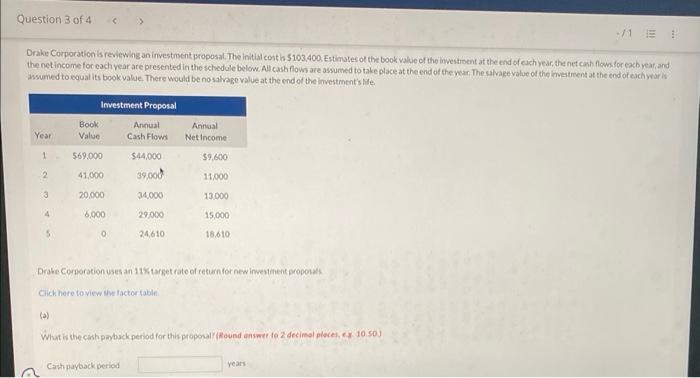

Question: Please help, DO NOT do it if you don't. Thanks Drake Corporation Ls revewng an investment proposal. The initial cost is $103,400. Estimates of thi

Drake Corporation Ls revewng an investment proposal. The initial cost is $103,400. Estimates of thi book valke of the investroent at the end of esch year, the net cash flows for eacb year, and the net income for each vear are presented in the schedule below. All cash flows are assumed to take place at the end of the wear. The alvagevalue of the ineatment at the end of each year iv issumed to equal its book value. There would be nosaliasevalue at the end of the linestment's ire Drahe Comoration uses an 111 arget rate of resurn for new ivestent propouds Cilick here to view tive factor fablel. (a) years What ks the annual rate of return for the investment? (Round answer to 2 decimal ploces, e.g. 10.50% ) Arnual rate of return foe the invesfinent (c) What is the net present value of the investment? tif the net present value it negative; use either a negotive sign preceding the number e s. -45 of porentheier er (45) Rownd anower th O decimal places, es. 125. For calculation purposes, ue 5 decimal ploces as displayed in the factor table provided. Net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts