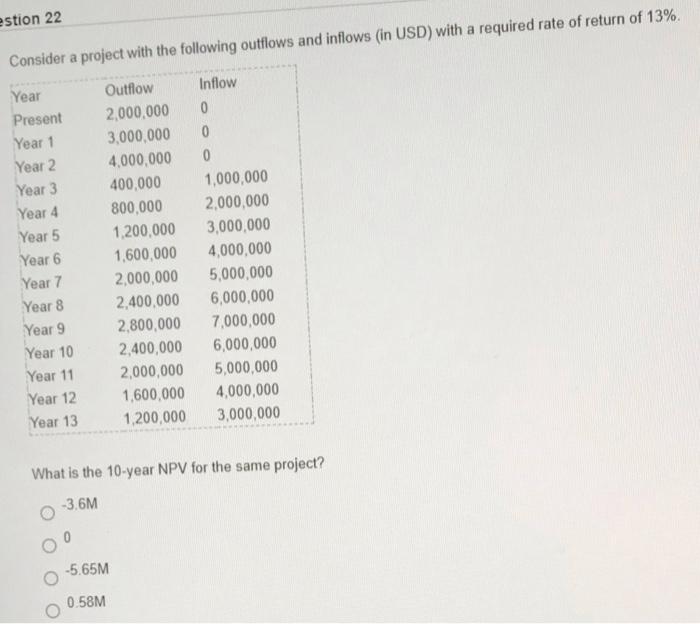

Question: please help fast 2218 estion 22 Consider a project with the following outflows and inflows (in USD) with a required rate of return of 13%.

please help fast 2218

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock