Question: PLEASE HELP FAST AND ALL IN ACCOUNTING. I WILL RATE 5 STARS. Haworth Company is a management consulting firm. The company expects to incur $114,000

PLEASE HELP FAST AND ALL IN ACCOUNTING. I WILL RATE 5 STARS.

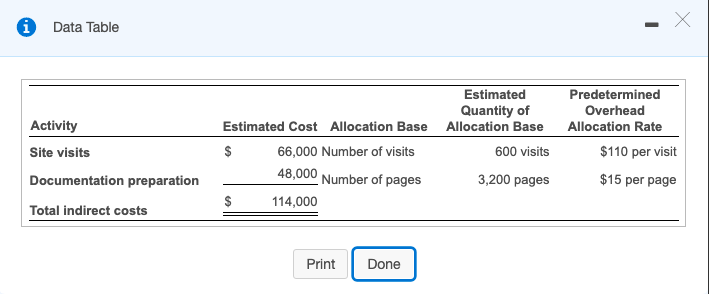

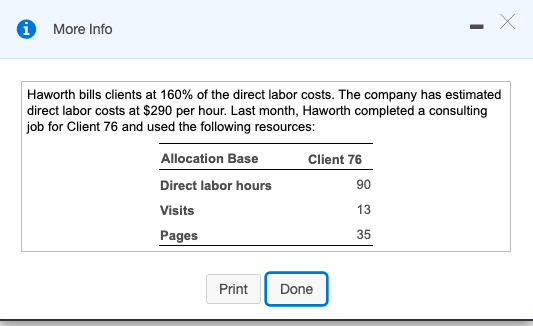

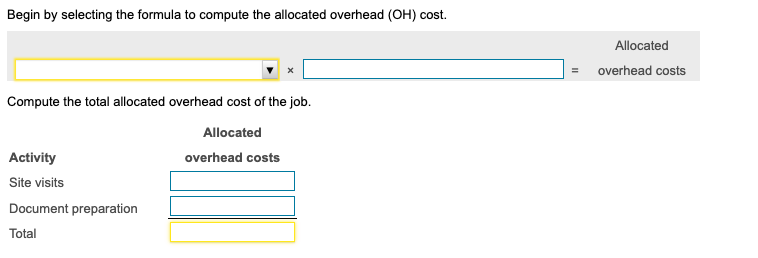

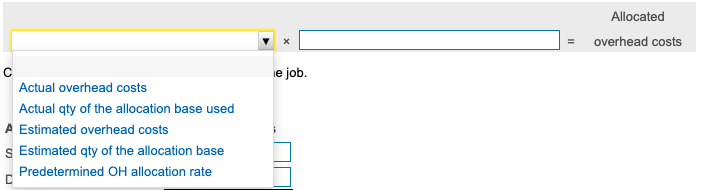

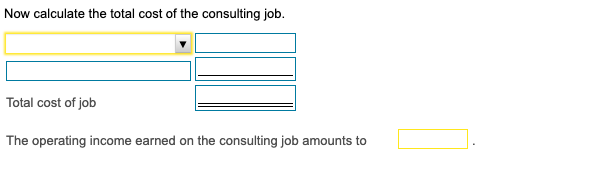

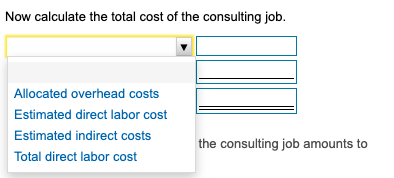

Haworth Company is a management consulting firm. The company expects to incur $114,000 of indirect costs this year. Indirect costs are allocated based on the following activities: : (Click the icon to view the activities.) (Click the icon to view additional information.) Determine the total cost of the consulting job and the operating income earned. i Data Table Estimated Quantity of Allocation Base Predetermined Overhead Allocation Rate Activity Site visits 600 visits $110 per visit Estimated Cost Allocation Base $ 66,000 Number of visits 48,000 Number of pages $ 114,000 Documentation preparation 3,200 pages $15 per page Total indirect costs Print Done 0 More Info Haworth bills clients at 160% of the direct labor costs. The company has estimated direct labor costs at $290 per hour. Last month, Haworth completed a consulting job for Client 76 and used the following resources: Allocation Base Client 76 Direct labor hours Visits Pages Print Done Begin by selecting the formula to compute the allocated overhead (OH) cost. Allocated overhead costs = Compute the total allocated overhead cost of the job. Allocated overhead costs Activity Site visits Document preparation Total Allocated overhead costs = le job. Actual overhead costs Actual qty of the allocation base used A Estimated overhead costs s Estimated qty of the allocation base Predetermined OH allocation rate Now calculate the total cost of the consulting job. Total cost of job The operating income earned on the consulting job amounts to Now calculate the total cost of the consulting job. Allocated overhead costs Estimated direct labor cost Estimated indirect costs Total direct labor cost the consulting job amounts to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts