 pts The amount of interest accrued is added to the note payable account and reported in the liabilities section of the balance sheet. True False Question 72 1 pts Accumulated depreciation is increased when depreciation is recognized. True False Question 73 1 pts When revenue is earned before the receipt of cash, an adjustment that increases a receivable and decreases a liability account is recorded. True False U Question 74 1 pts Every adjustment involves at least one income statement and one balance sheet account. True False Question 75 1 pts When an expense is incurred prior to the payment of cash for that expense, an adjustment that increases an expense account and decreases an asset is prepared. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts