Question: PLEASE HELP ASAP, THANK YOU, UPVOTE WILL BE GIVEN The most important element in determining whether and how a firm should expand overseas is Select

PLEASE HELP ASAP, THANK YOU, UPVOTE WILL BE GIVEN

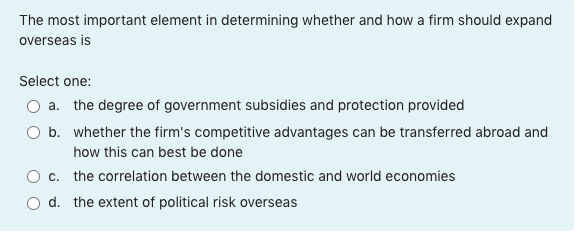

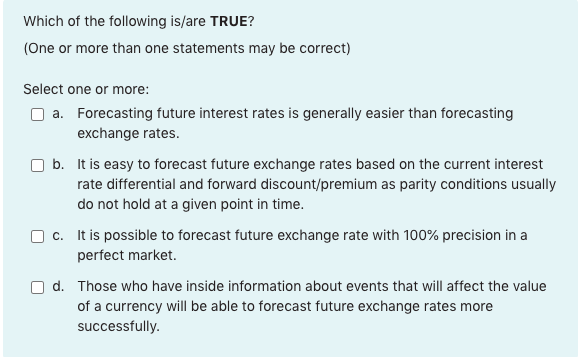

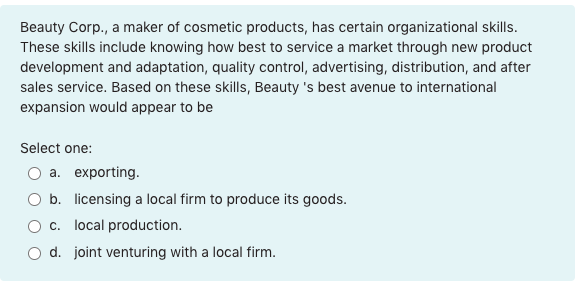

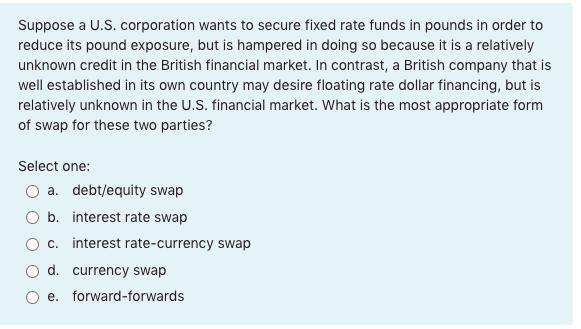

The most important element in determining whether and how a firm should expand overseas is Select one: a. the degree of government subsidies and protection provided b. whether the firm's competitive advantages can be transferred abroad and how this can best be done C. the correlation between the domestic and world economies d. the extent of political risk overseas Which of the following is/are TRUE? (One or more than one statements may be correct) Select one or more: a. Forecasting future interest rates is generally easier than forecasting exchange rates b. It is easy to forecast future exchange rates based on the current interest rate differential and forward discount/premium as parity conditions usually do not hold at a given point in time. c. It is possible to forecast future exchange rate with 100% precision in a perfect market d. Those who have inside information about events that will affect the value of a currency will be able to forecast future exchange rates more successfully Beauty Corp., a maker of cosmetic products, has certain organizational skills. These skills include knowing how best to service a market through new product development and adaptation, quality control, advertising, distribution, and after sales service. Based on these skills, Beauty's best avenue to international expansion would appear to be Select one: a. exporting. b. licensing a local firm to produce its goods. C. local production. d. joint venturing with a local firm. Suppose a U.S. corporation wants to secure fixed rate funds in pounds in order to reduce its pound exposure, but is hampered in doing so because it is a relatively unknown credit in the British financial market. In contrast, a British company that is well established in its own country may desire floating rate dollar financing, but is relatively unknown in the U.S. financial market. What is the most appropriate form of swap for these two parties? Select one: a. debt/equity swap b. interest rate swap c. interest rate-currency swap d. currency swap e. forward-forwards

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts