Question: Please help explain why the standard deduction is $12,000 in the equation but the problem says $12,400? I don't get where the $400 went Ch

Please help explain why the standard deduction is $12,000 in the equation but the problem says $12,400? I don't get where the $400 went

Please help explain why the standard deduction is $12,000 in the equation but the problem says $12,400? I don't get where the $400 went

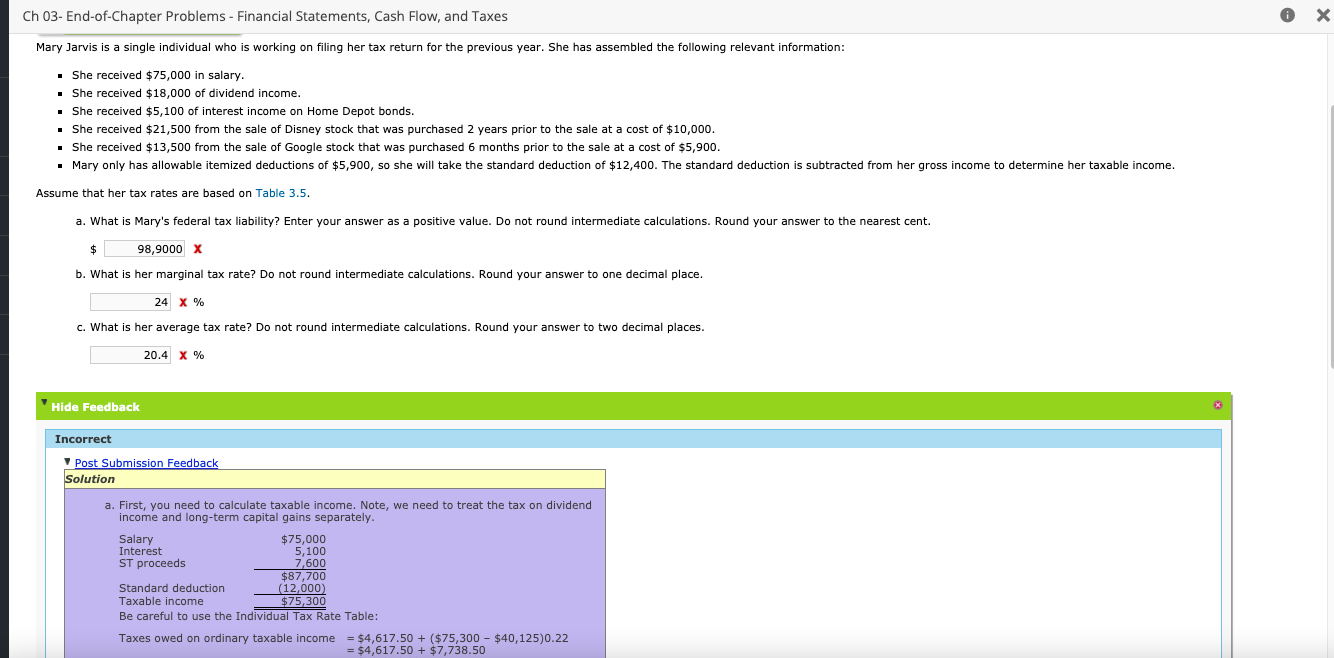

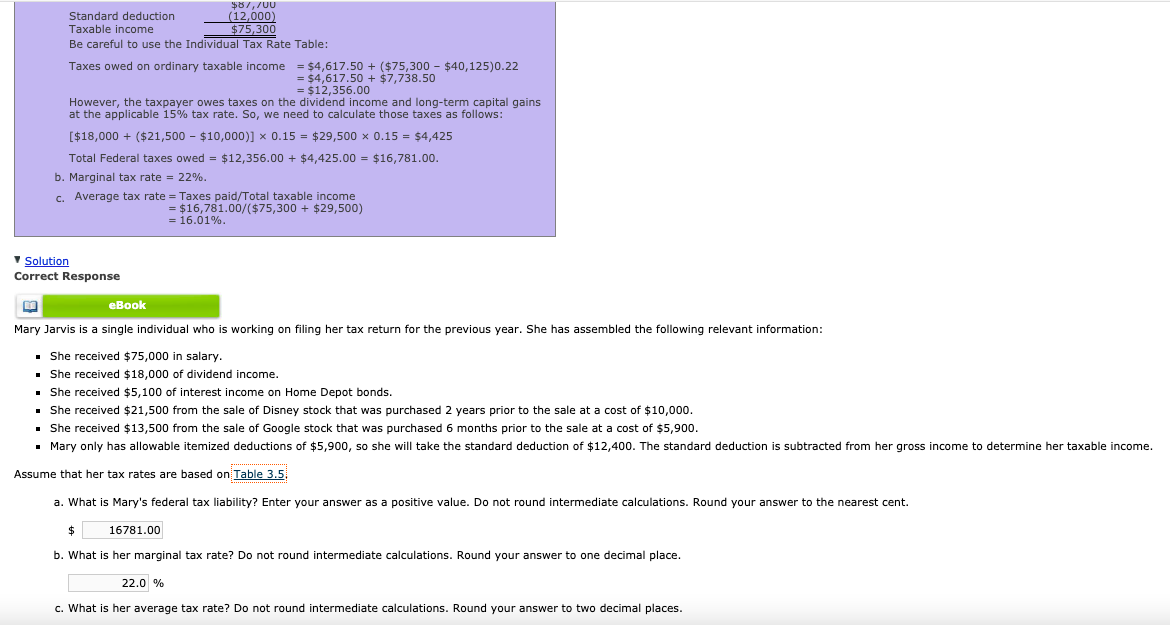

Ch 03- End-of-Chapter Problems - Financial Statements, Cash Flow, and Taxes x Mary Jarvis is a single individual who is working on filing her tax return for the previous year. She has assembled the following relevant information: She received $75,000 in salary. . She received $18,000 of dividend income. She received $5,100 of interest income on Home Depot bonds. She received $21,500 from the sale of Disney stock that was purchased 2 years prior to the sale at a cost of $10,000. She received $13,500 from the sale of Google stock that was purchased 6 months prior to the sale at a cost of $5,900. Mary only has allowable itemized deductions of $5,900, so she will take the standard deduction of $12,400. The standard deduction is subtracted from her gross income to determine her taxable income. Assume that her tax rates are based on Table 3.5. a. What is Mary's federal tax liability? Enter your answer as a positive value. Do not round intermediate calculations. Round your answer to the nearest cent. $ 98,9000 x b. What is her marginal tax rate? Do not round intermediate calculations. Round your answer to one decimal place. 24 x % C. What is her average tax rate? Do not round intermediate calculations. Round your answer to two decimal places. 20.4 X % Hide Feedback Incorrect ack Post Submissid Solution a. First, you need to calculate taxable income. Note, we need to treat the tax on dividend income and long-term capital gains separately. Salary $75,000 Interest 5,100 ST proceeds 7,600 $87,700 Standard deduction (12,000) Taxable income $75,300 Be careful to use the Individual Tax Rate Table: Taxes owed on ordinary taxable income = $4,617.50 + ($75,300 - $40,125)0.22 = $4,617.50 + $7,738.50 $87,/UU Standard deduction (12,000) Taxable income $75,300 Be careful to use the Individual Tax Rate Table: Taxes Owed on ordinary taxable income = $4,617.50 + ($75,300 - $40,125)0.22 = $4,617.50 + $7,738.50 = $12,356.00 However, the taxpayer owes taxes on the dividend income and long-term capital gains at the applicable 15% tax rate. So, we need to calculate those taxes as follows: [$18,000 + ($21,500 - $10,000)] 0.15 = $29,500 x 0.15 = $4,425 Total Federal taxes owed = $12,356.00 + $4,425.00 = $16,781.00. b. Marginal tax rate = 22%. C. Average tax rate = Taxes paid/Total taxable income = $16,781.00/($75,300 + $ 29,500) = 16.01% Solution Correct Response eBook Mary Jarvis is a single individual who is working on filing her tax return for the previous year. She has assembled the following relevant information: She received $75,000 in salary. . She received $18,000 of dividend income. She received $5,100 of interest income on Home Depot bonds. She received $21,500 from the sale of Disney stock that was purchased years prior to the sale at a cost of $10,000. She received $13,500 from the sale of Google stock that was purchased 6 months prior to the sale at a cost of $5,900. Mary only has allowable itemized deductions of $5,900, so she will take the standard deduction of $12,400. The standard deduction is subtracted from her gross income to determine her taxable income. Assume that her tax rates are based on Table 3.5 a. What is Mary's federal tax liability? Enter your answer as a positive value. Do not round intermediate calculations. Round your answer to the nearest cent. $ 16781.00 b. What is her marginal tax rate? Do not round intermediate calculations. Round your answer to one decimal place. 22.0 % C. What is her average tax rate? Do not round intermediate calculations. Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts