Question: please help ASAP!! You must make a copy before using this sheet. This is the master. File (right under the title) then make a copy

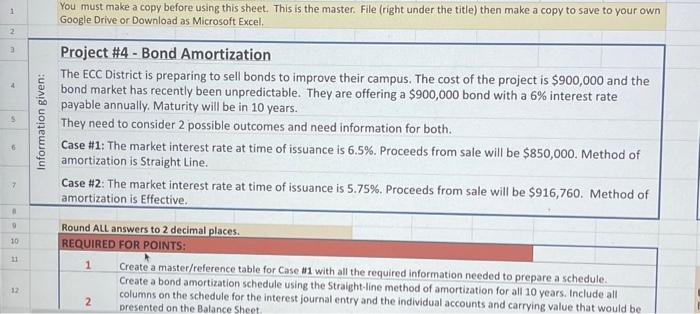

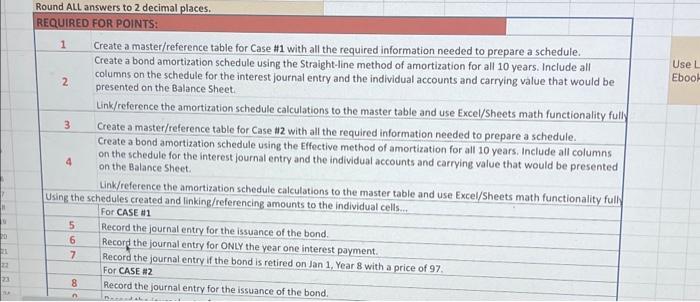

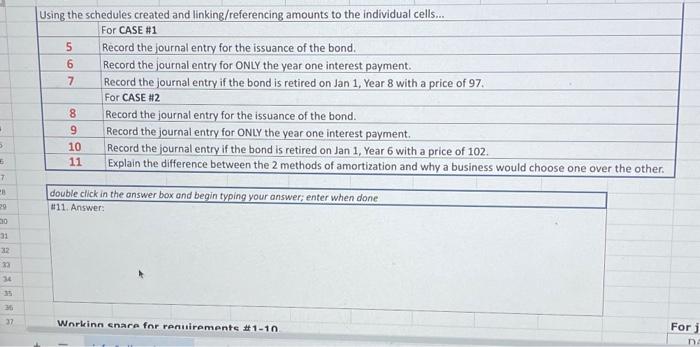

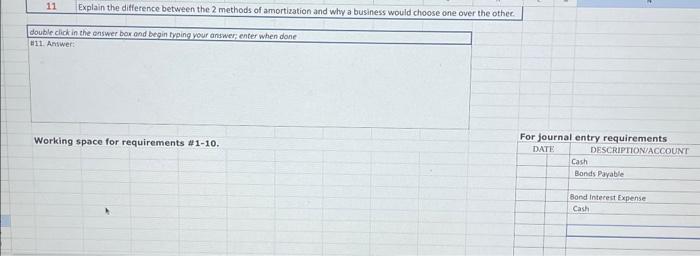

You must make a copy before using this sheet. This is the master. File (right under the title) then make a copy to save to your own Google Drive or Download as Microsoft Excel. Project \#4 - Bond Amortization The ECC District is preparing to sell bonds to improve their campus. The cost of the project is $900,000 and the bond market has recently been unpredictable. They are offering a $900,000 bond with a 6% interest rate payable annually. Maturity will be in 10 years. They need to consider 2 possible outcomes and need information for both. Case \#1: The market interest rate at time of issuance is 6.5%. Proceeds from sale will be $850,000. Method of amortization is Straight Line. Case \#2: The market interest rate at time of issuance is 5.75%. Proceeds from sale will be $916,760. Method of amortization is Effective. Round ALL answers to 2 decimal places. REQUIRED FOR POINTS: 1 Create a master/reference table for Case \#1 with all the required information needed to prepare a schedule. Create a bond amortization schedule using the Straight-line method of amortization for all 10 years. Include all 2 columns on the schedule for the interest journal entry and the individual accounts and carrying value that would be Round ALL answers to 2 decimal places. REQUIRED FOR POINTS: 1 Create a master/reference table for Case \#1 with all the required information needed to prepare a schedule. Create a bond amortization schedule using the Straight-line method of amortization for all 10 years. Include all 2 columns on the schedule for the interest journal entry and the individual accounts and carrying value that would be presented on the Balance sheet. Link/reference the amortization schedule calculations to the master table and use Excel/Sheets math functionality fully 3 Create a master/reference table for Case #2 with all the required information needed to prepare a schedule. Create a bond amortization schedule using the Effective method of amortization for all 10 years. Include all columns 4 on the schedule for the interest journal entry and the individual accounts and carrying value that would be presented on the Balance Sheet. Link/reference the amortization schedule calculations to the master table and use Excel/Sheets math functionality full Using the schedules created and linking/referencing amounts to the individual cells... For CASE H1 Record the journal entry for the issuance of the bond. Record the journal entry for ONLY the year one interest payment. Record the journal entry if the bond is retired on Jan 1, Year 8 with a price of 97. For CASE #2 Record the journal entry for the issuance of the bond. Using the schedules created and linking/referencing amounts to the individual cells... For CASE \#1 Record the journal entry for the issuance of the bond. Record the journal entry for ONLY the year one interest payment. Record the journal entry if the bond is retired on Jan 1, Year 8 with a price of 97. For CASE #2 8 Record the journal entry for the issuance of the bond. 9 Record the journal entry for ONIY the year one interest payment. 10 Record the journal entry if the bond is retired on Jan 1, Year 6 with a price of 102. 11 Explain the difference between the 2 methods of amortization and why a business would choose one over the other. double click in the answer box and begin typing your answer; enter when done H11. Answer: Working space for requirements #110. You must make a copy before using this sheet. This is the master. File (right under the title) then make a copy to save to your own Google Drive or Download as Microsoft Excel. Project \#4 - Bond Amortization The ECC District is preparing to sell bonds to improve their campus. The cost of the project is $900,000 and the bond market has recently been unpredictable. They are offering a $900,000 bond with a 6% interest rate payable annually. Maturity will be in 10 years. They need to consider 2 possible outcomes and need information for both. Case \#1: The market interest rate at time of issuance is 6.5%. Proceeds from sale will be $850,000. Method of amortization is Straight Line. Case \#2: The market interest rate at time of issuance is 5.75%. Proceeds from sale will be $916,760. Method of amortization is Effective. Round ALL answers to 2 decimal places. REQUIRED FOR POINTS: 1 Create a master/reference table for Case \#1 with all the required information needed to prepare a schedule. Create a bond amortization schedule using the Straight-line method of amortization for all 10 years. Include all 2 columns on the schedule for the interest journal entry and the individual accounts and carrying value that would be Round ALL answers to 2 decimal places. REQUIRED FOR POINTS: 1 Create a master/reference table for Case \#1 with all the required information needed to prepare a schedule. Create a bond amortization schedule using the Straight-line method of amortization for all 10 years. Include all 2 columns on the schedule for the interest journal entry and the individual accounts and carrying value that would be presented on the Balance sheet. Link/reference the amortization schedule calculations to the master table and use Excel/Sheets math functionality fully 3 Create a master/reference table for Case #2 with all the required information needed to prepare a schedule. Create a bond amortization schedule using the Effective method of amortization for all 10 years. Include all columns 4 on the schedule for the interest journal entry and the individual accounts and carrying value that would be presented on the Balance Sheet. Link/reference the amortization schedule calculations to the master table and use Excel/Sheets math functionality full Using the schedules created and linking/referencing amounts to the individual cells... For CASE H1 Record the journal entry for the issuance of the bond. Record the journal entry for ONLY the year one interest payment. Record the journal entry if the bond is retired on Jan 1, Year 8 with a price of 97. For CASE #2 Record the journal entry for the issuance of the bond. Using the schedules created and linking/referencing amounts to the individual cells... For CASE \#1 Record the journal entry for the issuance of the bond. Record the journal entry for ONLY the year one interest payment. Record the journal entry if the bond is retired on Jan 1, Year 8 with a price of 97. For CASE #2 8 Record the journal entry for the issuance of the bond. 9 Record the journal entry for ONIY the year one interest payment. 10 Record the journal entry if the bond is retired on Jan 1, Year 6 with a price of 102. 11 Explain the difference between the 2 methods of amortization and why a business would choose one over the other. double click in the answer box and begin typing your answer; enter when done H11. Answer: Working space for requirements #110

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts