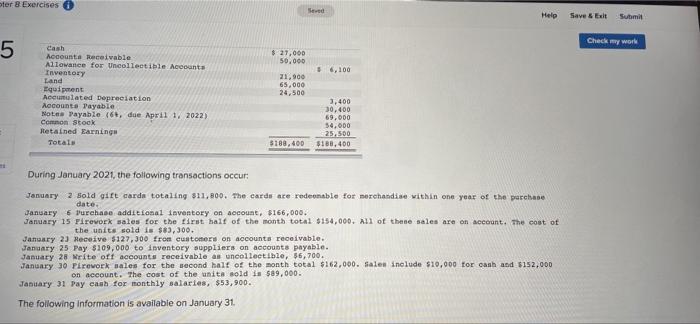

Question: please help been struggling for days ter 8 Exercises Sed Help Save & Ext Submit Check my world 5 $ 27,000 50.000 36,100 cash Accounts

please help been struggling for days

please help been struggling for days

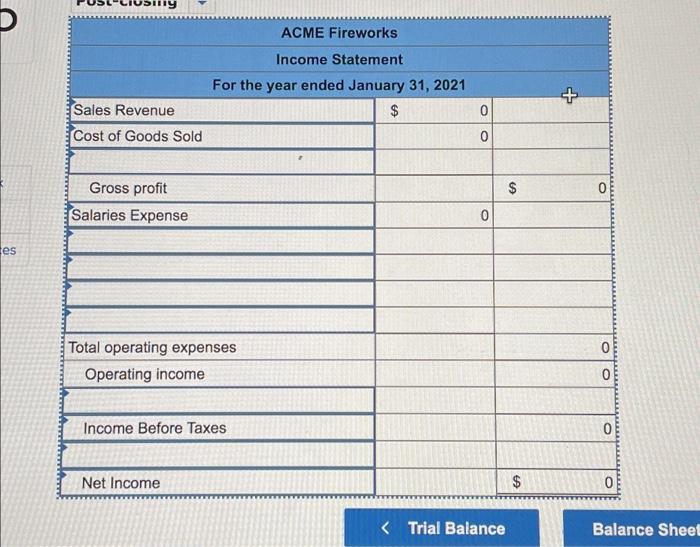

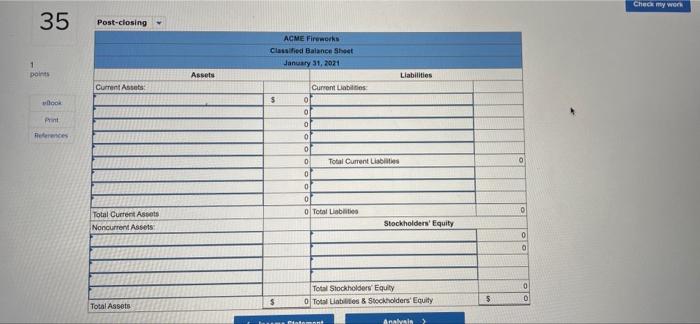

ter 8 Exercises Sed Help Save & Ext Submit Check my world 5 $ 27,000 50.000 36,100 cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Land taient Accumulated Depreciation Accounts Payable Note Payable 16t, due April 1. 2022) Common Stock Retained Earnings Totals 21,900 65.000 24,500 3,400 30,400 69,000 54.000 25,500 $180,400 3188, 400 During January 2021, the following transactions occur January 2 Sold gift cards totaling $11.800. The cards are redeemable for merchandise within one year of the parchase date. January 6 Purchase additional inventory on account, $166,000. January 15 Firework sales for the first half of the month total $154,000. All of these sales are on account. The cost of the units sold is $83,300. January 23 Receive $127,300 from customers on accounts receivable. January 25 Pay $109,000 to inventory suppliers on accounts payable. January 28 Write oft accounts receivable as uncollectible, 36,700. January 30 Pirework sales for the second half of the month total $162.000. sales include $10,000 tor cash and $152.000 on account. The cost of the units sold in $89,000. January 31 Pay cash for monthly salaries, $53,900. The following information is available on January 31. LIUSLY ACME Fireworks Income Statement For the year ended January 31, 2021 $ + 0 Sales Revenue Cost of Goods Sold $ 0 Gross profit Salaries Expense 0 es 0 Total operating expenses Operating income O Income Before Taxes 0 Net Income $ 0 ter 8 Exercises Sed Help Save & Ext Submit Check my world 5 $ 27,000 50.000 36,100 cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Land taient Accumulated Depreciation Accounts Payable Note Payable 16t, due April 1. 2022) Common Stock Retained Earnings Totals 21,900 65.000 24,500 3,400 30,400 69,000 54.000 25,500 $180,400 3188, 400 During January 2021, the following transactions occur January 2 Sold gift cards totaling $11.800. The cards are redeemable for merchandise within one year of the parchase date. January 6 Purchase additional inventory on account, $166,000. January 15 Firework sales for the first half of the month total $154,000. All of these sales are on account. The cost of the units sold is $83,300. January 23 Receive $127,300 from customers on accounts receivable. January 25 Pay $109,000 to inventory suppliers on accounts payable. January 28 Write oft accounts receivable as uncollectible, 36,700. January 30 Pirework sales for the second half of the month total $162.000. sales include $10,000 tor cash and $152.000 on account. The cost of the units sold in $89,000. January 31 Pay cash for monthly salaries, $53,900. The following information is available on January 31. LIUSLY ACME Fireworks Income Statement For the year ended January 31, 2021 $ + 0 Sales Revenue Cost of Goods Sold $ 0 Gross profit Salaries Expense 0 es 0 Total operating expenses Operating income O Income Before Taxes 0 Net Income $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts