Question: solution is from professor. Just need explanation. Problem 3 Several years ago, Western Electric Corp. purchased equipment for $20,000,000. Western uses straightline depreciation for financial

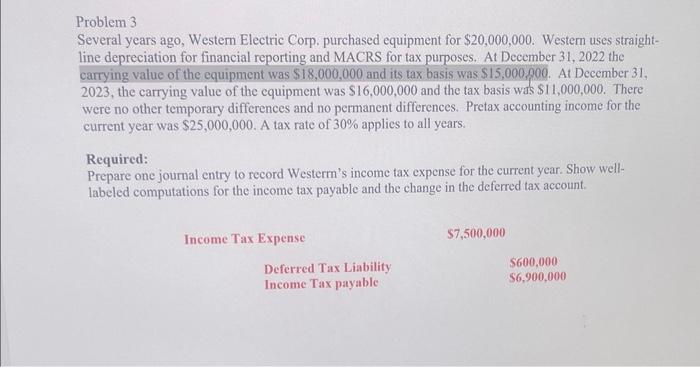

Problem 3 Several years ago, Western Electric Corp. purchased equipment for $20,000,000. Western uses straightline depreciation for financial reporting and MACRS for tax purposes. At December 31, 2022 the carrying value of the equipment was $18,000,000 and its tax basis was $15,000,000. At December 31 , 2023 , the carrying value of the equipment was $16,000,000 and the tax basis was $11,000,000. There were no other temporary differences and no permanent differences. Pretax accounting income for the current year was $25,000,000. A tax rate of 30% applies to all years. Required: Prepare one journal entry to record Westerm's income tax expense for the current year. Show welllabeled computations for the income tax payable and the change in the deferred tax account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts