Question: please help asap 2. You wrote 6 call options with a $55 strike price at a premium of $7.50. On the expiration date, the underlying

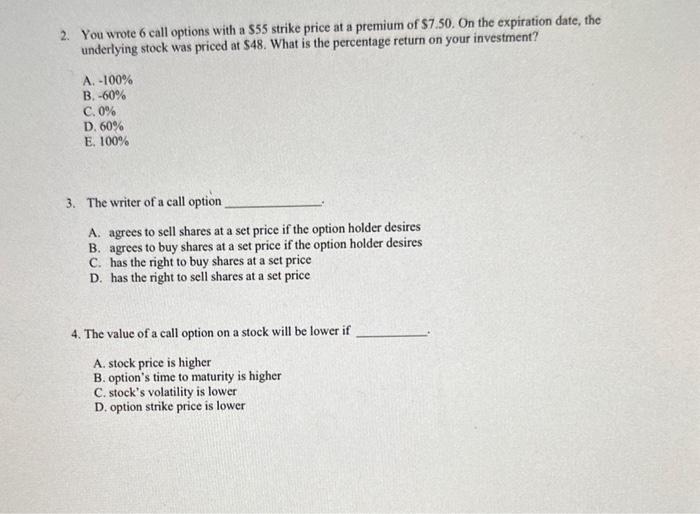

2. You wrote 6 call options with a $55 strike price at a premium of $7.50. On the expiration date, the underlying stock was priced at $48. What is the percentage return on your investment? A. 100% B. 60% C. 0% D. 60% E. 100% 3. The writer of a call option A. agrees to sell shares at a set price if the option holder desires B. agrees to buy shares at a set price if the option holder desires C. has the right to buy shares at a set price D. has the right to sell shares at a set price 4. The value of a call option on a stock will be lower if A. stock price is higher B. option's time to maturity is higher C. stock's volatility is lower D. option strike price is lower

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts