Question: PLease Help Fast As Possible? Question one: (15 marks) On, May 1, 2018, S. Products Co. purchased new machinery for $461,000. The machinery has an

PLease Help Fast As Possible?

PLease Help Fast As Possible?

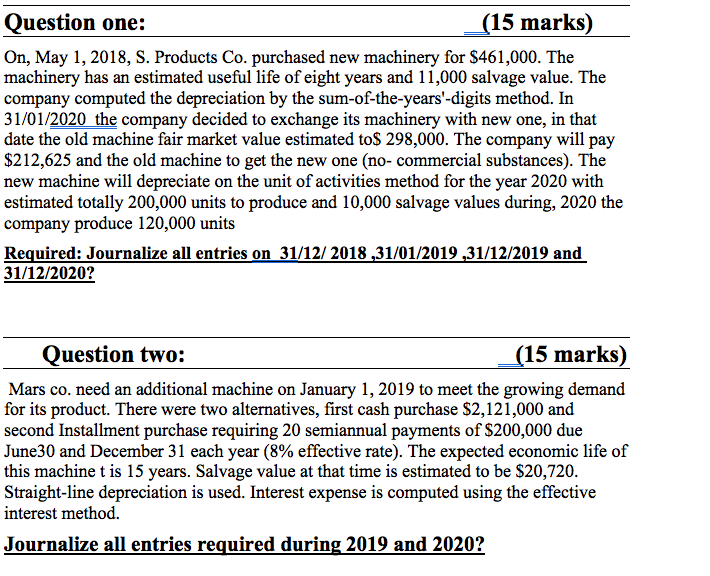

Question one: (15 marks) On, May 1, 2018, S. Products Co. purchased new machinery for $461,000. The machinery has an estimated useful life of eight years and 11,000 salvage value. The company computed the depreciation by the sum-of-the-years'-digits method. In 31/01/2020 the company decided to exchange its machinery with new one, in that date the old machine fair market value estimated to$ 298,000. The company will pay $212,625 and the old machine to get the new one (no-commercial substances). The new machine will depreciate on the unit of activities method for the year 2020 with estimated totally 200,000 units to produce and 10,000 salvage values during, 2020 the company produce 120,000 units Required: Journalize all entries on 31/12/2018 31/01/2019,31/12/2019 and 31/12/2020? Question two: (15 marks) Mars co. need an additional machine on January 1, 2019 to meet the growing demand for its product. There were two alternatives, first cash purchase $2,121,000 and second Installment purchase requiring 20 semiannual payments of $200,000 due June 30 and December 31 each year (8% effective rate). The expected economic life of this machine t is 15 years. Salvage value at that time is estimated to be $20,720. Straight-line depreciation is used. Interest expense is computed using the effective interest method. Journalize all entries required during 2019 and 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts