Question: Please help! Exercise 6-19A (Algo) Computing and recording the amortization of intangibles LO 6-9, 6-10 Dynamo Manufacturing paid cash to acquire the assets of an

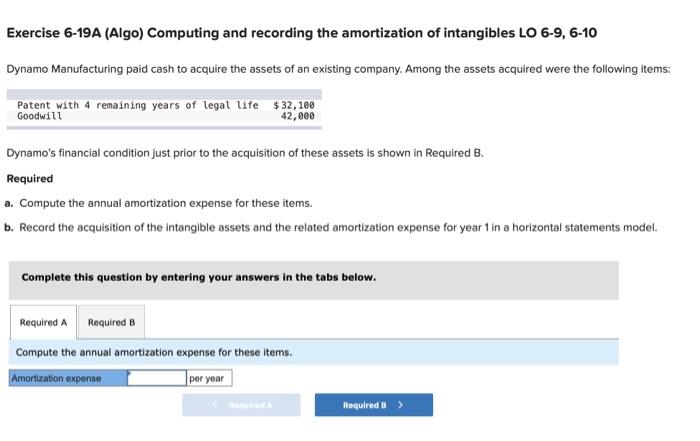

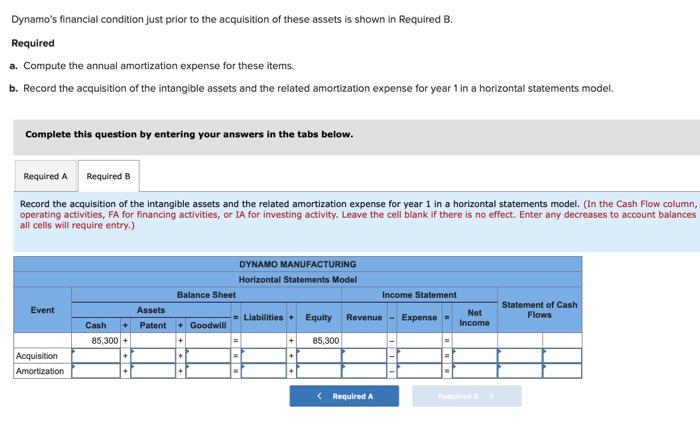

Exercise 6-19A (Algo) Computing and recording the amortization of intangibles LO 6-9, 6-10 Dynamo Manufacturing paid cash to acquire the assets of an existing company. Among the assets acquired were the following items: Patent with 4 remaining years of legal life $ 32, 100 Goodwill 42,000 Dynamo's financial condition just prior to the acquisition of these assets is shown in Required B. Required a. Compute the annual amortization expense for these items. b. Record the acquisition of the intangible assets and the related amortization expense for year 1 in a horizontal statements model. Complete this question by entering your answers in the tabs below. Required A Required B Compute the annual amortization expense for these items. Amortization expense per year Required 8 > Dynamo's financial condition just prior to the acquisition of these assets is shown in Required B. Required a. Compute the annual amortization expense for these items. b. Record the acquisition of the intangible assets and the related amortization expense for year 1 in a horizontal statements model Complete this question by entering your answers in the tabs below. Required A Required B Record the acquisition of the intangible assets and the related amortization expense for year 1 in a horizontal statements model. (In the Cash Flow column, operating activities, FA for financing activities, or IA for investing activity. Leave the cell blank if there is no effect. Enter any decreases to account balances all cells will require entry) DYNAMO MANUFACTURING Horizontal Statements Model Balance Sheet Income Statement Net Liabilities + Equity Revenue Expense + Goodwill Income 85,300 Event Assets Patent Statement of Cash Flows Cash 85,300+ Acquisition Amortization ++ .

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts