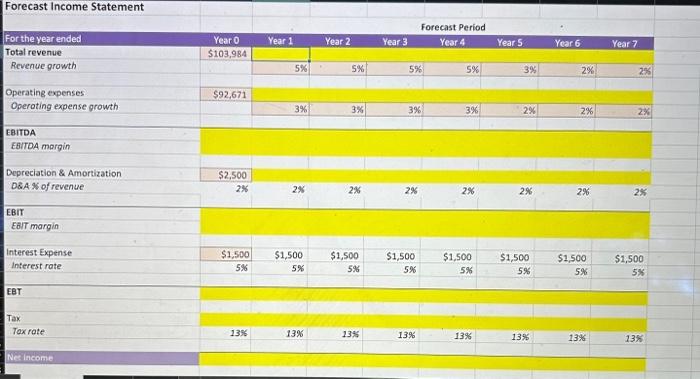

Question: Please help asap and please show formulas Forecast Income Statement For the year ended Total revenue Revenue growth Operating expenses Operoting expense growth EBITDA EBITDA

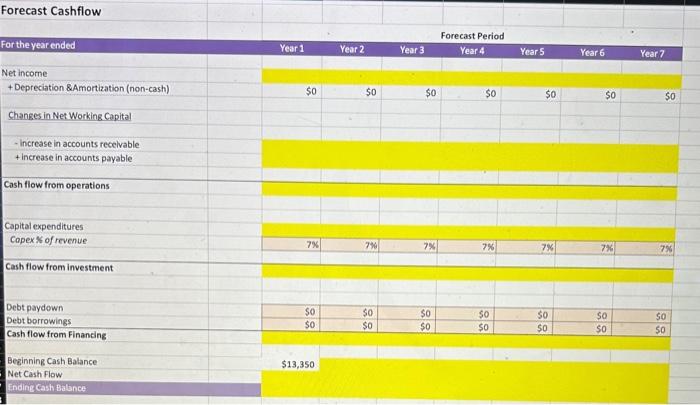

Forecast Income Statement For the year ended Total revenue Revenue growth Operating expenses Operoting expense growth EBITDA EBITDA margin Depreciation \\& Amortization DEA \ of revenue Forecast Period \\( \\frac{\\$ 2,500}{2 \\%} \\) \2 \2 \2 \2 \2 \2 EBIT EaIT margin Interest Expense Interest rate \\( \\frac{\\$ 1,500}{5 \\%} \\) \\( \\$ 1,500 \\) \\( \\$ 1,500 \\) \5 \\( \\$ 1,500 \\) \5 \\( \\$ 1,500 \\) \5 \\( \\$ 1,500 \\) EET \\( \\operatorname{Tax} \\) Tox rate 1356 \13 1395 \13 \13 \13 \13 \13 Forecast Cashflow For the year ended Forecast Period Net income + Depreciation \\&Amortization (non-cash) Changes in Net Working Capital - increase in accounts recelvable +increase in accounts payable Cash flow from operations Capital expenditures Copex \\( \\$ \\) of revenue Cash flow from investment Debt paydown Debt borrowings Cash flow from Finanding Beginning Cash Balance Net Cash Flow Ending Cash Batance Year 1 Year 3 Year 4 \\( \\$ 0 \\) Year 5 Year 6 Year 7 \\begin{tabular}{|l|l|l|l|l|l|l|} \\hline\\( \\$ 0 \\) & \\( \\$ 0 \\) & \\( \\$ 0 \\) & \\( \\$ 0 \\) & \\( \\$ 0 \\) & \\( \\$ 0 \\) & \\( \\$ 0 \\) \\\\ \\hline & & & & & & \\\\ \\hline \\end{tabular} Forecast Income Statement For the year ended Total revenue Revenue growth Operating expenses Operoting expense growth EBITDA EBITDA margin Depreciation \\& Amortization DEA \ of revenue Forecast Period \\( \\frac{\\$ 2,500}{2 \\%} \\) \2 \2 \2 \2 \2 \2 EBIT EaIT margin Interest Expense Interest rate \\( \\frac{\\$ 1,500}{5 \\%} \\) \\( \\$ 1,500 \\) \\( \\$ 1,500 \\) \5 \\( \\$ 1,500 \\) \5 \\( \\$ 1,500 \\) \5 \\( \\$ 1,500 \\) EET \\( \\operatorname{Tax} \\) Tox rate 1356 \13 1395 \13 \13 \13 \13 \13 Forecast Cashflow For the year ended Forecast Period Net income + Depreciation \\&Amortization (non-cash) Changes in Net Working Capital - increase in accounts recelvable +increase in accounts payable Cash flow from operations Capital expenditures Copex \\( \\$ \\) of revenue Cash flow from investment Debt paydown Debt borrowings Cash flow from Finanding Beginning Cash Balance Net Cash Flow Ending Cash Batance Year 1 Year 3 Year 4 \\( \\$ 0 \\) Year 5 Year 6 Year 7 \\begin{tabular}{|l|l|l|l|l|l|l|} \\hline\\( \\$ 0 \\) & \\( \\$ 0 \\) & \\( \\$ 0 \\) & \\( \\$ 0 \\) & \\( \\$ 0 \\) & \\( \\$ 0 \\) & \\( \\$ 0 \\) \\\\ \\hline & & & & & & \\\\ \\hline \\end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts