Question: please help asap Problem 12-16 SML and WACC [LO 4] An all-equity firm is considering the following projects. Project w X Y Z Beta .64

![please help asap Problem 12-16 SML and WACC [LO 4] An](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/67021eb5b0bf0_18167021eb5aa8fb.jpg)

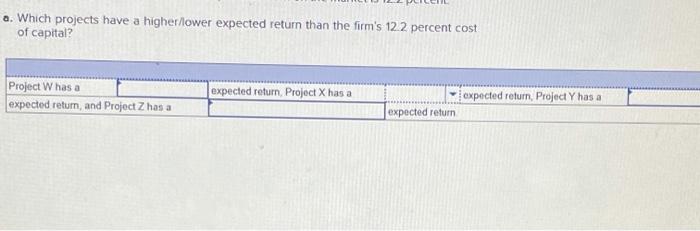

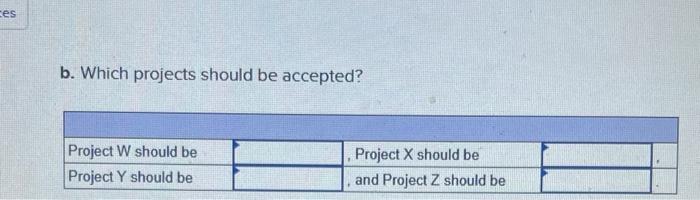

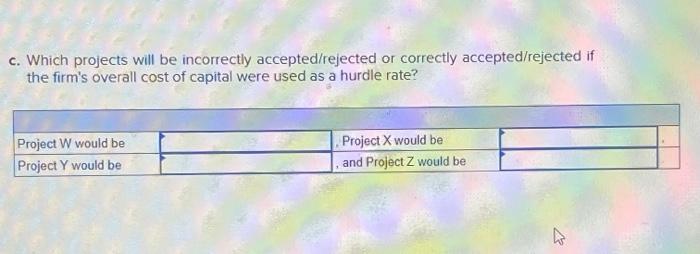

Problem 12-16 SML and WACC [LO 4] An all-equity firm is considering the following projects. Project w X Y Z Beta .64 .75 1.31 1.42 IRR 9.5% - 10.6 14.1 17.2 The T-bill rate is 5.2 percent, and the expected return on the market is 12.2 percent. a. Which projects have a higher lower expected return than the firm's 12.2 percent cost of capital? Project has a expected return, and Project Z has a expected return, Project X has a expected return Project Y has a expected return es b. Which projects should be accepted? Project W should be Project Y should be Project X should be and Project Z should be c. Which projects will be incorrectly accepted/rejected or correctly accepted/rejected if the firm's overall cost of capital were used as a hurdle rate? Project W would be Project would be Project X would be and Project Z would be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts