Question: PLEASE HELP!! Cannot seem to calculate Forward Rates correctly and Professor will not tell me what I am doing wrong after multiple attempts. Calculate and

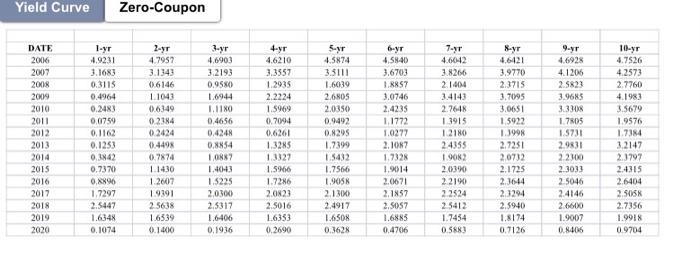

Calculate and plot the series of one-year forward rates for each year between 2006 - 2020, i.e., 2f1, 3f1, 4fi, sf1, 6f1, f1, 8f1, 9f1, 1of1 the presentation must include your forward rate estimates. For each forward-rate curve indicate the expected direction of future short-term rates, i.e., Increasing, Decreasing, Constant. . Yield Curve Zero-Coupon DATE 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 1-yr 4.9231 3.1683 0.3115 0.4964 0.2483 0.0759 0.1162 0.1253 0.3842 0.737) 0.8896 1.7297 2.5447 1.6348 0.1074 2-yr 4.7957 3.1343 06146 11043 0.6349 02184 0.2424 0.4498 07874 11430 1.2007 1.9391 25638 16339 0.1400 3-yr 4.6903 3.2193 0.9580 16944 1.1180 0.4656 0.4248 0.8854 1 OR? 1.4043 1.5225 2,0300) 2.5317 1.6406 0.1936 4-yr 4.6210 3.3557 1.2935 2.2224 1.5969 0.7094 0.6261 1.3285 1.3327 1.5966 1.7286 2.0N 23 2.5016 16353 0.2690 5-yr 4.5874 3.3111 1.6039 2.680S 2.0350 0.9492 0.8295 1.7399 1.5432 1.7566 1.95 2.13%) 2.4917 1.6508 0.3628 6-yr 4.58-40 3.6703 1.8857 3.0746 2.4235 1.1772 1.0277 2.1087 1.7328 1.9014 2.0671 2.1857 2.5057 1.685 0.4706 7-yr 4.6042 3.8266 2.1404 3.4143 2.7648 1.3915 1.2180 2.4355 1.9082 20390 22190 2.2524 25412 1.7454 0.5883 8-yr 4.6421 3.9770 2.3715 3.7095 3.0651 1.5922 1.1998 2.7251 2,0732 2.1725 2.3644 2.3294 2.5940 1.8174 0.7126 9-yr 4.6928 4.1206 2.5823 3.9685 3.330 17805 1.5731 2.9831 2.2900 2.3033 2.5046 2.4146 26600 1.9007 0.8406 10-yr 4.7526 4.2573 2.7760 4.1983 3.5679 1.9576 1.7384 3.2147 2.3797 2.4315 2.6404 2.5058 2.7356 1.9918 0.9704 Calculate and plot the series of one-year forward rates for each year between 2006 - 2020, i.e., 2f1, 3f1, 4fi, sf1, 6f1, f1, 8f1, 9f1, 1of1 the presentation must include your forward rate estimates. For each forward-rate curve indicate the expected direction of future short-term rates, i.e., Increasing, Decreasing, Constant. . Yield Curve Zero-Coupon DATE 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 1-yr 4.9231 3.1683 0.3115 0.4964 0.2483 0.0759 0.1162 0.1253 0.3842 0.737) 0.8896 1.7297 2.5447 1.6348 0.1074 2-yr 4.7957 3.1343 06146 11043 0.6349 02184 0.2424 0.4498 07874 11430 1.2007 1.9391 25638 16339 0.1400 3-yr 4.6903 3.2193 0.9580 16944 1.1180 0.4656 0.4248 0.8854 1 OR? 1.4043 1.5225 2,0300) 2.5317 1.6406 0.1936 4-yr 4.6210 3.3557 1.2935 2.2224 1.5969 0.7094 0.6261 1.3285 1.3327 1.5966 1.7286 2.0N 23 2.5016 16353 0.2690 5-yr 4.5874 3.3111 1.6039 2.680S 2.0350 0.9492 0.8295 1.7399 1.5432 1.7566 1.95 2.13%) 2.4917 1.6508 0.3628 6-yr 4.58-40 3.6703 1.8857 3.0746 2.4235 1.1772 1.0277 2.1087 1.7328 1.9014 2.0671 2.1857 2.5057 1.685 0.4706 7-yr 4.6042 3.8266 2.1404 3.4143 2.7648 1.3915 1.2180 2.4355 1.9082 20390 22190 2.2524 25412 1.7454 0.5883 8-yr 4.6421 3.9770 2.3715 3.7095 3.0651 1.5922 1.1998 2.7251 2,0732 2.1725 2.3644 2.3294 2.5940 1.8174 0.7126 9-yr 4.6928 4.1206 2.5823 3.9685 3.330 17805 1.5731 2.9831 2.2900 2.3033 2.5046 2.4146 26600 1.9007 0.8406 10-yr 4.7526 4.2573 2.7760 4.1983 3.5679 1.9576 1.7384 3.2147 2.3797 2.4315 2.6404 2.5058 2.7356 1.9918 0.9704

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts