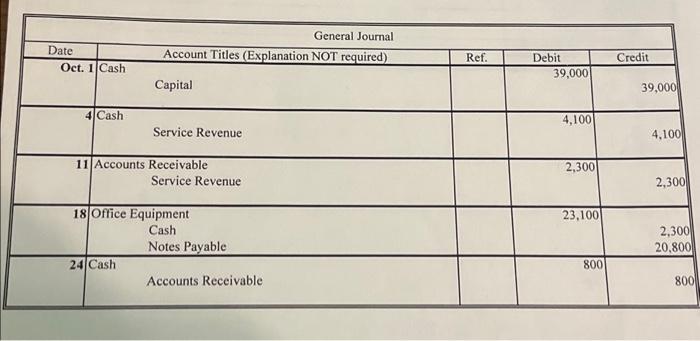

Question: Please help! Date Oct. 1 Cash 4 Cash General Journal Account Titles (Explanation NOT required) Capital Service Revenue 11 Accounts Receivable 24 Cash Service Revenue

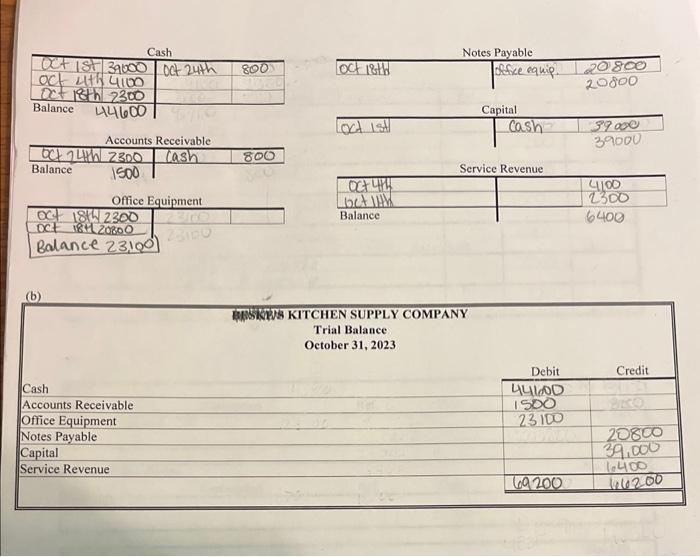

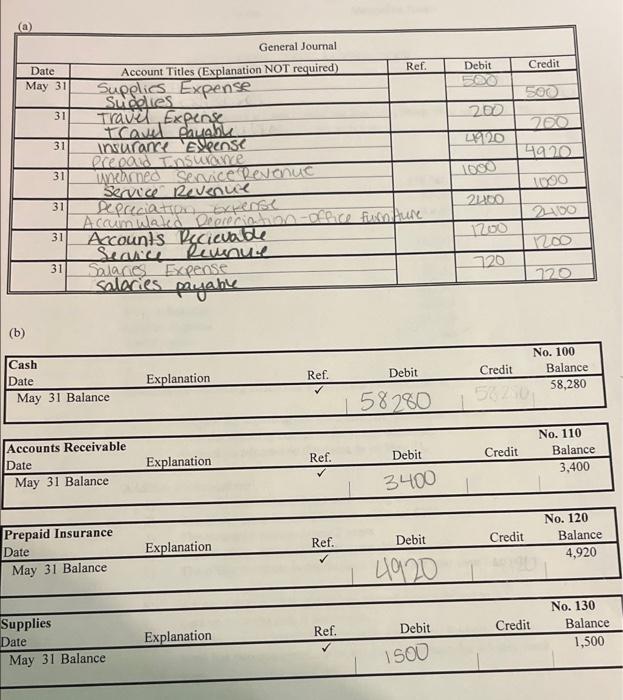

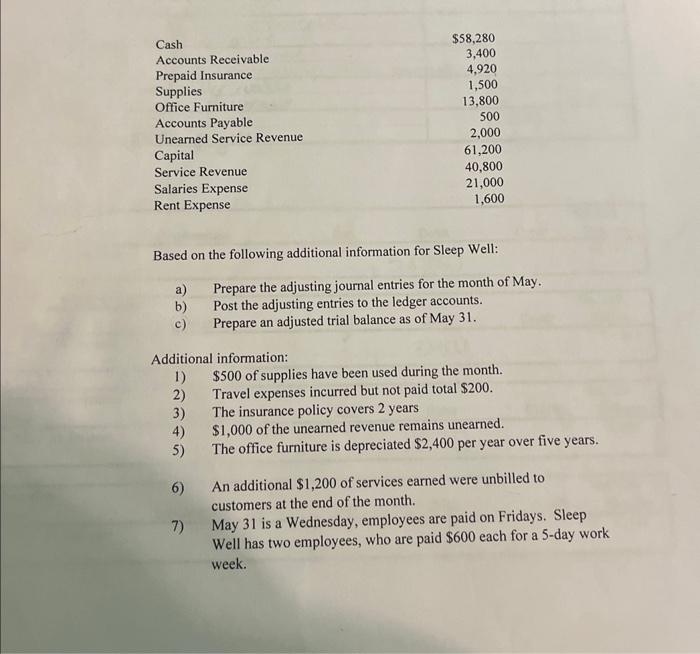

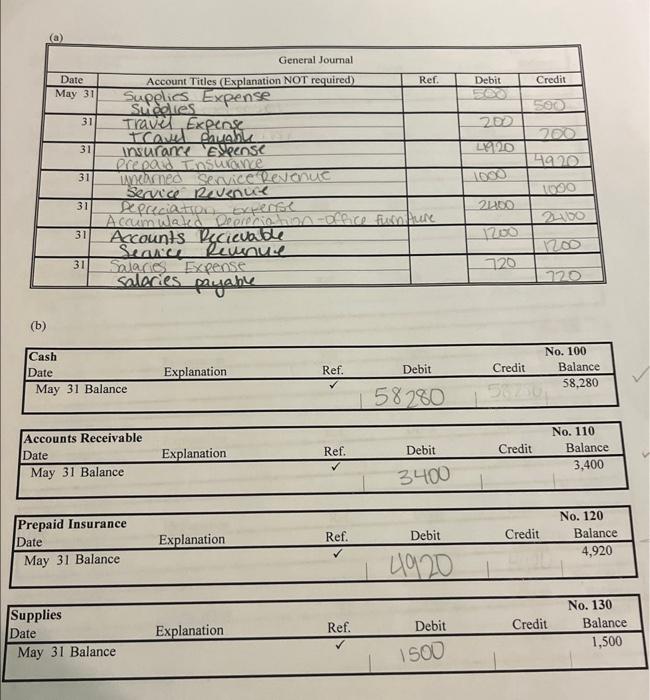

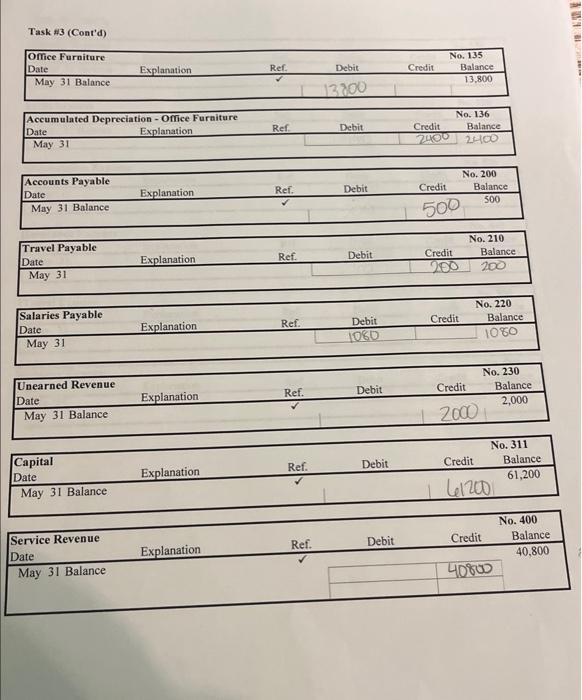

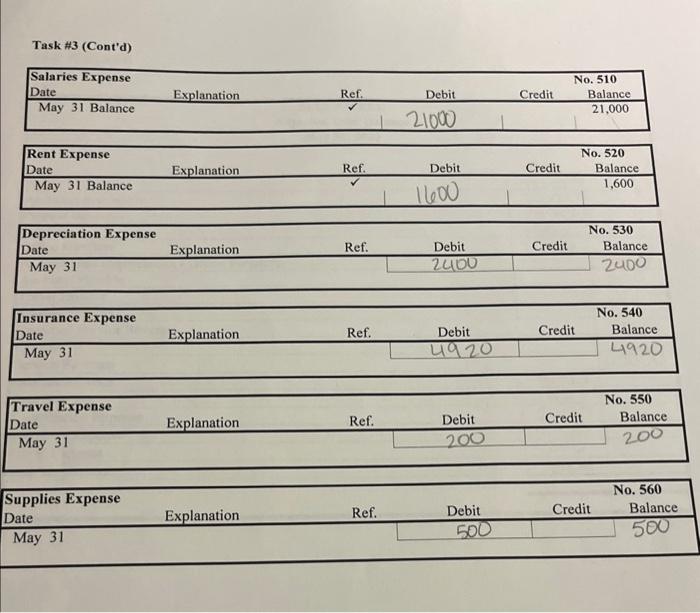

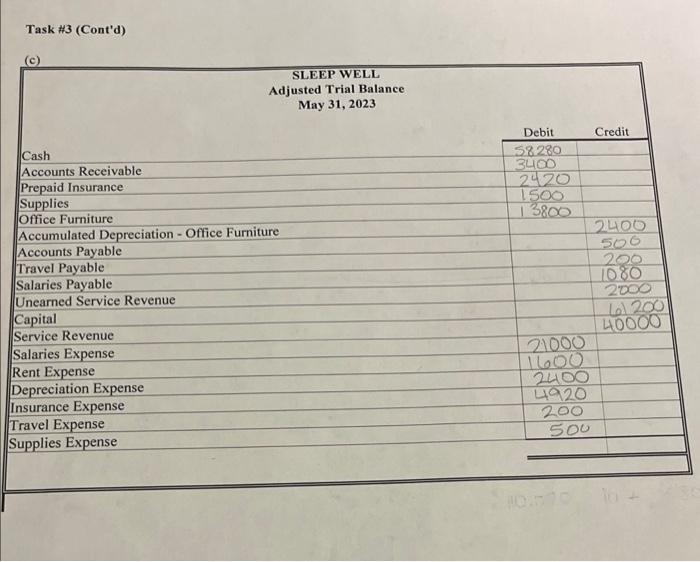

(b) \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ General Journal } \\ \hline Date & Account Titles (Expla & Ref. & Debit & Credit \\ \hline Oct. 1 & Cash Capital & & 39,000 & 39,000 \\ \hline 4 & Cash & & 4,100 & 4,100 \\ \hline 11 & \begin{tabular}{l} Accounts Receivable \\ Service Revenue \end{tabular} & & 2,300 & 2,300 \\ \hline 18 & \begin{tabular}{l} Office Equipment \\ Cash \\ Notes Payable \end{tabular} & & 23,100 & \begin{tabular}{r} 2,300 \\ 20,800 \\ \end{tabular} \\ \hline 24 & Accounts Receivable & & 800 & 800 \\ \hline \end{tabular} Task 13 (Cont'd) Task \#3 (Cont'd) \begin{tabular}{|lrrrrr|} \hline \begin{tabular}{l} Salaries Expense \\ Date \end{tabular} & Explanation & Ref. & Debit & Credit & No. 510 \\ \hline May 31 Balance & & & 21000 & & 21,000 \\ \hline \end{tabular} \begin{tabular}{|lccccc|} \hline \begin{tabular}{l} Rent Expense \\ Date \end{tabular} & Explanation & Ref. & Debit & Credit & \begin{tabular}{c} No. 520 \\ Balance \end{tabular} \\ \hline May 31 Balance & & & 1600 & & 1,600 \\ \hline \end{tabular} \begin{tabular}{|llllll|} \hline \begin{tabular}{l} Depreciation Expense \\ Date \end{tabular} & Explanation & Ref. & Debit & Credit & \begin{tabular}{c} No. 530 \\ Balance \end{tabular} \\ \hline May 31 & & 2400 & & 2400 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline Insurance Expense & & & & & 0.540 \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline May 31 & & & 4920 & & 4920 \\ \hline \end{tabular} \begin{tabular}{|llcccc|} \hline \begin{tabular}{l} Travel Expense \\ Date \end{tabular} & Explanation & Ref. & Debit & Credit & \begin{tabular}{c} No. 550 \\ Balance \end{tabular} \\ \hline May 31 & & 200 & & 200 \\ \hline \end{tabular} (b) \begin{tabular}{|c|c|c|} \hline & ash & \\ \hline \begin{tabular}{l} ot ist 39000 \\ oct 4 th 4100 \\ oct isth 2300 \end{tabular} & Oct 24 th & 800 \\ \hline 44600 & & \\ \hline \end{tabular} Notes Payable \begin{tabular}{|c|c|c|} \hline OC+ 18+b & office equip. & \begin{tabular}{l} 20800 \\ 20800 \end{tabular} \\ \hline \multicolumn{3}{|c|}{ Capital } \\ \hline OCt ist & cash & \begin{tabular}{l} 39000 \\ 39000 \end{tabular} \\ \hline \end{tabular} Accounts Receivable \begin{tabular}{|l|l|l|} \hline Oct 24h 2300 & Cash & 800 \\ \hline Balance & 1500 & \end{tabular} Service Revenue \begin{tabular}{|l|c|} \hline oct 4h & 4100 \\ \hline bet 11h & 2300 \\ \hline Balance & 6400 \\ \hline \end{tabular} \begin{tabular}{l} Office Eq \\ Oct 18 ht 2300 \\ oct 18420800 \\ Balance 23.100 \\ \hline \end{tabular} (b) Task #3 (Cont'd) \begin{tabular}{|c|c|c|} \hline & ash & \\ \hline \begin{tabular}{l} ot ist 39000 \\ oct 4 th 4100 \\ oct isth 2300 \end{tabular} & Oct 24 th & 800 \\ \hline 44600 & & \\ \hline \end{tabular} Notes Payable \begin{tabular}{|c|c|c|} \hline OC+ 18+b & office equip. & \begin{tabular}{l} 20800 \\ 20800 \end{tabular} \\ \hline \multicolumn{3}{|c|}{ Capital } \\ \hline OCt ist & cash & \begin{tabular}{l} 39000 \\ 39000 \end{tabular} \\ \hline \end{tabular} Accounts Receivable \begin{tabular}{|l|l|l|} \hline Oct 24h 2300 & Cash & 800 \\ \hline Balance & 1500 & \end{tabular} Service Revenue \begin{tabular}{|l|c|} \hline oct 4h & 4100 \\ \hline bet 11h & 2300 \\ \hline Balance & 6400 \\ \hline \end{tabular} \begin{tabular}{l} Office Eq \\ Oct 18 ht 2300 \\ oct 18420800 \\ Balance 23.100 \\ \hline \end{tabular} (b) (b) \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ General Journal } \\ \hline Date & Account Titles (Expla & Ref. & Debit & Credit \\ \hline Oct. 1 & Cash Capital & & 39,000 & 39,000 \\ \hline 4 & Cash & & 4,100 & 4,100 \\ \hline 11 & \begin{tabular}{l} Accounts Receivable \\ Service Revenue \end{tabular} & & 2,300 & 2,300 \\ \hline 18 & \begin{tabular}{l} Office Equipment \\ Cash \\ Notes Payable \end{tabular} & & 23,100 & \begin{tabular}{r} 2,300 \\ 20,800 \\ \end{tabular} \\ \hline 24 & Accounts Receivable & & 800 & 800 \\ \hline \end{tabular} Based on the following additional information for Sleep Well: a) Prepare the adjusting journal entries for the month of May. b) Post the adjusting entries to the ledger accounts. c) Prepare an adjusted trial balance as of May 31 . Additional information: 1) $500 of supplies have been used during the month. 2) Travel expenses incurred but not paid total $200. 3) The insurance policy covers 2 years 4) $1,000 of the unearned revenue remains unearned. 5) The office furniture is depreciated $2,400 per year over five years. 6) An additional $1,200 of services earned were unbilled to customers at the end of the month. 7) May 31 is a Wednesday, employees are paid on Fridays. Sleep Well has two employees, who are paid $600 each for a 5-day work week

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts