Question: Please help compute! our division is considering two investment projects, each of which requires an up-front expenditure of $24 million. You estimate that the cost

Please help compute!

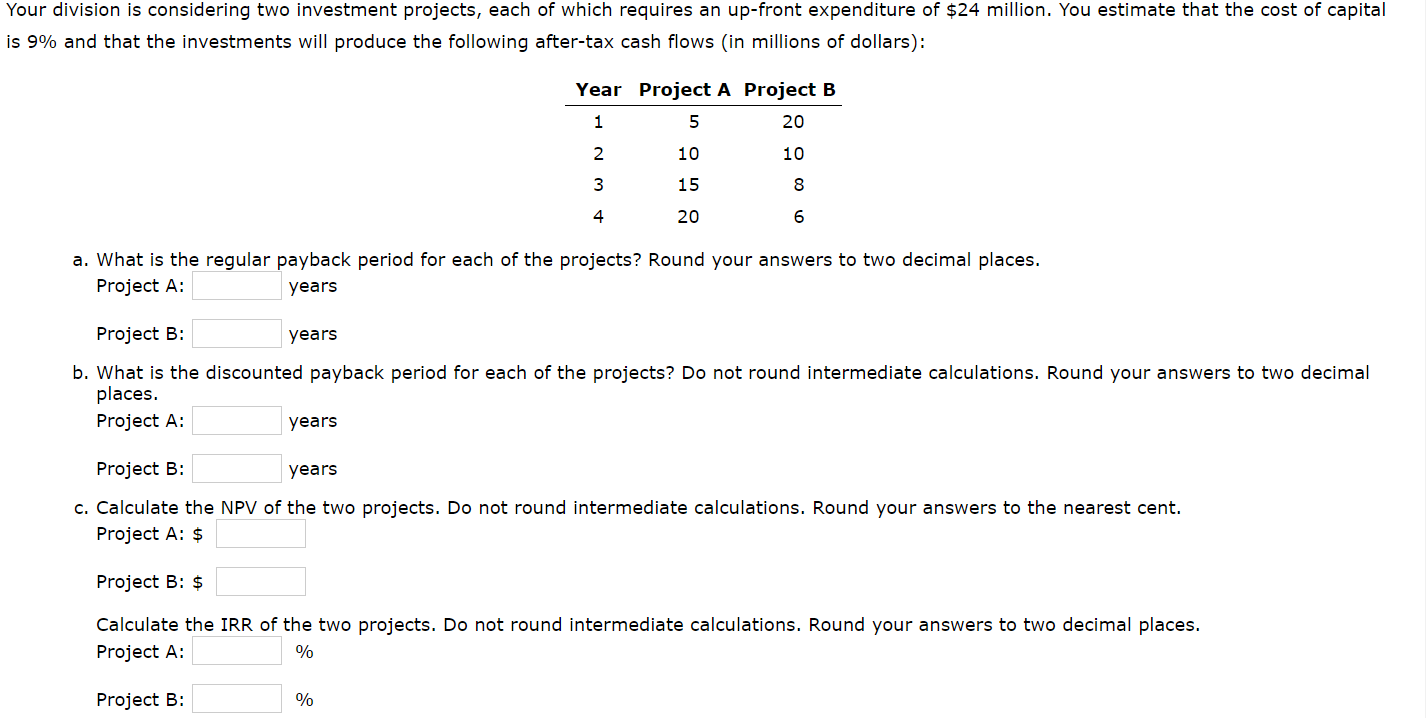

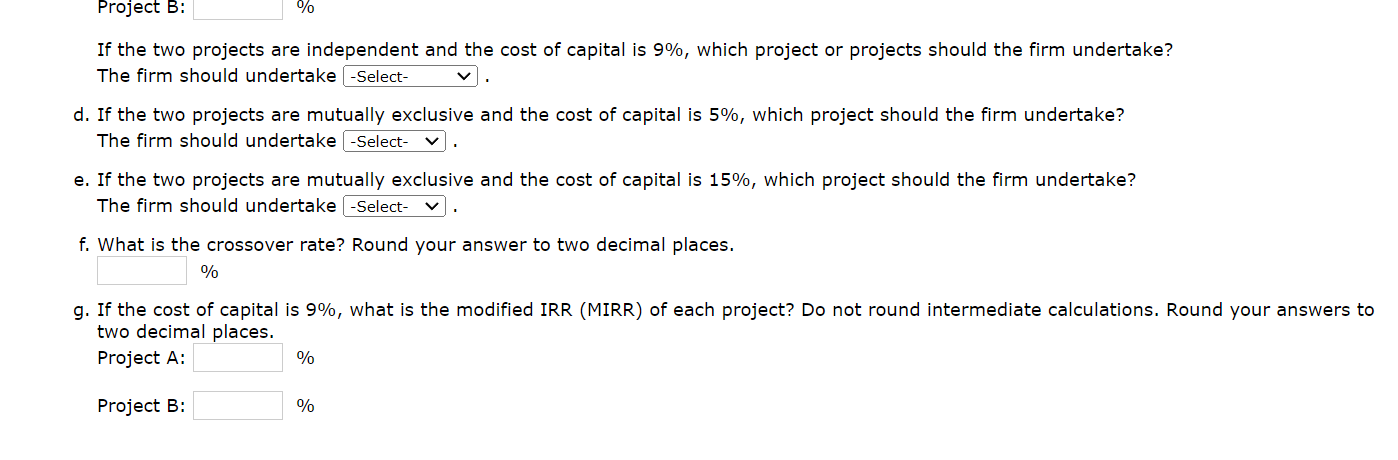

our division is considering two investment projects, each of which requires an up-front expenditure of $24 million. You estimate that the cost of capital 5% and that the investments will produce the following after-tax cash flows (in millions of dollars): a. What is the reqular payback period for each of the projects? Round your answers to two decimal places. Project A: years Project B: years b. What is the discounted payback period for each of the projects? Do not round intermediate calculations. Round your answers to two decimal places. Project A: years Project B: years c. Calculate the NPV of the two projects. Do not round intermediate calculations. Round your answers to the nearest cent. Project A: \$ Project B: \$ Calculate the IRR of the two projects. Do not round intermediate calculations. Round your answers to two decimal places. Project A: % Project B: % If the two projects are independent and the cost of capital is 9%, which project or projects should the firm undertake? The firm should undertake d. If the two projects are mutually exclusive and the cost of capital is 5%, which project should the firm undertake? The firm should undertake e. If the two projects are mutually exclusive and the cost of capital is 15%, which project should the firm undertake? The firm should undertake f. What is the crossover rate? Round your answer to two decimal places. % g. If the cost of capital is 9%, what is the modified IRR (MIRR) of each project? Do not round intermediate calculations. Round your answers to two decimal places. Project A: % Project B: %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts