Question: You must make a copy before using this sheet. This is the master. File ( right under the title ) then make a copy to

You must make a copy before using this sheet. This is the master. File right under the title then make a copy to save to your own Google Drive or Download as Microsoft Excel.

The Google Sheet should be shared with me

rziwiski@student.elgin.edu with editor privilege & notify; the Excel worksheet can be placed in the Assignment folder in the module in DL

Project # Bond Amortization

The ECC District is preparing to sell bonds to improve their campus. The cost of the project is $ and the bond market has recently been unpredictable. They are offering a $ bond with a interest rate payable annually. Maturity will be in years.

They need to consider possible outcomes and need information for both.

Case #: The market interest rate at time of issuance is Proceeds from sale are $ Method of amortization is Straight Line.

Case #: The market interest rate at time of issuance is Proceeds from sale are $ Method of

Outcomes: to be demonstrated in this project

A

Complete amortization calculations using both the straight line and effective interest methodologles.

B

Use technology to record and summarize information used in business

decisions.

Round ALL answers to decimal places.

REQUIRED FOR POINTS:

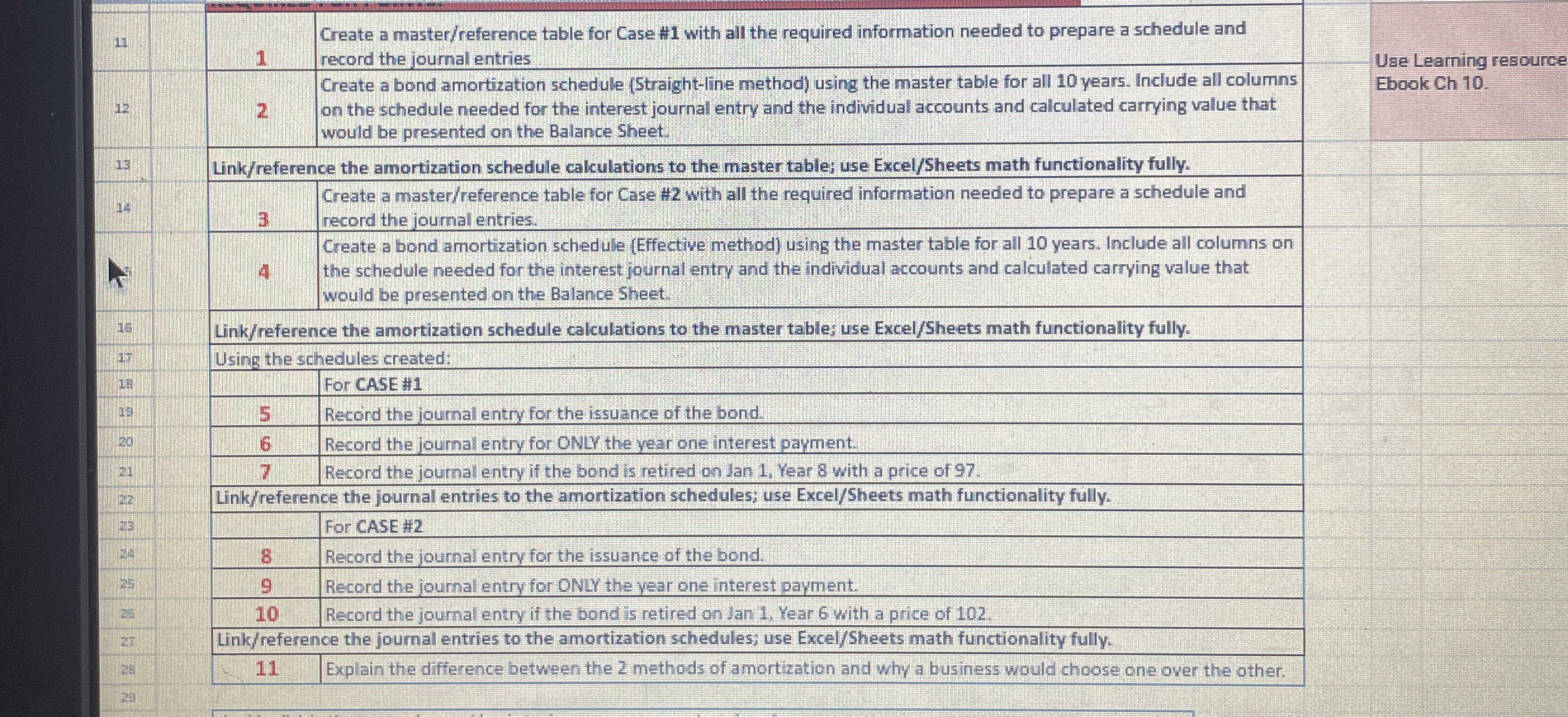

tableCreate a masterreference table for Case # with all the required information needed to prepare a schedule and record the journal entriesCreate a bond amortization schedule Straightline method using the master table for all years. Include all columns on the schedule needed for the interest journal entry and the individual accounts and calculated carrying value that would be presented on the Balance Sheet.Linkreference the amortization schedule calculations to the master table; use ExcelSheets math functionality fully.Create a masterreference table for Case with all the required information needed to prepare a schedule and record the journal entries.hiCreate a bond amortization schedule Effective method using the master table for all years. Include all columns on the schedule needed for the interest journal entry and the individual accounts and calculated carrying value that would be presented on the Balance Sheet.Linkreference the amortization schedule calculations to the master table; use ExcelSheets math functionality fully.Using the schedules created:For CASE #Record the journal entry for the issuance of the bond.Record the journal entry for ONLY the year one interest payment.Record the journal entry if the bond is retired on lan Year with a price of Linkreference the journal entries to the amortization schedules; use ExcelSheets math functionality fully.For CASE HRecord the journal entry for the issuance of the bond.Record the journal entry for ONLY the year one interest payment.Record the journal entry if the bond is retired on Jan Year with a price of Linkreference the journal entries to the amortization schedules; use ExcelSheets math functionality fully.Explain the difference between the methods of amortization and why a business would choose one over the other.

Use Learning resource

Ebook Ch

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock