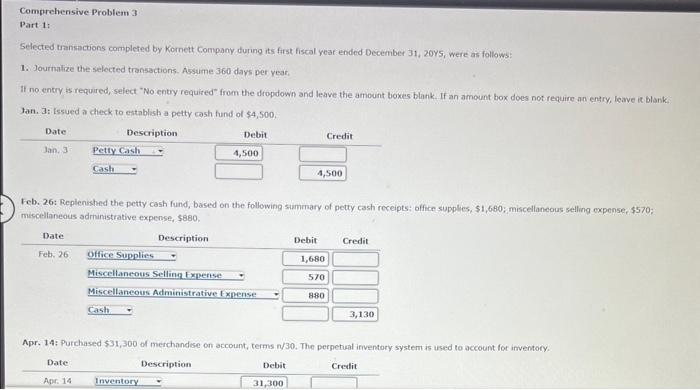

Question: Please help! Comprehensive Problem 3 Part 1: Selected transactions completed by Kornett Company during its first fiscal year ended December 31, 20r5, were as follows:

![accountiny for uncollectible receivables.] Sept. 15: Reinstated the Firiey account written off](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f701eb3b0fb_91466f701ea11326.jpg)

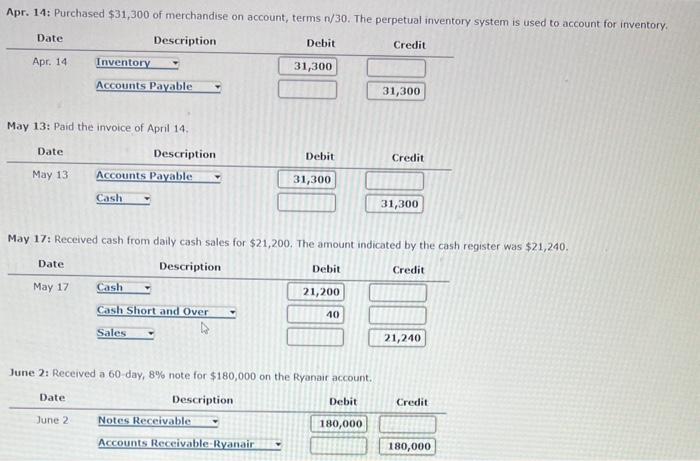

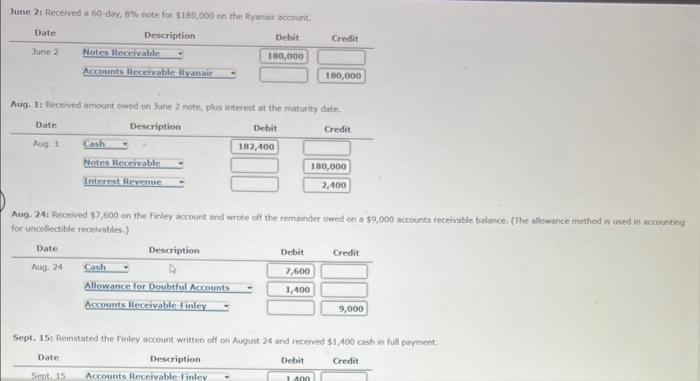

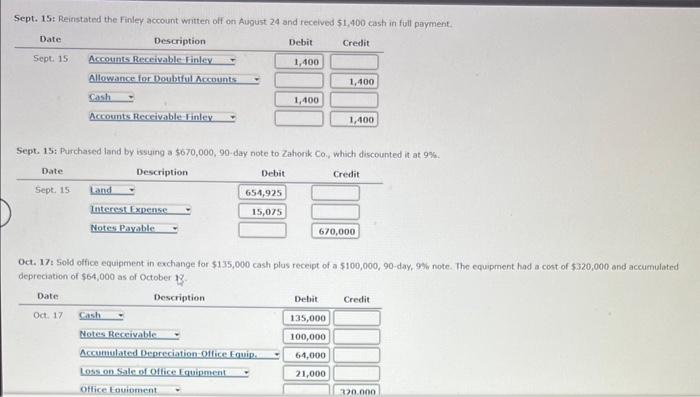

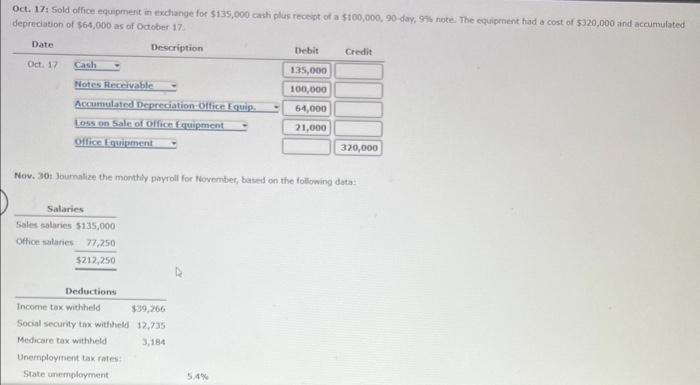

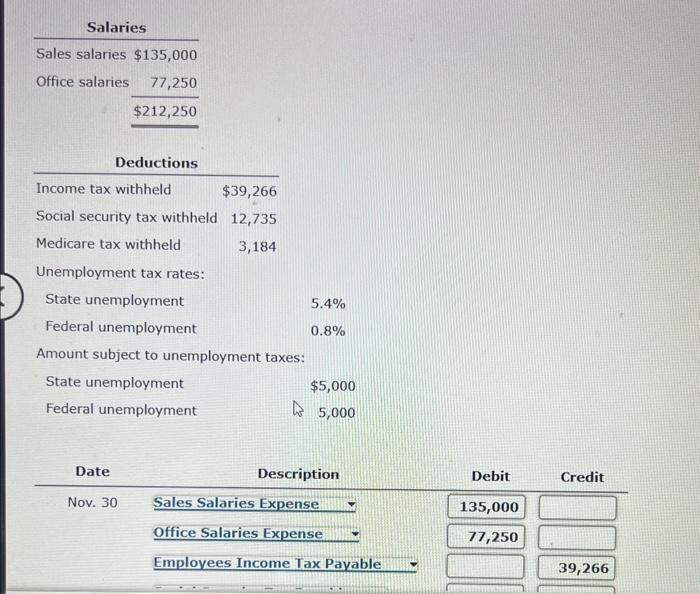

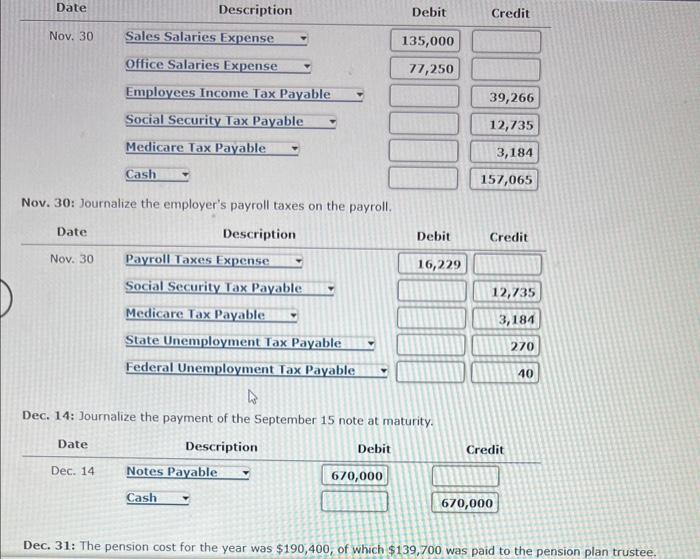

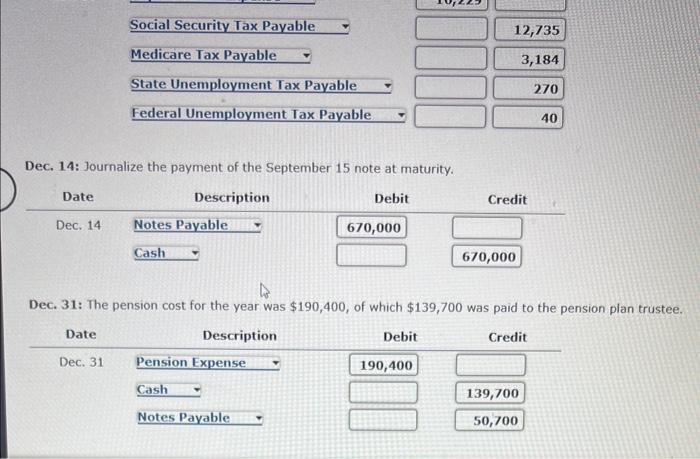

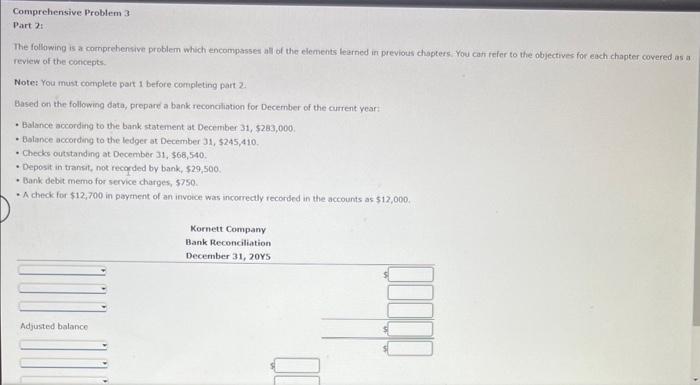

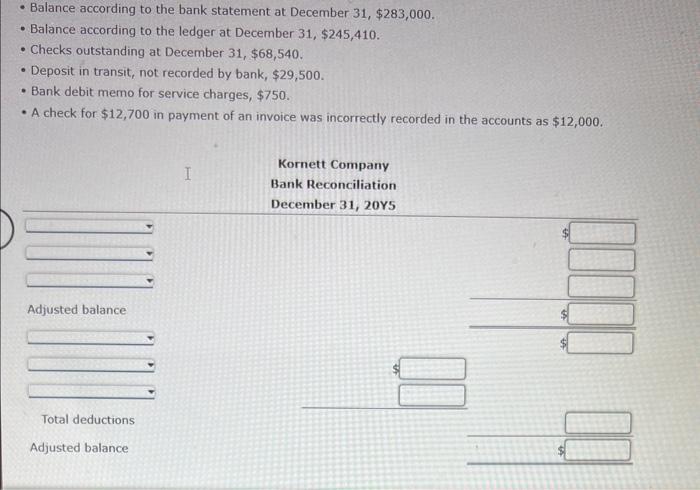

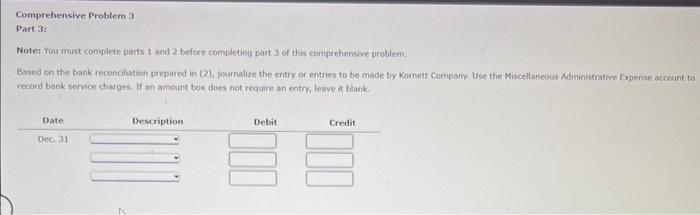

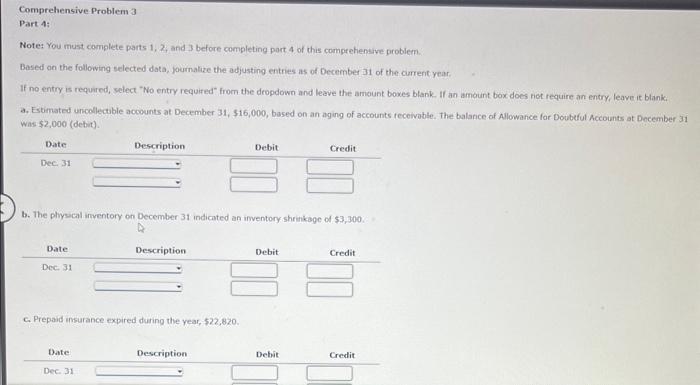

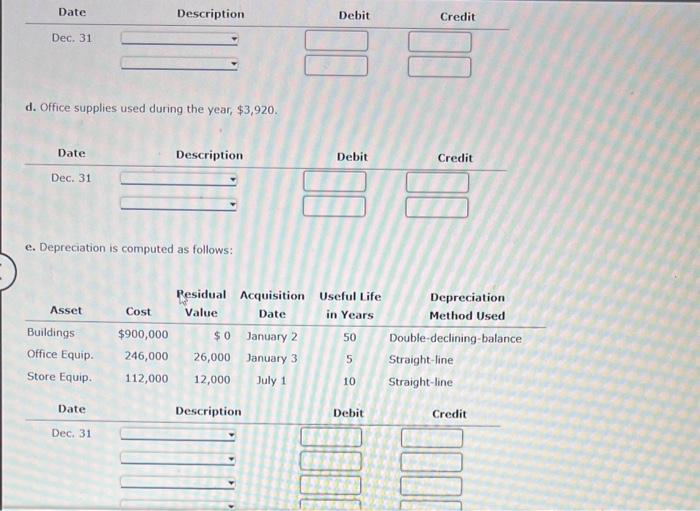

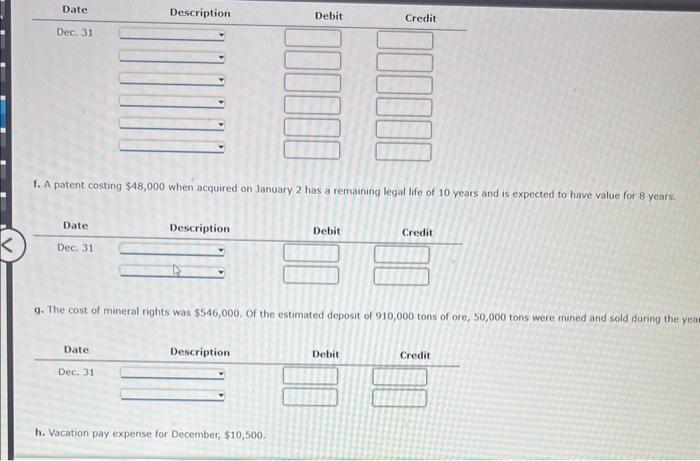

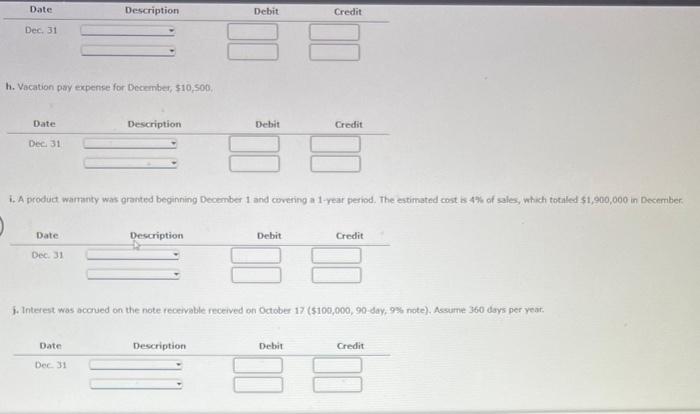

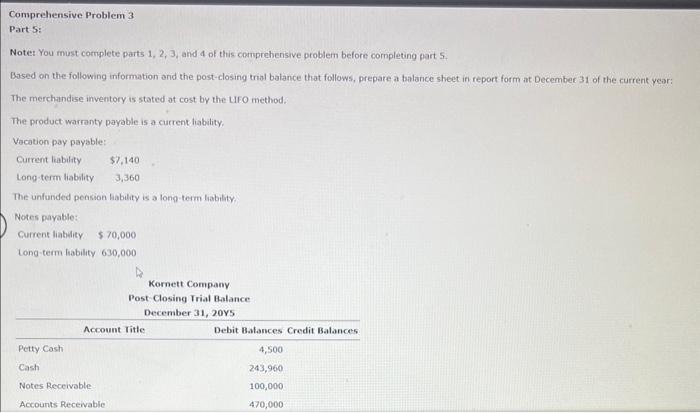

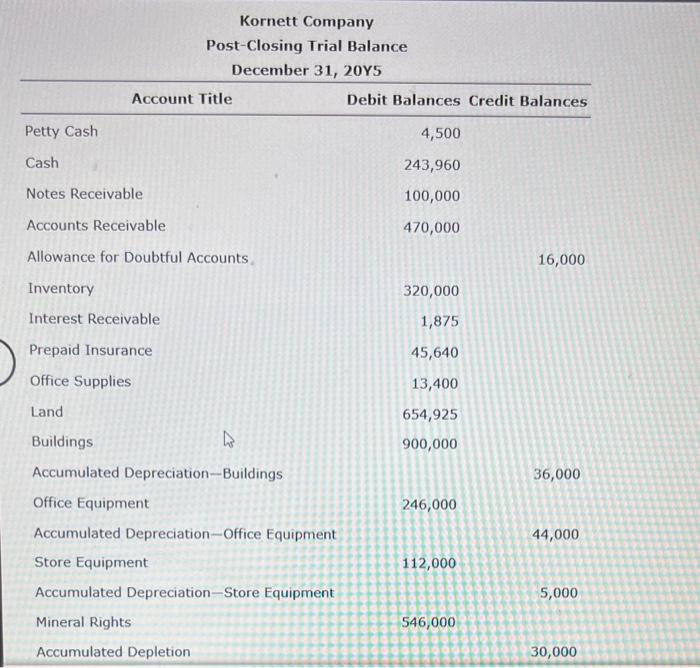

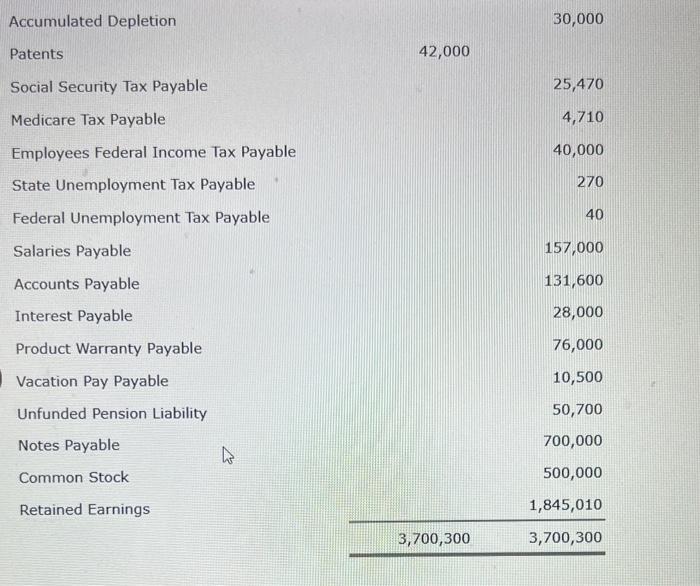

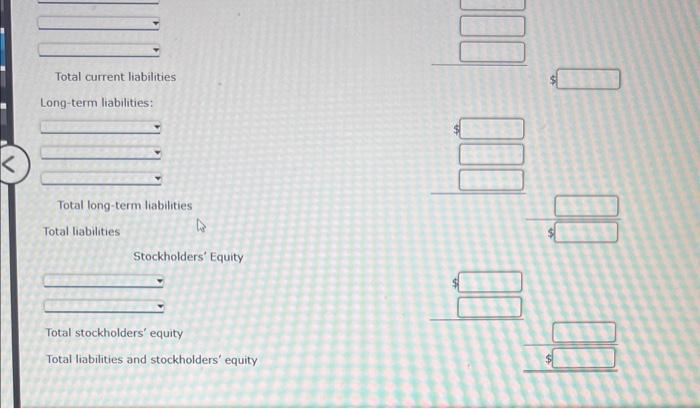

Comprehensive Problem 3 Part 1: Selected transactions completed by Kornett Company during its first fiscal year ended December 31, 20r5, were as follows: 1. Journalize the selected transactions. Assume 360 days per year, If no entry is required, select "No entry required" from the dropdown and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. 3an. 3i tssued a check to establish a petty cash fund of $4,500. Feb. 26: Replenished the petty cash fund, based on the following sumraary of petty cash receipts: affice supplies, $1,680; miscellaneous selling expense, $570; miccellaneous administrative expense, $880. Apr. 14: Purchased $31,300 of merchandise on account, terms n/30. The perpehial irventory system is used to account for imventory. May 13: Paid the invoice of April 14. May 17: Received cash from daily cash sales for $21,200. The amount indicate June 2: Received a 60 -day, 8% note for $180,000 on the Ryanair account. June 2: Recerved a 60 -day, 874 note for $160,000 an the fyanair account. Aug. 1: feceived amount owed an lune 2 note, plus inter edt at the miaturity date. Aug. 24: Received $7,600 on the Finley account and wrote of the femunder owed on a 59,000 accounts feceivable balance. (The allowance imethod is used in accountiny for uncollectible receivables.] Sept. 15: Reinstated the Firiey account written off on August 24 and recenved 51,400 cast in full patyment. Sept. 15: Reinstated the Finley account written off on August 24 and received 51,400 cash in full payment. Sept. 13: Purchased land by issuing a $670,000,90-day note to Zahork Co., which discounted it at 9%. Oct. 17. Sold office equipment in exchange for $135,000 cash plus receipt of a $100,000,90-day, 9% note. The equipment had a cont of $320,000 and accumulated depreciation of $64,000 as of October 18 . Oct. 17: Sold office equipment in exchange for $135,000 cash plus recolipt of a $100,000,90day,936 note- The equipenent had a cost of $320,000 and acrumulated depreciation of $64,000 as of October 17. Nov. 30: Joumalize the monthify poyroll for Novernter, based on the following datas Salaries Sales salaries $135,000 Office salaries $212,25077,250 Unemployment tax rates: State unemployment Federal unemployment 5.4% 0.8% Amount subject to unemployment taxes: State unemployment $5,000 Federal unemployment 5,000 Nov. 30: Journalize the employer's payroll taxes on the payroll. Dec. 14: Journalize the payment of the September 15 note at maturity. Dec. 14: Journalize the payment of the September 15 note at maturity. Dec. 31: The pension cost for the year was $190,400, of which $139,700 was paid to the pension plan trustee. The following is a comprehensive problem which encompasset all of the elements learned iet previous chapters. You can refer to the objectives for each chapter covered as a review of the conicepts. Note: You must complete part 1 before completing part 2. Based on the following data, prepare a bank reconcliation for December of the current year: - Balance according to the bank statement at December 31,$283,000. - Eolance according to the ledger at December 31,$245,410. - Checks outstanding at December 31, $66,540. - Deposit in transit, not recarded by bank, $29,500. - Bank debit memo for service charges, 5750. - A check for $12,700 in payment of an invoice was incorrectly recorded in the accounts as $12,000. - Balance according to the bank statement at December 31,$283,000. - Balance according to the ledger at December 31,$245,410. - Checks outstanding at December 31,$68,540. - Deposit in transit, not recorded by bank, $29,500. - Bank debit memo for service charges, $750. - A check for $12,700 in payment of an invoice was incorrectly recorded in the accounts as $12,000. Note: You must complete parts 1 and 2 before completang pait 3 of this conpipehensive problem. Based on the bank reconclabtion prepared in (2), journalize the entry or entries to be made by Komett Campany: Use the Miscellaneous Administrative Expenise account to record bank service charges. If an amount box does not require an entry, leave it blank. Notes You must complete parts 1,2 , and 3 before completing port 4 of this comprehenave problem. Based on the following selected data, journalize the adjusting entries as of December 31 of the currentiyear: If no entry is required, select "No entry required" from the dropdown and leave the amount boxes blank. If an amount box does hot require an entry, leave it blaniki. a. Estimated uncollectbble accounts at December 31, $16,000, based on an aging of accounts teceivable. The balance of Allowance for Doubeful Accounts at December 31 was $2,000 (dehit). b. The physical imventory on December 31 indicated an inventory shrinkage of $3,300. c. Prepaid insurance expired during the year, $22,820. d. Office supplies used during the year, $3,920. e. Depreciation is computed as follows: f. A patent costing $48,000 when acquired on January 2 has a remaining legal life of 10 years and is expected to have value for 8 years. 9. The cost of mineral rights was $546,000. Of the estimated deposit of 910,000 tons of ore, 50,000 tons were mined and sold during the ye h. Vacation pay expense for December, $10,500. h. Vacation pay expense for December, \$10,500. i. A product wamanty was granted beginning December f and covering a 1 -yar perfod. The eatimated coot is 47 of sales, which totaled $1,900,000 in December 7. Interest was acorued on the note receivable received on October 17 ( $100,000,90day,98 nate). Assume 360 doys per yeat. Part S: Note! You must complete parts 1,2,3, and 4 of this comprehenisive problem before completing part 5. Based on the following information and the post-closing trial balance that follows, prepare a balance sheet in report form at December 31 of the current year: The merchandise inventory is stated at cost by the LFO method. The product warranty payable is a current liability. Vacation pay payable: The unfunded pension hability is a long-term liability. Notes payable: Gurrent liabdity $70,000 Long-tem liability 630,000 Kornett Company Post-Closing Trial Balance December 31,20 Y5 Petty Cash Debit Balances Credit Balances 4,500 Cash 243,960 Notes Receivable 100,000 Accounts Receivable 470,000 Allowance for Doubtful Accounts. 16,000 Inventory Interest Receivable Prepaid Insurance Office Supplies Land Buildings Accumulated Depreciation-Buildings 36,000 Office Equipment 246,000 Accumulated Depreciation-Office Equipment 44,000 Store Equipment 112,000 Accumulated Depreciation-Store Equipment 5,000 Mineral Rights 546,000 Accumulated Depletion 30,000 Accumulated Depletion 30,000 Patents 42,000 Social Security Tax Payable Medicare Tax Payable Employees Federal Income Tax Payable 25,470 4,710 40,000 State Unemployment Tax Payable Federal Unemployment Tax Payable Salaries Payable Accounts Payable Interest Payable Product Warranty Payable Vacation Pay Payable Unfunded Pension Liability Notes Payable Common Stock Kornett Company Balance Sheet December 31, 20 Y5 Assets Current assets: Total current assets Property, plant, and equipment: Total current assets Property, plant, and equipment: Total property, plant, and equipment Intangible assets: Total assets Liabilities Total property, plant, and equipment Intangible assets: Total assets Liabilities Current liabilities: Total current liabilities Long-term liabilities: Total long-term liabilities Total liabilities Stockholders' Equity Total stockholders' equity Total liabilities and stockholders' equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts