Question: please help asap. will give thimbs up :) On March 1,2023, Hane Company began construction of a state-of the-art training facility. The facility was finished

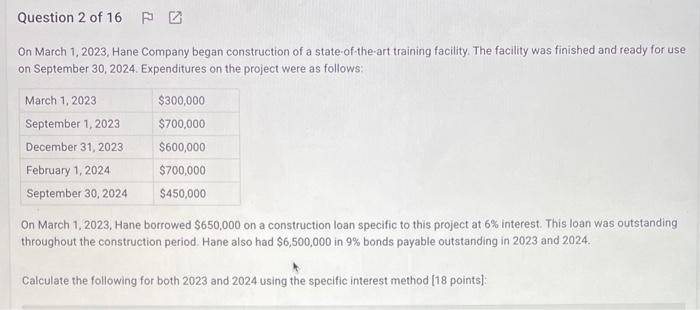

On March 1,2023, Hane Company began construction of a state-of the-art training facility. The facility was finished and ready for use on September 30,2024 . Expenditures on the project were as follows: On March 1, 2023. Hane borrowed $650,000 on a construction loan specific to this project at 6% interest. This loan was outstanding throughout the construction period. Hane also had $6,500,000 in 9% bonds payable outstanding in 2023 and 2024. Calculate the following for both 2023 and 2024 using the specific interest method [18 points]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts