Question: Please help explain CAPSIM Round 1 E Resea Development Products Perceptual Map 0 Able 0 Acre 0 Adam 0 Aft O Agape O 0 New

Please help explain CAPSIM Round 1

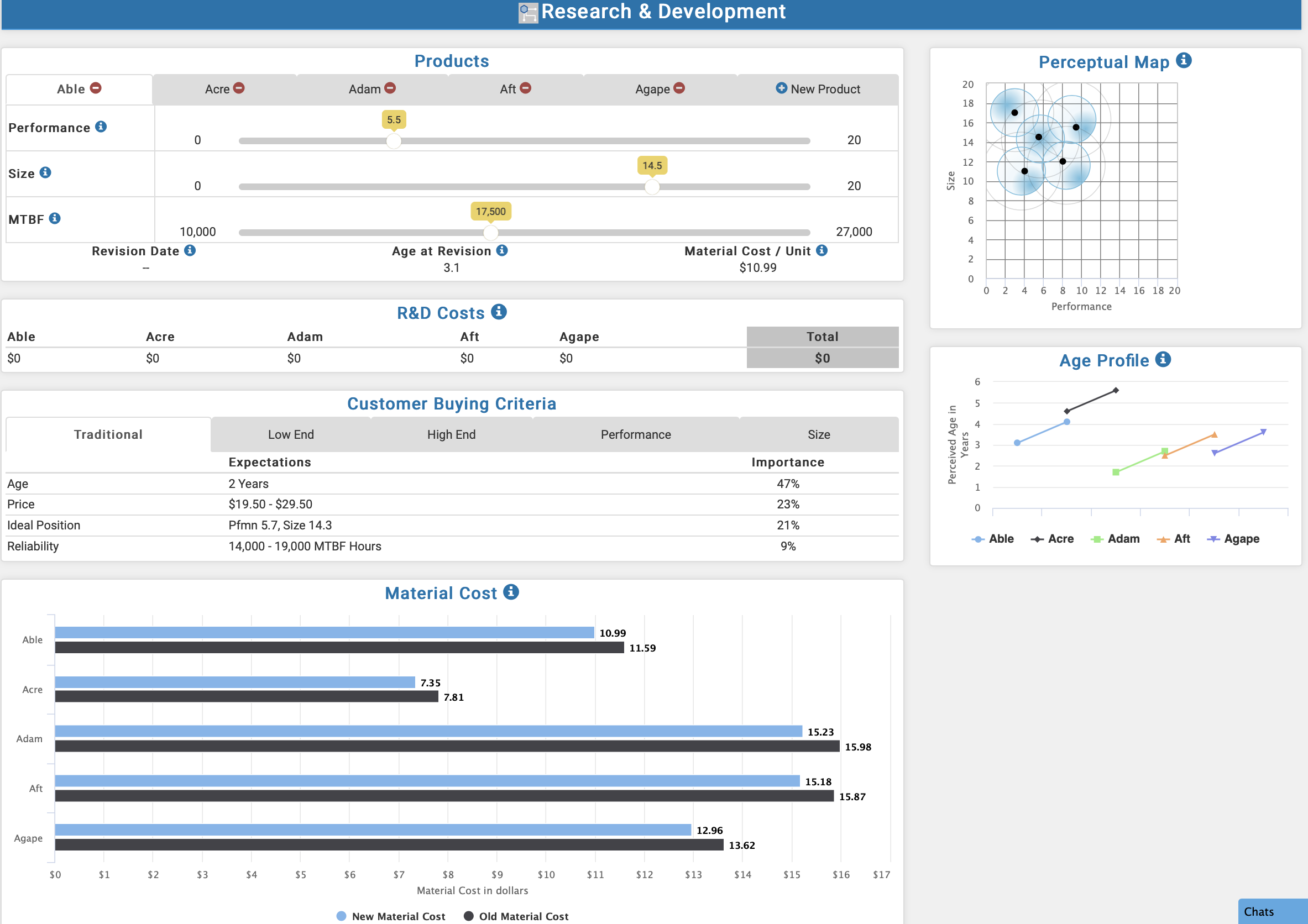

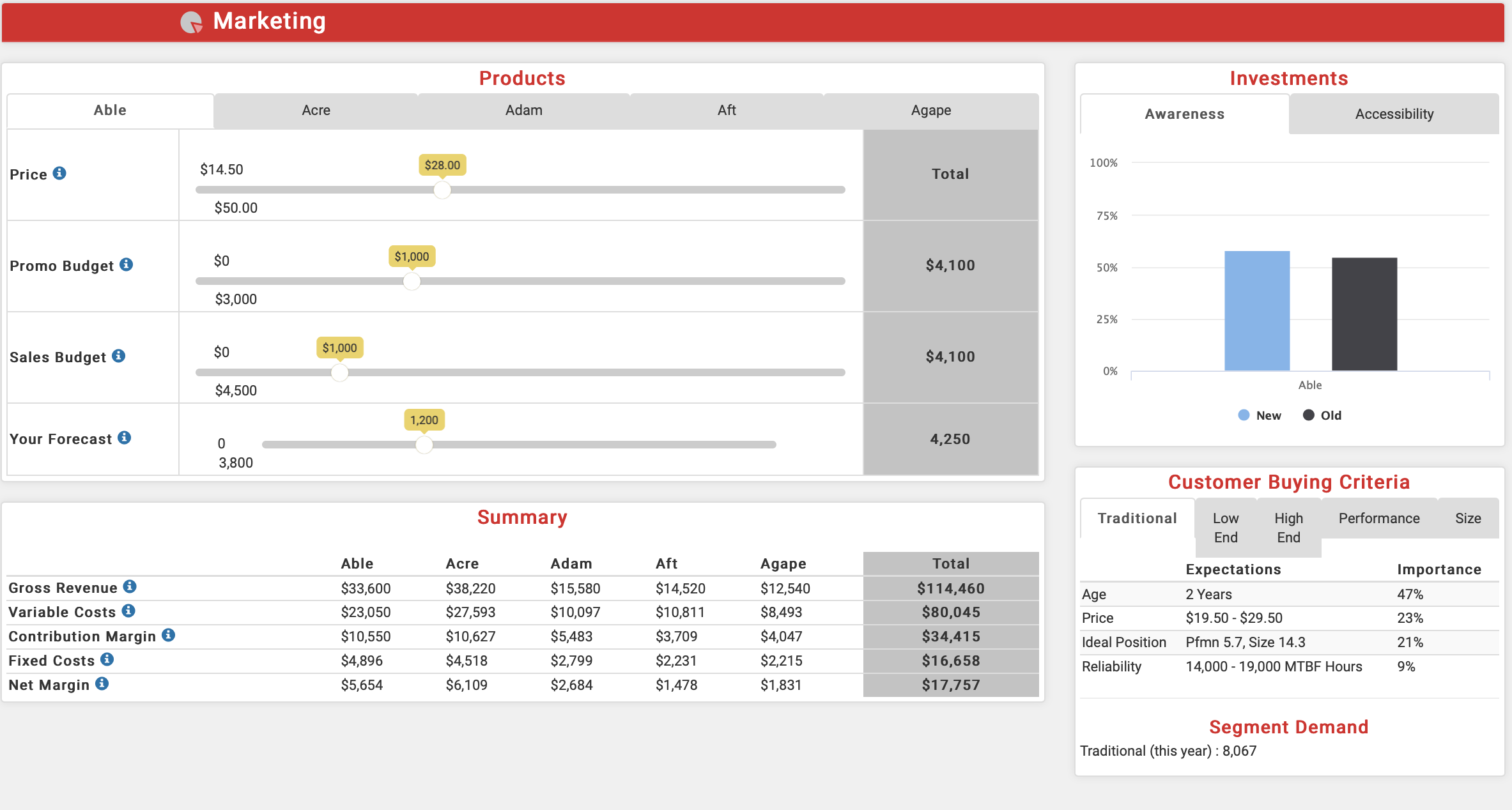

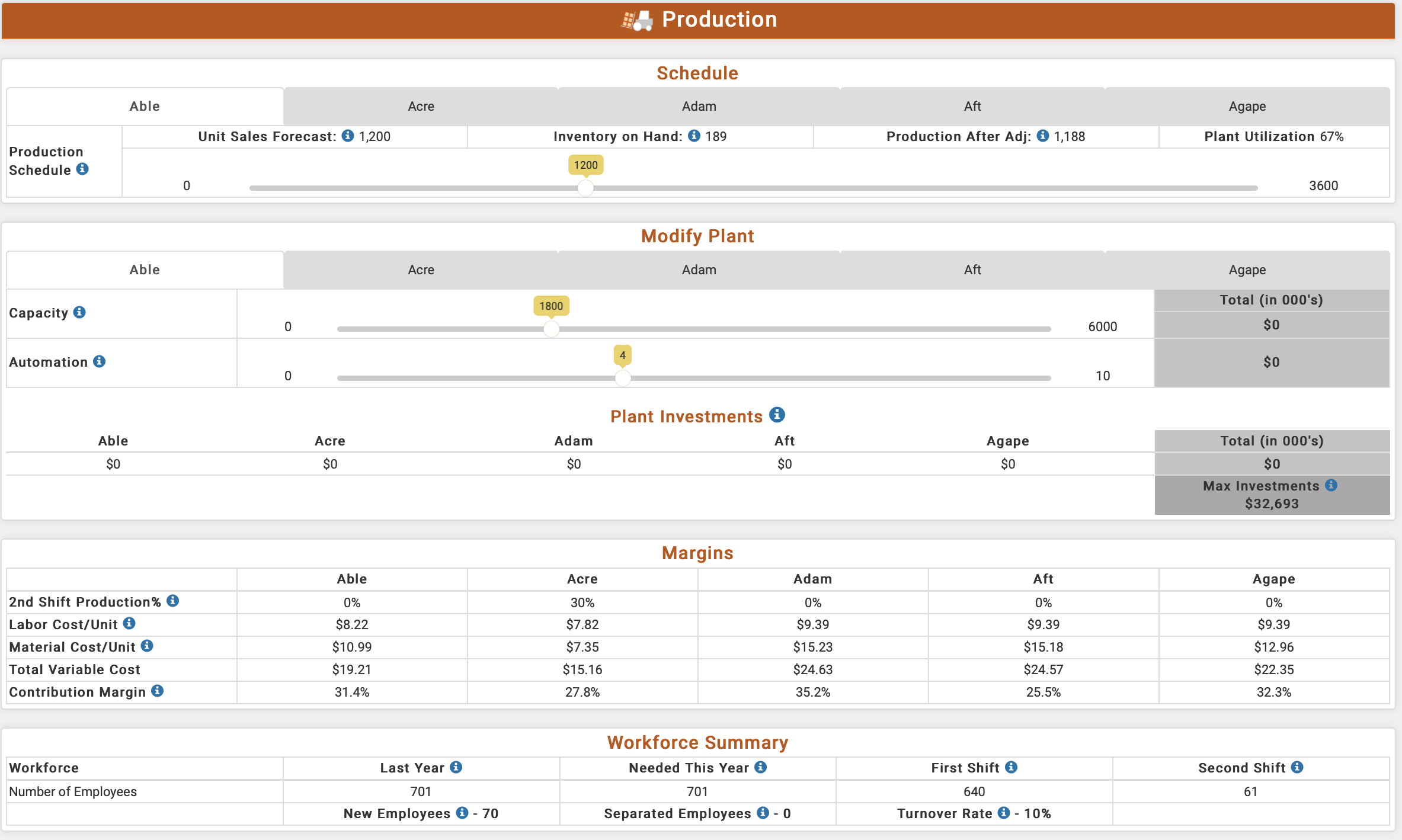

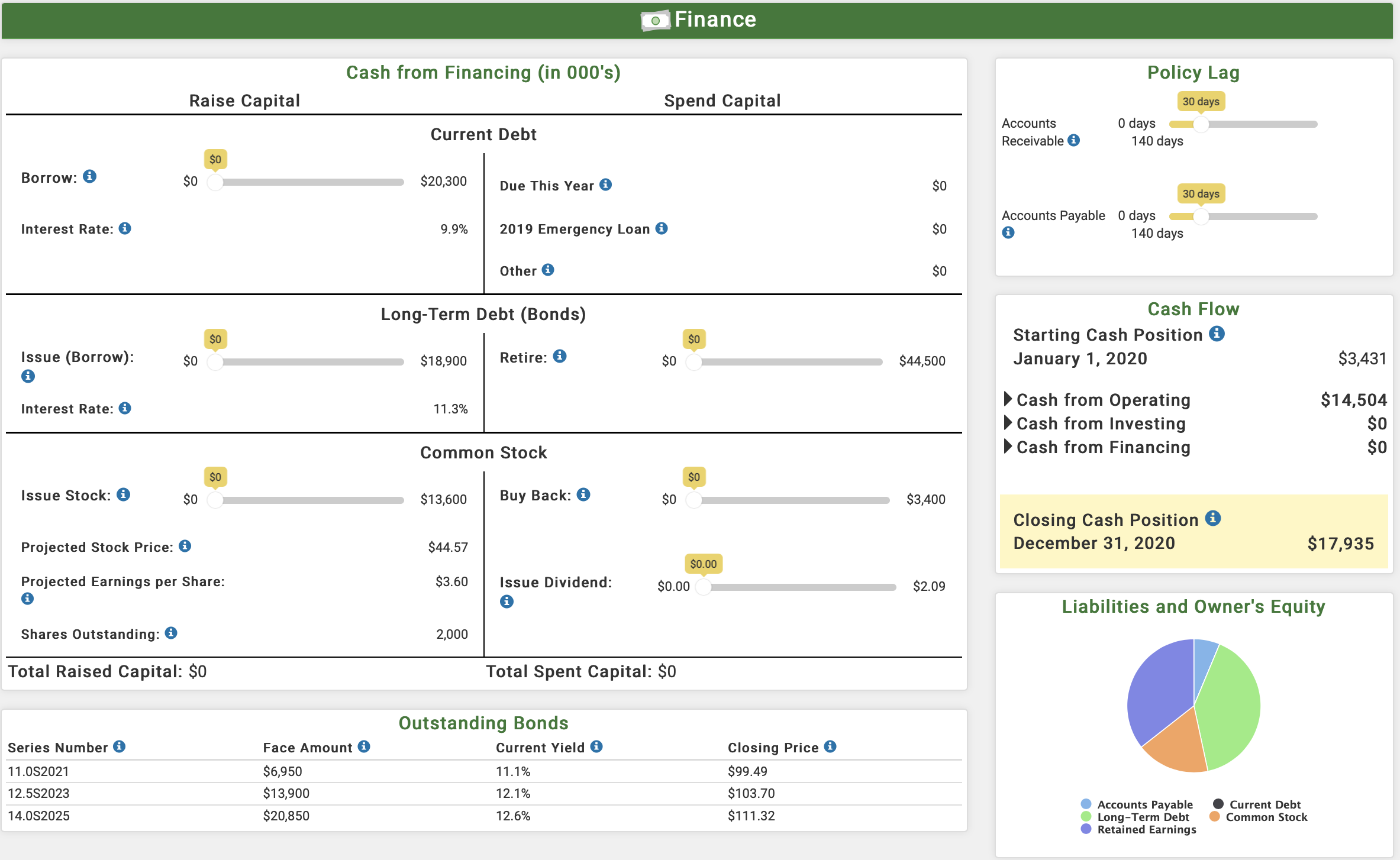

E Resea Development Products Perceptual Map 0 Able 0 Acre 0 Adam 0 Aft O Agape O 0 New Product 2 A A i 18 ( 9/ 5.5 l 16 Performance 0 0 20 14 \\l' 12 o ' Size 0 PE 3 10 l '9' 0 20 \\_ ; , 8 MTBF 0 17.5w 6 10,000 27.000 4 Revision Date 0 Age at Revision 9 Material Cost / Unit 0 2 - 3.1 $10.99 0 o 2 4 s 3 101214161820 R&D Costs 0 Performance Able Acre Adam Aft Agape So so so so so Age Prole 9 Customer Buying Criteria = 0 Traditional Low End High End Performance Size f: g : / // Expectations Importance 5 g 2 7// Age 2Years 47% 1 L Price $19.50 - 329050 23% 0 Ideal Position men 57, Size 143 21% Reliability 14,000 - 19,000 MTBF Hours 9% * Ame *' Am 'L' \"m * A" 'F \"9"\" Material Cost 0 Able Acre Adam . An 15 1a Agape 50 $1 32 33 S4 IS 36 17 $8 19 $10 $11 112 313 114 $15 316 317 Material Cost in dollars . New Material Cost . Old Material Cost - ,, , VProdurcts Agape Able Acre Adam Price 0 314-50 - $50.00 Promo Budget 0 $0 - $3.000 Sales Budget 0 $0 - $4,500 Y'" Forecast 9 D 3,800 Summary Able Acre Adam Aft Agape Gross Revenue 8 $33,600 $38,220 $15,580 $14,520 $12,540 Variable Costs 0 $23,050 $27,593 $10,097 $10,811 $8,493 Contribution Margin 0 $10,550 $10,627 $5,483 $3,709 $4,047 Fixed costs 0 $4,896 $4,518 $2,799 32,231 32215 Net Margin 0 $5,654 $6,109 $2,684 $1,478 $1,831 Investments Awareness Accessibility 100% ' 75% 50% 25% 0% Able 0 New 0 Old Customer Buying Criteria Traditional 1 Law High Perfermance Size End End Expectations 7 Impedance ' Age 2 Years 47% Price $19.50 - $29.50 23% 1 Ideal Position men 5.7, Size 14.3 21% 1 Reliability 14.000 -19,000 MTBF Hours 9% Segment Demand Traditional (this year) : 8,067 Produ tion Able Production Schedule 0 Able capacity 0 Automation 0 Able 30 2nd Shift Production?' 0 Labor Cost/Unit 0 Material Cost/Unit 0 Total Variable Cost Contribution Margin e Workforce Number of Employees Unit Sales Forecast: 6 1,200 Schedule Acre Adam Inventory on Hand: 0 189 Aft Production After Adj: 0 1,188 Modify Plant Acre Adam A Plant Investments 0 Acre Adam Aft Agape $0 30 $0 $0 Margins Able Acre Adam Aft 0% 30% 0% 0% $822 $7.82 $9.39 $939 $10.99 $7.35 31523 $15.18 $19.21 $15.16 32463 $24.57 31 .4% 27.8% 35.2% 25,596 Workforce Summary Last Year 0 Needed This Year 0 First shift 0 701 701 640 New Employees 0 - 70 Separated Employees 0 - 0 Turnover Rate 9 - 1 0% Agape Plant Utilization 67% 3600 6000 10 Agape 0% $9.39 $12.96 $22.35 32.3% Second Shift 6 61 Finance Raise Capital Borrow: 0 30 Interest Rate: 0 Issue (Borrow): $0 0 Interest Rate: 0 30 Issue Stock: 0 $0 Projected Stock Price: 0 Projected Earnings per Share: Shares Outstanding: 0 1 $20,300 1+ $18,900 1 $13,600 Cash from Financing (in 000's) Spend Capital Current Debt Due This Year 0 9.9% 2019 Emergency Loan 0 Other 0 Long-Term Debt (Bonds) Retire: 0 SD 113% Common Stock Buy Back: 0 $0 $44.57 $3.60 Issue Dividend: $0.00 9 2,000 $0 $0 $0 . $44,500 Total Raised Capital: $0 Series Number 0 11.032021 12.582023 14.082025 Face Amount 0 $6,950 $1 3,900 $20,850 Total Spent Capital: $0 Outstanding Bonds Current Yield 0 11.1% 12.1% 12.6% Closing Price 0 $99.49 $103.70 $111.32 Policy Lag 30m Accounts 0 days &. ., , Receivable 0 140 days 30% Accounts Payable 0 days 1 9 140 days Cash Flow Starting Cash Position 0 January 1, 2020 $3,431 > Cash from Operating $14,504 > Cash from Investing $0 D Cash from Financing $0 Closing Cash Position 0 December 31, 2020 $17,935 Liabilities and Owner's Equity 7 . Accounts Payable . Current Debt LongTerm Debt 0 Common Stock . Retained Earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts