Question: please help! due soon Problem 1: On March 1, St. Patty sold to an Irish leprechaun a large four-leaf clover for $20,000 to be displayed

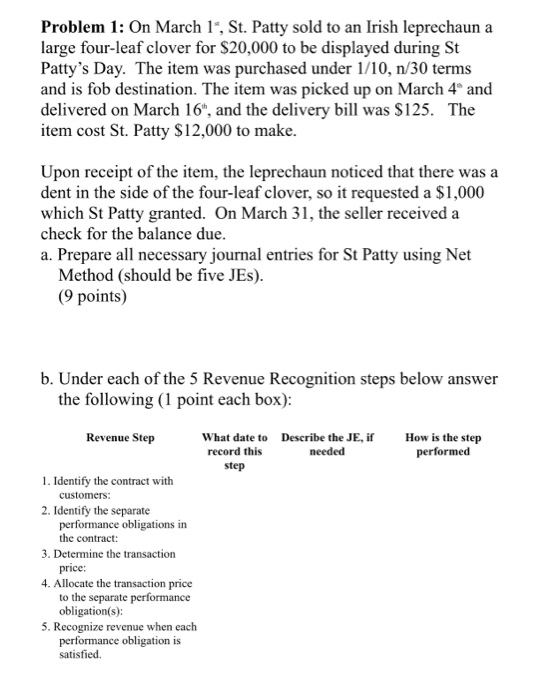

Problem 1: On March 1, St. Patty sold to an Irish leprechaun a large four-leaf clover for $20,000 to be displayed during St Patty's Day. The item was purchased under 1/10, n/30 terms and is fob destination. The item was picked up on March 4 and delivered on March 16, and the delivery bill was $125. The item cost St. Patty S12,000 to make. Upon receipt of the item, the leprechaun noticed that there was a dent in the side of the four-leaf clover, so it requested a $1,000 which St Patty granted. On March 31, the seller received a check for the balance due. a. Prepare all necessary journal entries for St Patty using Net Method (should be five JEs). (9 points) b. Under each of the 5 Revenue Recognition steps below answer the following (1 point each box): Describe the JE, if needed How is the step performed Revenue Step What date to record this step 1. Identify the contract with customers: 2. Identify the separate performance obligations in the contract: 3. Determine the transaction price: 4. Allocate the transaction price to the separate performance obligation(s): 5. Recognize revenue when each performance obligation is satisfied

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts