Question: plz fast Question one: (20 marks) On, April 1, 2018, S. Products Co. purchased new machinery for $450,000. The machinery has an estimated useful life

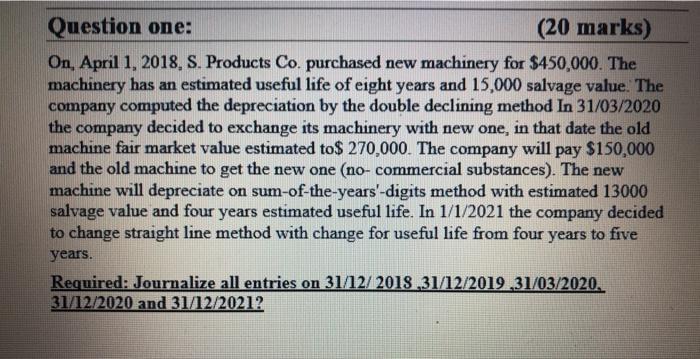

Question one: (20 marks) On, April 1, 2018, S. Products Co. purchased new machinery for $450,000. The machinery has an estimated useful life of eight years and 15,000 salvage value. The company computed the depreciation by the double declining method In 31/03/2020 the company decided to exchange its machinery with new one, in that date the old machine fair market value estimated to$ 270,000. The company will pay $150,000 and the old machine to get the new one (no-commercial substances). The new machine will depreciate on sum-of-the-years-digits method with estimated 13000 salvage value and four years estimated useful life. In 1/1/2021 the company decided to change straight line method with change for useful life from four years to five years. Required: Journalize all entries on 31/12/ 2018,31/12/2019,31/03/2020. 31/12/2020 and 31/12/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts