Question: please help D Question 3 Questions 13 and 14 are based on the following information: Bono Company recently incurred the following costs: (1) Purchase price

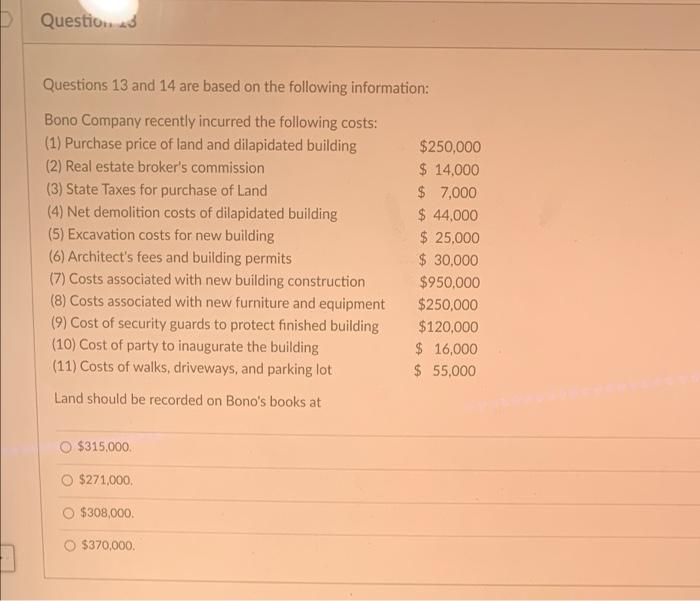

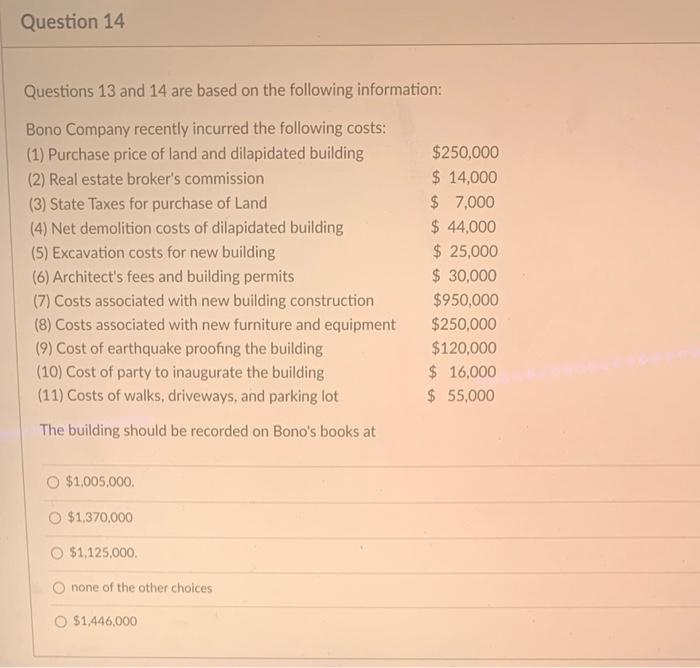

D Question 3 Questions 13 and 14 are based on the following information: Bono Company recently incurred the following costs: (1) Purchase price of land and dilapidated building $250,000 (2) Real estate broker's commission $ 14,000 (3) State Taxes for purchase of Land $ 7,000 (4) Net demolition costs of dilapidated building $ 44,000 (5) Excavation costs for new building $ 25,000 (6) Architect's fees and building permits $ 30,000 (7) Costs associated with new building construction $950,000 (8) Costs associated with new furniture and equipment $250,000 (9) Cost of security guards to protect finished building $120,000 (10) Cost of party to inaugurate the building $ 16,000 (11) Costs of walks, driveways, and parking lot $ 55,000 Land should be recorded on Bono's books at $315.000 $271,000 $308,000 $370,000 Question 14 Questions 13 and 14 are based on the following information: Bono Company recently incurred the following costs: (1) Purchase price of land and dilapidated building (2) Real estate broker's commission (3) State Taxes for purchase of Land (4) Net demolition costs of dilapidated building (5) Excavation costs for new building (6) Architect's fees and building permits (7) Costs associated with new building construction (8) Costs associated with new furniture and equipment (9) Cost of earthquake proofing the building (10) Cost of party to inaugurate the building (11) Costs of walks, driveways, and parking lot The building should be recorded on Bono's books at $250,000 $ 14,000 $ 7,000 $ 44,000 25,000 $ 30,000 $950,000 $250,000 $120,000 $ 16,000 $ 55,000 O $1,005,000 $1,370,000 O $1,125,000 O none of the other choices O $1,446,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts