Question: please help Chapter 2 Assignment 1 Pentin memut kop21A%252F%252 M COMM From Ma Sweeten Company had no jobs in progress at the begening of March

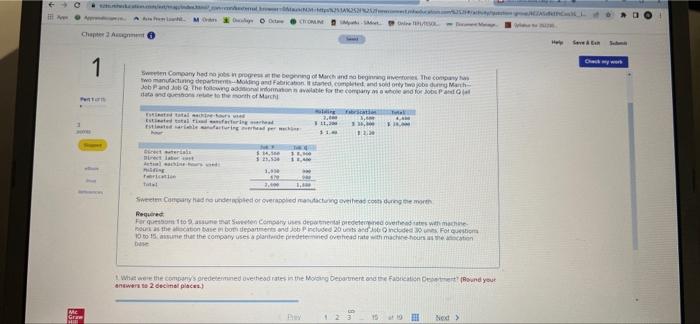

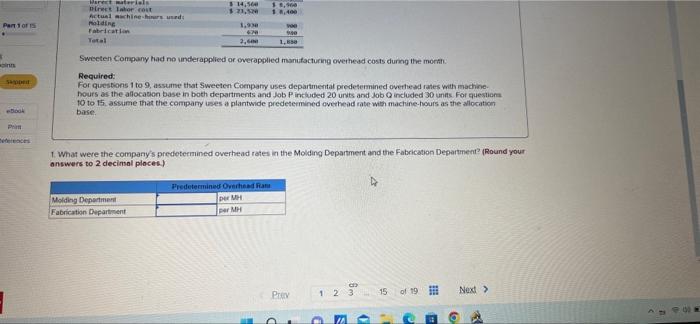

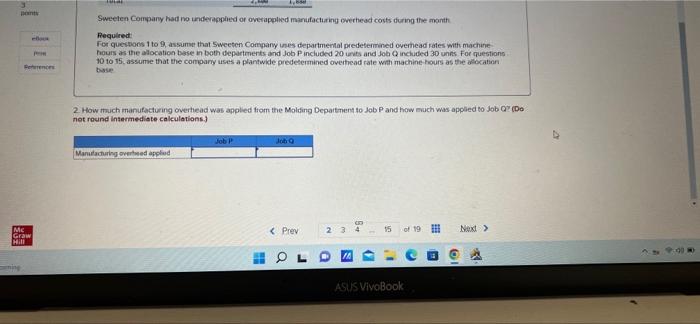

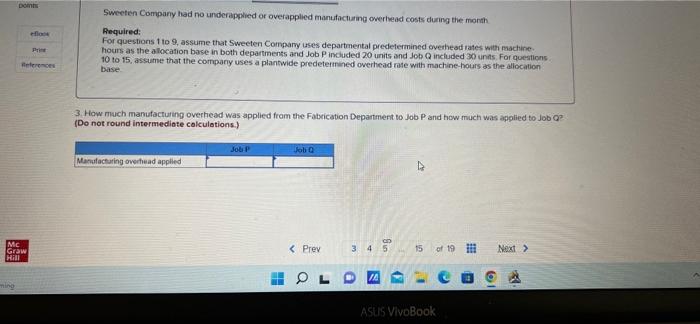

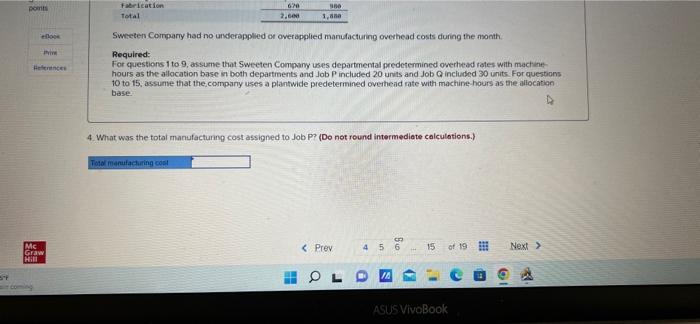

Chapter 2 Assignment 1 Pentin memut kop21A%252F%252 M COMM From Ma Sweeten Company had no jobs in progress at the begening of March and no beginning ventes. The company has two manufacturing departments-Molding and Fabrication it staned, completed and sold only two jobs dung Manch Job P and Job Q The following additional information is available for the company as a whole and for Jobs P and Q data and questions relate to the month of March maling Extincted total machine-tours d Estimated total rid facturing read estimated sariable manufacturing verhead per c 12.00 hour MY $14,500 cest teriais niet later $ 21,53 W 11,000 11,400 ww Atlas Pilding ricatie 1,000 479 3,400 total Sweet Company had no underscipled or overapplied manufacturing overhead costs during the moth Required: For questom 1 to 9, assume that Sweeten Company uses departmental predeterreined overhead rates with machine hours as the allocation base in both departments and Job Pincluded 20 unts and Job O included 30 units For question 10 to 15 assume that the company uses a plantwide predetermined overhead rate with machine-hours heaocation base What were the company's predetermined overhead rates in the Molding Department and the Fabrication Department (Round your answers to 2 decimal places) Pey 123 15 199 Sed > Mc Grae bil 11,200 110 Help Seven Scho Marect materials $14,500 Direct labor cost $ 21,520 $9,500 18,400 Actual machine-hrs used: Molding Fabrication 1,900 670 100 9:00 Total 2,600 1,650 Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: sapped For questions 1 to 9, assume that Sweeten Company uses departmental predetermined overhead rates with machine hours as the allocation base in both departments and Job P included 20 units and Job Q included 30 units. For questions 10 to 15. assume that the company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. ebook Pri 1. What were the company's predetermined overhead rates in the Molding Department and the Fabrication Department? (Round your answers to 2 decimal places) Predetermined Overhead Ram per MH Molding Department Fabrication Department per MH S 1 2 3 15 of 19 Next > Part 1 of 15 # int M Prev S 4 ^093. 3 eBook References Mc Graw Hill ming Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month Required: For questions 1 to 9, assume that Sweeten Company uses departmental predetermined overhead rates with machine hours as the allocation base in both departments and Job P included 20 units and Job Q included 30 units. For questions 10 10 15, assume that the company uses a plantwide predetermined overhead rate with machine-hours as the allocation 2. How much manufacturing overhead was applied from the Molding Department to Job P and how much was applied to Job Q? (Do not round intermediate calculations.) Job P Job Q Manufacturing overheed applied 5 0 ASUS VivoBook 2 3 X points efloor Prine References Mc Graw Hill Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month Required: For questions 1 to 9, assume that Sweeten Company uses departmental predetermined overhead rates with machine- hours as the allocation base in both departments and Job P included 20 units and Job Q included 30 units. For questions 10 to 15, assume that the company uses a plantwide predetermined overhead rate with machine-hours as the allocation base 3. How much manufacturing overhead was applied from the Fabrication Department to Job P and how much was applied to Job Q? (Do not round intermediate calculations.) Job P Job Q Manufacturing overhead applied CO IA ASLIS VivoBook points Prime References Mc Graw Hill coming 620 900 Fabrication Total 2,000 1,800 Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1 to 9, assume that Sweeten Company uses departmental predetermined overhead rates with machine hours as the allocation base in both departments and Job P included 20 units and Job Q included 30 units. For questions 10 to 15, assume that the company uses a plantwide predetermined overhead rate with machine-hours as the allocation base 4. What was the total manufacturing cost assigned to Job P? (Do not round intermediate calculations.) Total manufacturing cost SE Chapter 2 Assignment 1 Pentin memut kop21A%252F%252 M COMM From Ma Sweeten Company had no jobs in progress at the begening of March and no beginning ventes. The company has two manufacturing departments-Molding and Fabrication it staned, completed and sold only two jobs dung Manch Job P and Job Q The following additional information is available for the company as a whole and for Jobs P and Q data and questions relate to the month of March maling Extincted total machine-tours d Estimated total rid facturing read estimated sariable manufacturing verhead per c 12.00 hour MY $14,500 cest teriais niet later $ 21,53 W 11,000 11,400 ww Atlas Pilding ricatie 1,000 479 3,400 total Sweet Company had no underscipled or overapplied manufacturing overhead costs during the moth Required: For questom 1 to 9, assume that Sweeten Company uses departmental predeterreined overhead rates with machine hours as the allocation base in both departments and Job Pincluded 20 unts and Job O included 30 units For question 10 to 15 assume that the company uses a plantwide predetermined overhead rate with machine-hours heaocation base What were the company's predetermined overhead rates in the Molding Department and the Fabrication Department (Round your answers to 2 decimal places) Pey 123 15 199 Sed > Mc Grae bil 11,200 110 Help Seven Scho Marect materials $14,500 Direct labor cost $ 21,520 $9,500 18,400 Actual machine-hrs used: Molding Fabrication 1,900 670 100 9:00 Total 2,600 1,650 Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: sapped For questions 1 to 9, assume that Sweeten Company uses departmental predetermined overhead rates with machine hours as the allocation base in both departments and Job P included 20 units and Job Q included 30 units. For questions 10 to 15. assume that the company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. ebook Pri 1. What were the company's predetermined overhead rates in the Molding Department and the Fabrication Department? (Round your answers to 2 decimal places) Predetermined Overhead Ram per MH Molding Department Fabrication Department per MH S 1 2 3 15 of 19 Next > Part 1 of 15 # int M Prev S 4 ^093. 3 eBook References Mc Graw Hill ming Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month Required: For questions 1 to 9, assume that Sweeten Company uses departmental predetermined overhead rates with machine hours as the allocation base in both departments and Job P included 20 units and Job Q included 30 units. For questions 10 10 15, assume that the company uses a plantwide predetermined overhead rate with machine-hours as the allocation 2. How much manufacturing overhead was applied from the Molding Department to Job P and how much was applied to Job Q? (Do not round intermediate calculations.) Job P Job Q Manufacturing overheed applied 5 0 ASUS VivoBook 2 3 X points efloor Prine References Mc Graw Hill Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month Required: For questions 1 to 9, assume that Sweeten Company uses departmental predetermined overhead rates with machine- hours as the allocation base in both departments and Job P included 20 units and Job Q included 30 units. For questions 10 to 15, assume that the company uses a plantwide predetermined overhead rate with machine-hours as the allocation base 3. How much manufacturing overhead was applied from the Fabrication Department to Job P and how much was applied to Job Q? (Do not round intermediate calculations.) Job P Job Q Manufacturing overhead applied CO IA ASLIS VivoBook points Prime References Mc Graw Hill coming 620 900 Fabrication Total 2,000 1,800 Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1 to 9, assume that Sweeten Company uses departmental predetermined overhead rates with machine hours as the allocation base in both departments and Job P included 20 units and Job Q included 30 units. For questions 10 to 15, assume that the company uses a plantwide predetermined overhead rate with machine-hours as the allocation base 4. What was the total manufacturing cost assigned to Job P? (Do not round intermediate calculations.) Total manufacturing cost SE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts