Question: Please help explain part B. I got 1.30 million for $1115 and $1195 which is correct but for some reason it is incorrect for the

Please help explain part B. I got 1.30 million for $1115 and $1195 which is correct but for some reason it is incorrect for the $1275. I've got several wrong answers and explanation on chegg so please solve only if you understand it, thanks.

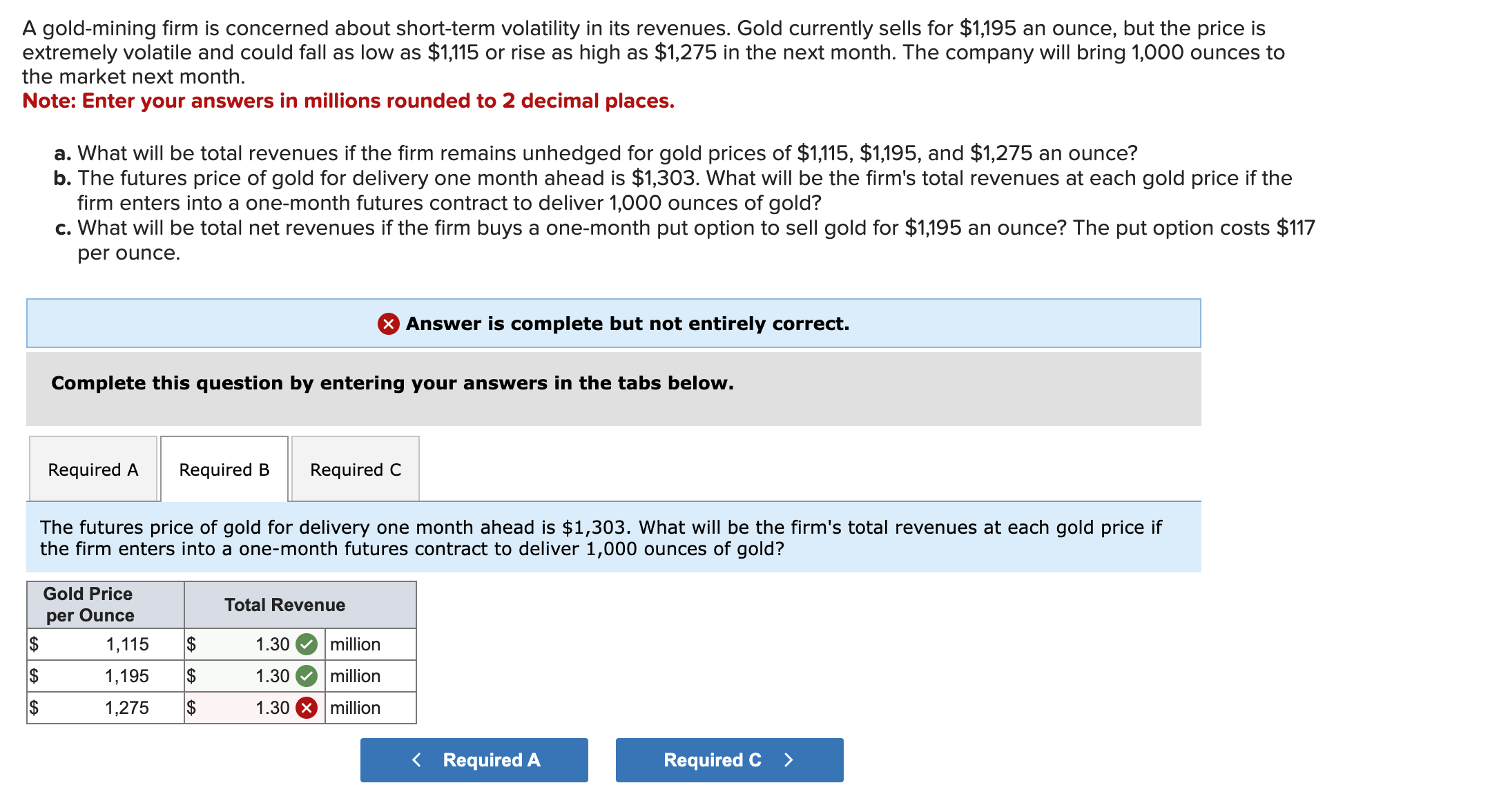

A gold-mining firm is concerned about short-term volatility in its revenues. Gold currently sells for $1,195 an ounce, but the price is extremely volatile and could fall as low as $1,115 or rise as high as $1,275 in the next month. The company will bring 1,000 ounces to the market next month. Note: Enter your answers in millions rounded to 2 decimal places. a. What will be total revenues if the firm remains unhedged for gold prices of $1,115,$1,195, and $1,275 an ounce? b. The futures price of gold for delivery one month ahead is $1,303. What will be the firm's total revenues at each gold price if the firm enters into a one-month futures contract to deliver 1,000 ounces of gold? c. What will be total net revenues if the firm buys a one-month put option to sell gold for $1,195 an ounce? The put option costs $11 per ounce. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. The futures price of gold for delivery one month ahead is $1,303. What will be the firm's total revenues at each gold price if the firm enters into a one-month futures contract to deliver 1,000 ounces of gold? A gold-mining firm is concerned about short-term volatility in its revenues. Gold currently sells for $1,195 an ounce, but the price is extremely volatile and could fall as low as $1,115 or rise as high as $1,275 in the next month. The company will bring 1,000 ounces to the market next month. Note: Enter your answers in millions rounded to 2 decimal places. a. What will be total revenues if the firm remains unhedged for gold prices of $1,115,$1,195, and $1,275 an ounce? b. The futures price of gold for delivery one month ahead is $1,303. What will be the firm's total revenues at each gold price if the firm enters into a one-month futures contract to deliver 1,000 ounces of gold? c. What will be total net revenues if the firm buys a one-month put option to sell gold for $1,195 an ounce? The put option costs $11 per ounce. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. The futures price of gold for delivery one month ahead is $1,303. What will be the firm's total revenues at each gold price if the firm enters into a one-month futures contract to deliver 1,000 ounces of gold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts