Question: Please Help!!! EQuestion Help Easy Espresso purchased a coffee drink machine on January 1, 2018, for $34.000. Expected usefu ife is 10 years or 50.000

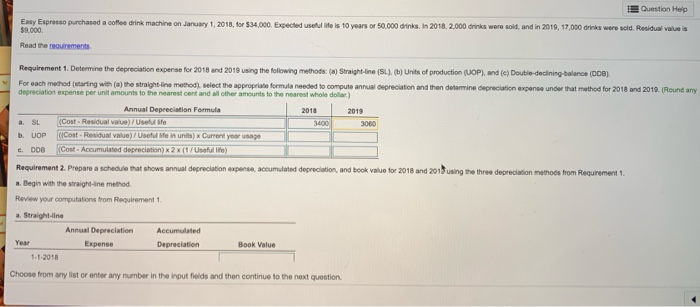

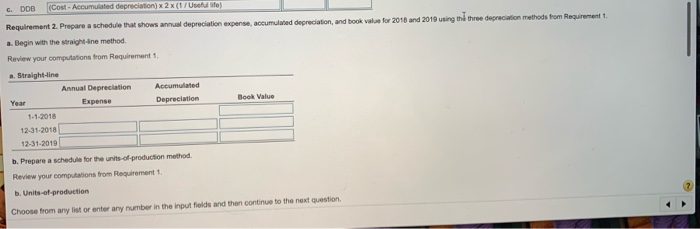

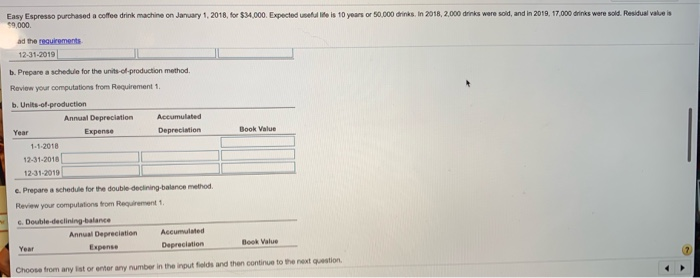

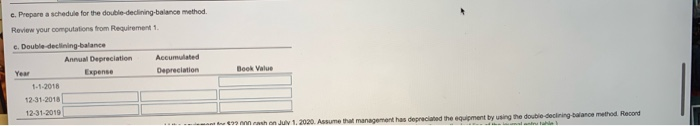

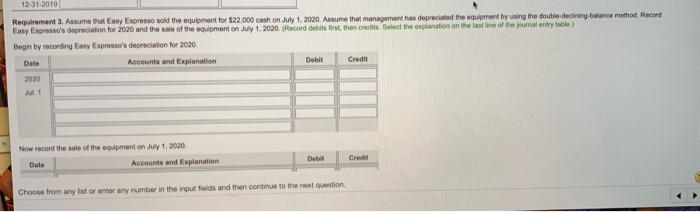

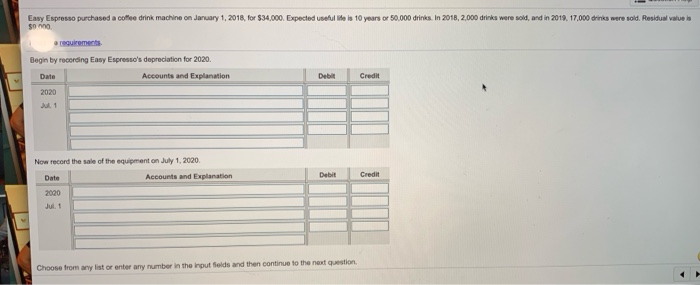

EQuestion Help Easy Espresso purchased a coffee drink machine on January 1, 2018, for $34.000. Expected usefu ife is 10 years or 50.000 drinks, In 2018, 2,000 drinks were sold, and in 2019, 17,000 drinks were sold. Residual value is $9.000 Read the requirements Requirement 1. Determine the depreciation expense for 2018 and 2019 using the folowing methods: (a) Straight-ine (SL). (b) Units of production (UOP), and (e) Double-declining-balance (DDB) For each method (starting with (a) the straight-line method), select the appropriate formula needed to compute annual depreciation and then detemine depreciation expense under that mathod for 2018 and 2019. (Round any depreciation expense per unit amounts to the nearest cent and all other amounts to the nearest whole dollar) Annual Depreciation Formula 2018 2013 (Cost- Residual value)/ Uselul ife SL 3400 3060 (ICost-Residual value)/ Useful Me in units) x Current year usage b. UOP Cost- Accumulated depreciation) x2x (1/Useful lfe) e. DDB Requirement 2. Prepare a schedule that shows annual depreciation expense, accumulated depreciation, and book value for 2018 and 201 using the three depreciation methods from Requirement 1 a. Begin with the straight-ine method Review your computations from Requirement 1 a. Straight-line Annual Depreciation Accumulated Year Expense Depreciation Book Value 1-1-2018 Choose from any list or enter any number in the input fields and then continue to the next question. (Cost- Acoumulated depreciation) x 2 x (1/Useful life) DDB Requirement 2. Prepare a schedule that shows annual depreciation expense, accumulated depreciation, and book valae for 2018 and 2019 using thi three depreciation methods from Requirement 1 a. Begin with the straightine method. Review your computations from Requirement 1. a. Straight-line Annual Depreciation Accumulated Year Depreciation Book Value Expense 1-1-2018 12-31-2018 12-31-2019 b. Prepare a schedule for the units-of-production method Review your computations from Requirement 1 b. Units-of-production Choose from any list or enter any number in the input fields and then continue to the next question. Easy Espresso purchased a coffee drink machine on January 1, 2018, for $34.000. Expected useful life is 10 vears or 50.000 drinks. In 2018, 2,000 drinks were sold, and in 2019, 17.000 drinks were sold. Residual value is 9,000 ad the requirements 12-31-2019 b. Prepare a schedule for the units-of-production method Review your computations from Requirement 1. b. Units-of-production Accumulated Annual Depreciation Book Valuer Depreciation xpense Year 1-1-2018 12-31-2018 12-31-2019 . Prepare a schedule for the double-decining-balance method. Review your computations from Requirement 1 c. Double-declining-balance Accumulated Annual Depreciation Book Value Depreciation Expense Year Choose from any ist or entor any number in the input fiolds and then continue to the next question, e. Prepare a schedule for the double-declining-balance method. Review your computations from Requirement 1 c. Double-declining-balance Annual Depreciation Accumulated Book Value Depreciation Year Expense 1-1-2018 12-31-2018 12-31-2019 99 000 cash on July 1, 2020, Assume that management has depreciated the equinment by using the double-decining-balance method Record e d etre table 12-31-2019 Requirement 3. Assume that Easy Espresso sold the equipment for $22,000 cash on July 1, 2020. Assume that management has depreciated the equipment by using the double-declining-balance method. Recond Easy Espresso's depreciation for 2020 and the sale of the equipment on July 1, 2020, (Record debits first, then credits. Select the explanation on the last ine of the joumal entry table) Begin by recording Easy Espresso's depreciation for 2020. Credit Debit Accounts and Explanation Date 2020 Jul 1 Now record the sale of the equipment on July 1, 2020 Debi Credit Accounts and Explanation Date Choose from any ist or entor any number in the input felds and then continue to the next question. Easy Espresso purchased a cofee drink machine on January 1, 2018, for $34,000. Expected useful life is 10 years or 50,000 drinks. In 2018, 2,000 drinks were sold, and in 2019, 17,000 drinks were sold. Residual value is $o nno a requirements Begin by recording Easy Espresso's depreciation for 2020. Accounts and Explanation Debit Credit Date 2020 Jul 1 Now record the sale of the equipment on July 1, 2020. Credit Accounts andExplanation Debit Date 2020 Jul. 1 Choose from any list or enter any number in the input Selds and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts